‘Love and work are the cornerstones of human happiness.’

Sigmund Freud

‘If you worked for me, I’d slap your hand with my trowel’, Mick told us with a smile on Friday.

We were working with him on the stone wall on the west side of our garden. The wall is designed to keep out deer…and break the cold winds coming off the Atlantic.

And while we have worked off-and-on at DIY masonry projects for many, many years, we never had any proper training.

‘Never put the pins in like that’, Mick explained.

The little stones — known as ‘pins’ — used to fill the gaps between the big stones should not be set upright but on their sides.

Every day, the wall comes closer to completion. And every day, we look out at 8:00am with growing satisfaction; Mick and his helper, Connie, are on the job. They are getting something done — something of value.

And every day we wonder: what have Silicon Valley and Wall Street done for us lately?

We see the value of what Mick and Connie are doing, but as to the US’s leading industries…we’re not so sure. Do our hamburgers taste better, thanks to the money-masters at Goldman Sachs? Does our roof shed water thanks to the whiz kids who work for Google? Is the view from our dining room more fetching…is our back still stiff? Is our hair still disappearing?

Yes, now we can stream movies at home. But is that really so much better than going to the theatre? And we can ‘chat’ online…for hours and hours. But is that an improvement on getting together for a drink? Or actually, hanging up and getting some work done?

Is the electronic media just souped-up TV? Wasting our time and leaving us poorer?

Anti-social media

Young people, 16–24, spend an average of 21 hours per week — equal to half of a full-time job — on social media. Unlike our money, time can’t be faked. Wouldn’t it be better to use it learning something useful?

But people vote with the money. (Who are we to tell them how to spend it?) And they’ve voted heavily in favour of Netflix, Google, Amazon…and a whole ticket of internet-based candidates. But they can change their minds. The S&P 500 went down 10% in January. The Nasdaq, where the techs tend to reside, fell 15%. Meta (formally Facebook) dropped 25% in a single day last week, marking the largest one-day loss for an American company in the history of the US stock exchange. Mr Zuckerberg, Facebook’s founder, saw his net worth plummet by US$31 billion…roughly the GDP of Estonia. How does one man ‘lose’ an entire country’s annual output in a single day? Where did it go?

And what about Peloton? The company sells an exercise bike, with a computer screen mounted on the handlebars, for US$2,000. It took a loss of almost half a billion dollars last year. And its stock — once the darling of the tech investors — has dropped 85% since December 2020.

What happened? And what made them so valuable in the first place? The business plan for almost the whole Silicon sector — including Google, Meta, and Peloton — was the same: capture someone’s ‘eyeballs’, and you’ll be able to sell him more stuff. At first, it worked beautifully. Unlike its rivals in print media, the new companies didn’t have the expense of printing or delivering paper. Neither did they have to pay for ‘content’; users provided the cat videos and mindless commentaries themselves. And finally, they could target their advertising much more precisely, allowing customers to choose what they wanted to see and allowing them to tailor ads to the reader’s interests. That’s why ads seem to ‘follow you around’ as you cruise the worldwide web.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

A TikTok to the Face

But the model had built-in limits. The industrial revolution increased incomes, giving consumers more money to buy the new output. But the internet revolution has done no such thing. Consumer incomes have been mostly flat…and are now, after inflation, declining. Time remains constant. So the new companies were never actually creating new wealth; they were just taking eyeballs and ad revenue from traditional media. Then, when the low-hanging fruit had been picked, they scrapped with each other for market share. That’s why TikTok is such a threat to Facebook…and why Meta’s price fell so sharply when word got out that it was losing the battle.

Drawing back, we see more dots to connect and a ghastlier picture: While investment in the tech sector soared…capital was drawn away from ‘old industries’. Now, there is more and more ‘clickbait’ on the internet, but we’re running out of real stuff.

Yesterday came this news item from Bloomberg:

‘Jeff Currie, the closely-followed head of commodities research at Goldman Sachs Group Inc., says he’s never seen commodity markets pricing in the shortages they are right now.

‘“I’ve been doing this 30 years and I’ve never seen markets like this,” Currie said in a Bloomberg TV interview. “This is a molecule crisis. We’re out of everything, I don’t care if it’s oil, gas, coal, copper, aluminum, you name it we’re out of it.”’

Real things need to be coaxed out of the ground…heated and hammered…distilled and distributed…by real people. But what’s this? People are so busy on their phones they don’t have time for real work.

Here’s a report from 60 Minutes:

‘The government’s jobs report released [in early January] tells us what has happened: well over 20 million people quit their jobs in the second half of 2021. Some are calling it the “big quit,” others the “great resignation.”’

Huh? Commodities vanishing. People leaving their jobs. Another report shows the ‘labour participation rate’ back to where it was in the ‘70s…before women went to work en masse. And today, one out of every eight working-age men is unemployed.

Alive…but not kicking (in)

Last week’s employment report also showed that those still working aren’t working as much as they used to. The ‘aggregate hours worked’ figure is still below 2019’s level.

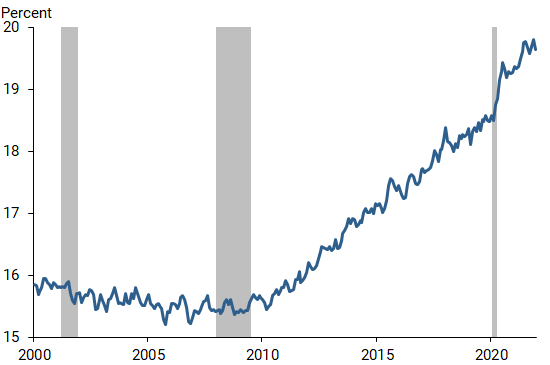

Then there’s this chart from the Federal Reserve Board of San Francisco, which shows the percentage of retired individuals as a share of labour force nonparticipants:

|

|

| Source: Federal Reserve Board of San Francisco |

What to make of it? Dots all over the place. At first, they seem unconnected, like marbles loosed onto a concrete floor. But wait…

The closer we look…the clearer the pattern becomes…

Prices rising…workers idle…a parasitic elite…transfer payments increasing…

An ugly scene.

Stay tuned…

Regards,

|

Bill Bonner,

For The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.