The last two years have seen many false rallies in the gold stock space. It even culminated in a massive bear market that trimmed the gold stock indices around the world by almost 50%.

In many cases, individual companies fell harder, trading at a fraction of what they were last April.

Now, I’m a long-term camper…holding onto core positions in my gold stock portfolio while making tactical trades to vary my portfolio mix between producers, developers, explorers and precious metals exchange-traded funds (ETFs).

It hasn’t been easy at all. I held onto some of my positions that are now down as much as 80%. But I’ve enjoyed some wins, doubling down as some companies tumbled before staging a swift recovery.

That’s why I’m not changing my strategy. However, I’ve fielded queries from many readers who’re wondering why I don’t adopt a more active trading strategy.

Let’s discuss this today.

Gold stocks — A rollercoaster ride that went nowhere?

For almost the last three years, gold stock investors and speculators have been through an odyssey as economic and geopolitical tensions riled the markets, the global economy and commodities prices.

You’d think the conditions would be perfect for gold and silver. They’re monetary metals that should offer a compelling safe haven to the fiat currency system in times of war, rising inflation and economic uncertainty. In turn, companies engaged in mining and exploring these metals should ride the coattails of a meteoric run for gold and silver, delivering immense riches to its shareholders.

If only it were so!

Let me show you how gold and established gold producers (proxied by the ASX Gold Index and [ASX:XGD]) performed recently:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

This chart speaks volumes if you look closely.

Gold’s done quite well, delivering just under 20% returns since the start of 2021. It wasn’t a smooth and easy ride, but those who put their cash into gold enjoyed more peace of mind than those invested in gold stocks.

Those invested in established gold producers rode a rollercoaster. Fortunately for most, the thrills came with some rewards as the index bounced quickly from late September 2022. It staged a robust bull run and took the index back to the levels it traded in 2021.

With the benefit of hindsight, you could argue that active trading would’ve been the way to go.

This rollercoaster has tossed and turned the buy-and-hold investors, leaving them without much reward.

However, I believe these last three difficult years have been building up to a crescendo in the gold investing space…

A perfect storm

Looking back, I can’t help but suspect that we’ve lived the last three years in a perfect storm that combined disasters with poor judgment and incompetence from the elites.

The US Federal Reserve and the US Treasury came out in mid-2021 to talk down the notion that inflation was speeding up — thereby negatively impacting business and consumer confidence. This changed later in the year as they assured the people that it was ‘transitory’…only to quickly concede that it would last longer than initially expected.

By early 2022, the Russian-Ukraine conflict erupted, and the central banks acted in unison to rapidly raise interest rates not long after. All this occurred as the sanctions against Russia — and their retaliation of cutting off the gas supply to Europe — saw a rapid rise in the price of oil, leading to inflation spiralling out of control.

If anything, it looked like they sabotaged the global economy: locking down the world, stifling trade through sanctions, reducing the supply of currency and making it hard for businesses and households to access credit causing many to struggle to make ends meet.

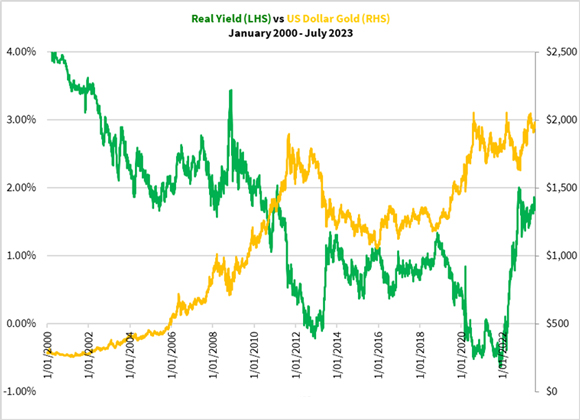

You can see in the figure below how the US long-term real yield rose quickly at an unprecedented pace since 2000:

|

|

| Source: US Treasury, Thomson Reuters Refinitiv Datastream |

The last time the real yield rose was in 2013–14 when Federal Reserve Chair Ben Bernanke implemented ‘Operation Twist’. Gold plunged hard from US$1,900 to US$1,200 within three months. It all but wiped out the speculators in this space and caused many to swear off gold forever.

The real yield rose more abruptly this time round. However, notice how gold held its ground more firmly? It dipped from US$2,000 to US$1,610. And it’s rebounded quite quickly.

This points to the increasing awareness by the investment community that central banking might be on its last legs.

Buying the dips and holding delivered eye-opening rewards

You can see earlier in this article the ASX Gold Index rebounded quickly after the brutal selloff. That wasn’t the case in the last bear market in 2012–14 when it lingered in the doldrums for almost 18 months.

The many false rallies we’ve experienced this time may’ve been disappointing if you expected a quick recovery for the index to make new highs. In this case, those who actively traded enjoyed better results to date. However, those who adopted the buy-and-hold strategy were offered several opportunities to accumulate and wait for the big payoff instead.

The recovery from last September has delivered some rewards for buy-and-hold investors. I expect more coming in the next leg of the bull run. This comes as the US Federal Reserve and other central banks inevitably cut interest rates as the current economic conditions are unsustainable.

I can say with confidence that if you’re a buy-and-hold investor, some of your holdings should be clearly in the black now if you’ve held on and bought more as prices fell.

Let me name two of them, both of which happen to be on my recommendation list.

Major gold producer Northern Star Resources [ASX:NST], which operates in Australia and the US, plunged from almost $11.50 in April 2022 to as low as $6.75 at its trough three months later. It staged a recovery in the subsequent bull market to close as high as $14.44 just over three months ago, giving a return of 114%!

Another is large producer Evolution Mining [ASX:EVN] that operates five mines in Australia and Canada. Investors have seen its share price as high as $6 in mid-2021, but it more than halved last year as management downgraded its production forecasts for 2023–24 due to rising costs. At its lowest in mid-October, it was trading as low as $1.80. However, things have picked up and operations are starting to get back into gear. Currently, it’s trading at $3.68, or 104% higher than its lows last year.

The prospects for these companies are solid meaning there’s more to rewards to come!

I know that’s easy to say in hindsight. Many are inclined to want to cut losses rather than ride the full extent of the plunge.

But I spend a lot of time researching this space to identify companies that have the right characteristics — sound operations, good drill results, a solid cash balance to weather the storm, properties near existing mines, and sound management with a track record of moving things forward.

And when the market moves back into gold stocks in a big way as I foresee, I’m expecting my portfolio to make back those paper limits and much more. Plus, I’ll enjoy the 50% discount on capital gains when I sell because I held for longer than 12 months.

This strategy isn’t for everyone. But it’s worked for me. It’s also what the mining investment veterans like Rick Rule, Bill Powers and Don Durrett do.

I’ve even included the YouTube videos (including my interviews with Rick and Don) for you to watch!

So check out those videos and start your long-term gold investing journey with me today by joining me at The Australian Gold Report.

God bless,

|

Brian Chu,

Editor, Fat Tail Commodities

![ASX Gold Index and [ASX:XGD])](https://daily.fattail.com.au/wp-content/uploads/2023/07/COM20230731_1_580.jpg)

Comments