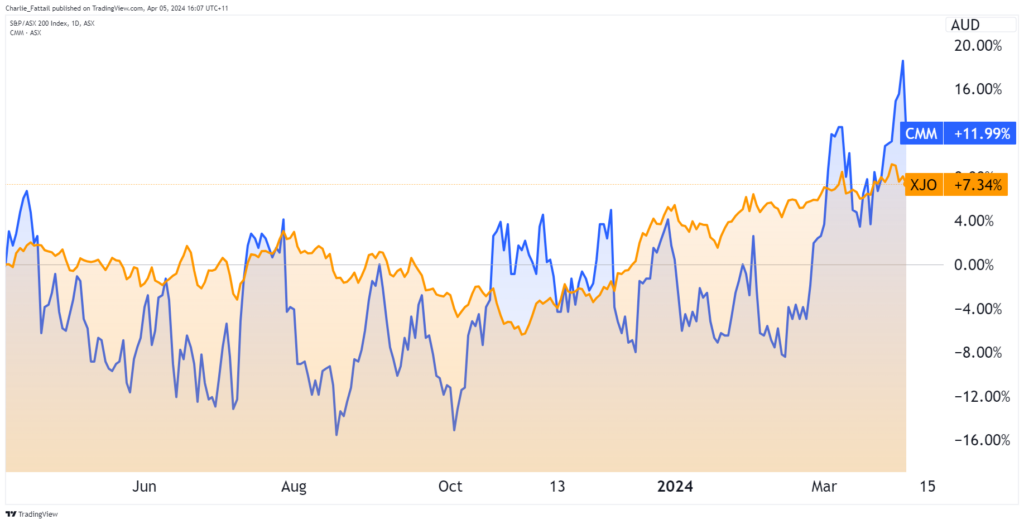

Capricorn Metals [ASX:CMM] shares are down by -5.56% today, trading at $5.18 per share as the company disappointed investors with its latest quarterly update.

The gold explorer joined the ranks of several other mid-tier miners who faced production challenges during the March quarter.

Despite gold touching record-high prices of around US$2,300 per ounce, many Western Australian miners have seen heavy rainfall— prompting several production downgrades.

Regis Resources [ASX:RRL], Gold Road [ASX:GOR],and Westgold [ASX:WGX] are among some of the local miners that have downgraded production so far.

Capricorn warned investors about this in early March, but with the reality hitting home today, the company again saw selling pressure.

These moves brought the company’s share price back to only a 10% gain in the past 12 months. But are today’s selloffs a buying opportunity for gold bulls?

Source: TradingView

Operations update

Capricorn said more than 280mm of heavy rainfall significantly hampered open pit mining activities at its Karlawinda Gold Project (KGP).

More than eight days’ worth of shifts were lost, as well as access to higher-grade ore blocks in the open pit at the WA site.

As a result, gold production for the quarter came in at just 26,017 ounces, lower than expected and contributing to total output of 86,116 ounces for the nine months ending March 2024.

The weather issues caused significant disruptions to the mining schedule, with Capricorn’s mining contractor MACA struggling to achieve anywhere near the budgeted material movements.

Here’s what the open pit looked like after one of the major downpours in early March.

Source: CMM, 7 March

The company has warned that while efforts are underway to ramp up operations, the residual impacts will likely result in gold production for the June 2024 quarter ranging between 26,000 to 29,000 ounces.

Consequently, Capricorn revised its full-year 2024 production guidance to between 112,000 to 115,000 ounces, compared to the previous estimate of 115,000 to 125,000 ounces.

Capricorn says it will still land within the original range of its All Sustaining Cost (AISC) guidance of $1,270–1,370 per ounce, but one can imagine it will land near the top of that range.

This disappointing production performance is a setback for the company as it aims to develop its Mt Gibson project.

Capricorn’s Executive Chairman Mark Clark attempted to offer a silver lining today, saying:

‘It was a challenging quarter at the KGP with significant rainfall impacting mining operations and gold production. However, it was pleasing that despite these impacts the operation delivered a cash and gold build of $27.6 million for the quarter before the discretionary capital spent at Mt Gibson.

The residual effects on mining productivity are still being felt and will be our key operational focus in the June quarter to set the project up for a strong operational performance in FY25.’

As of the end of March, Capricorn had cash and gold on hand of $177.8 million, an increase of $27.6 million for the quarter after capital expenditures.

Outlook for Capricorn

While the March quarter was undoubtedly disappointing, Capricorn could offer a ray of hope if it can quickly resolve the mining issues and set the stage for a stronger operational performance in FY25.

With gold prices providing a tailwind, investors may have a reason for cautious optimism, provided the company can execute its plans and deliver on its production targets.

Gold ended a seven-day run today, with prices falling slightly from record highs to around US$2,270s.

Despite this, it looks favourable that gold prices will trend higher in the coming months due to economic uncertainties and safe-haven demand due to geopolitical tensions.

Adding to that, we’ve also seen a jump in buying from Central Banks, especially China, as they attempt to move away from the US dollar with gold reserves.

If gold prices continue to strengthen, higher realised prices could partially offset the company’s lower production.

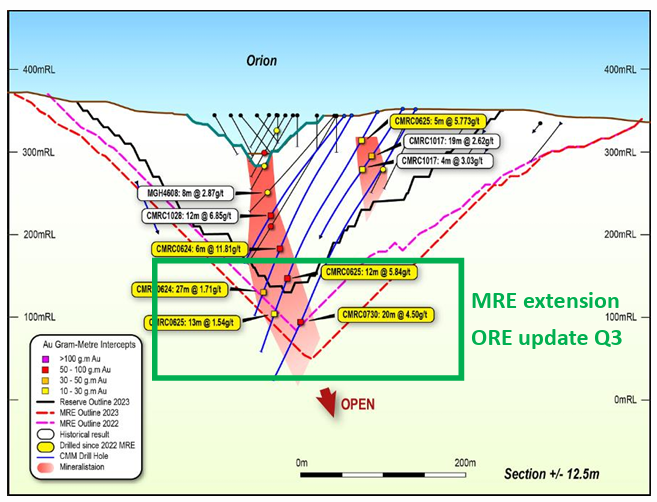

Also around the corner for Capricorn is its Mt Gibson gold project, which the company hopes will become its new KGP sibling.

With a mineral resource estimate of 3.24 million ounces and hopes of deeper reserves, the company is pinning much of its growth on developing this project.

Source: CMM

The extension of drilling that finished in December 2023 at Mt Gibson has Capricorn targeting a Q3 reserve upgrade to the site before starting the mining contract tender.

The development is fully funded and so far looks to be smooth sailing, but as we’ve seen from KGP, disruptions could set the stock price back in the quarters ahead.

Floodgates open for gold stocks

We’ve seen some highs and lows for gold stocks in recent years, but things are finally becoming clearer.

Gold prices are soaring, but until recently, many mid-to-large cap gold miners have struggled.

The ASX gold miners ETF has underperformed gold prices by more than 30% over the past three years, according to UBS.

But what a difference a few weeks can make. Speculators are piling in, and shares are starting to rise.

Our local Gold Editor, Brain Chu, has been discussing the value disparity between gold prices and producers for some time.

He has lined up what he thinks are the best plays in the Australian gold sector as share prices finally catch up to gold prices.

He knows these gold stocks better than most. When these stocks last soared in 2019 and 2022, his private family gold fund beat the index by more than seven times.

If you want to discover more about ASX-listed gold stocks to leverage the rising gold price in 2024.

Then click here to learn how to get access to three stocks Brian believes are set to spike.

Regards,

Charlie Ormond

For Fat Tail Daily

Comments