How long have we been stuck in the pandemic blues?

Sometimes it feels like it will never end. Well, the thing is, it just did.

Well, part of it did. On the economic front that is.

And while case numbers soar here in Australia, we seem to be mostly defying the urge to jump at shadows. There is a firm focus on hospitalisations now, and not just case numbers.

It almost feels like things are getting better, even as they start to look worse on the surface.

Well, the markets are at one of those points as well.

We just hit an important target that you might not have been thinking too much about.

I want to talk about that in a minute.

Let me first give you a bit of background to help explain it…

The target

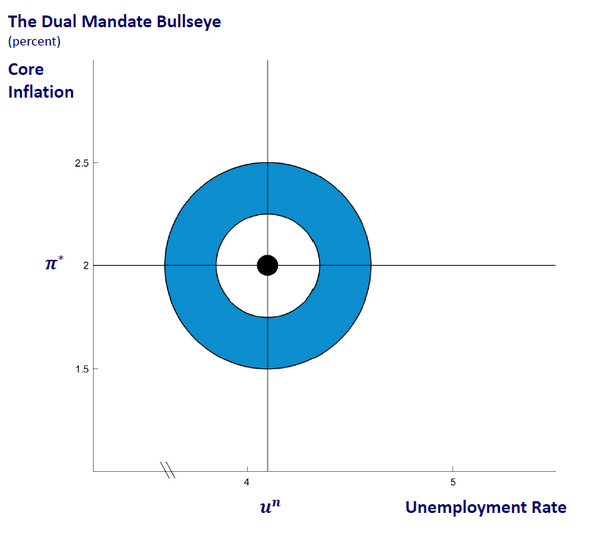

The Federal Reserve (the Fed) in the US has two goals — or what they call the ‘dual mandate’.

‘Stable prices and maximum sustainable employment.’

Stable prices specifically mean inflation is as close as possible to 2%. The Fed ‘would be concerned if inflation were running persistently above or below this objective’. So you can think of this as a static target.

Employment, on the other hand, is much more contextual. What they believe is the right level of employment changes over time. Their latest estimate for a good level of employment is 4.1%.

The Federal Reserve Bank of Chicago — one of the member banks who help set these targets — has a neat diagram that shows this dual mandate. Check it out below:

|

|

|

Source: Chicagofed.org |

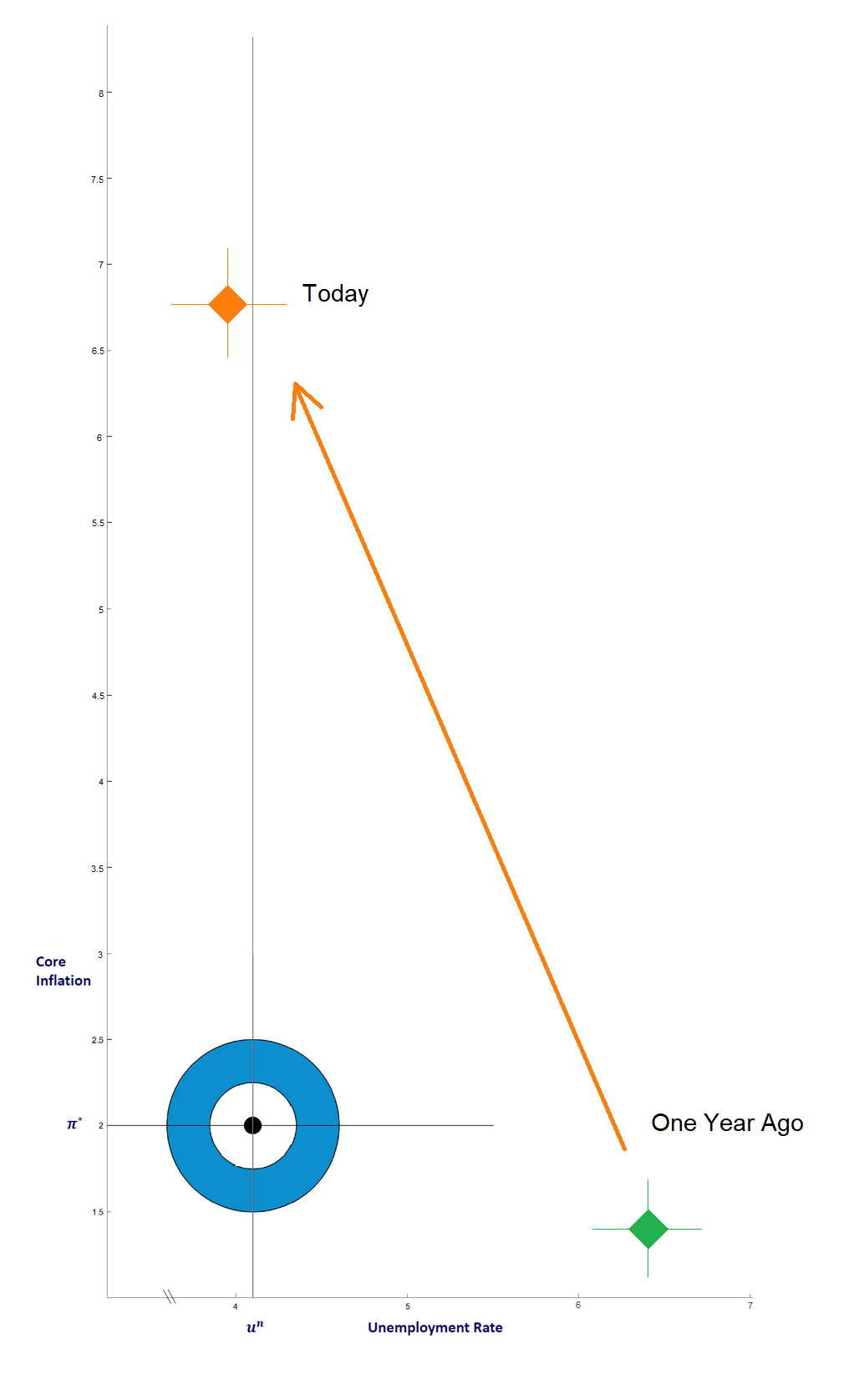

Now, the interesting thing is where things currently sit in relation to these targets, and how fast we got there.

12 months ago, the Fed could justify low interest rates. Both unemployment and inflation weren’t doing so well.

We’re very quickly in the exact opposite position.

But I’ll get back to that in a minute.

Late last year, I wrote about the misconception that central banks make decisions, and the market follows. In reality, the markets do their thing and central banks react.

The latest comments out of the Fed are a perfect example of this. It has been obvious for several months that they’re dancing to the wrong tune.

Last week, James Bullard — a current voting member on US interest rate decisions — said that they might need to raise rates as early as March.

This comment signalled a shift in stance of the Fed towards a more urgent need to raise rates.

The thing is that was before the unemployment figure dropped down from 4.2% to 3.9% in Friday’s US non-farm employment figures.

So inflation at 6.8% against a target of 2%, and unemployment at 3.9%, with a target of 4.1%.

That means…

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Bullseye…well sort of

That chart above tells a pretty interesting story when we plot where the US was 12 months ago, and where they’re today.

In the following chart, the current situation is shown with the orange diamond. The green diamond shows how things were in January 2021.

|

|

|

Source: Chicagofed.org |

If inflation looks a bit extreme in this diagram, that’s only because it is. It’s the main concern.

At first, they tried to shrug it off as transitory. Then Biden tried to leverage it for political ammunition to attack the price of oil, which I spoke about here.

The only excuse that the Fed had for not hiking before was unemployment being above their 4.1% target.

In the December meeting, the Fed board members estimated that the unemployment rate for 2022 will be 3.5%. None of the members see the rate getting back above 4% in the next three years.

So the unemployment rate should no longer be a handbrake on interest rate rises.

This brings us back to the current inflation surge.

All eyes on inflation

The next US inflation data is due out on Wednesday night.

If inflation goes higher again — above 6.8% — we’re going to see the Fed scramble to lift rates. This brings forth the slim chance of a rate hike at the next meeting, in late January.

The Fed will try to avoid moving rates in January if they can. It would go against their recent guidance.

However, there is not another meeting until March, and inflation is already looking pretty daunting.

If they need to raise rates in January, we should see commentary out of the Fed shift quickly after this inflation data tomorrow night.

This is because they try as much as possible not to surprise the market with their moves.

In this case, though, I think we will find the market receptive to fighting inflation.

You can mark Friday, 7 January, as a fundamental turning point for the markets.

That’s the day the Fed hit its dual mandate target, meaning that we’re now looking at the prospect of entering an interest rate hiking cycle.

The first thing on a lot of people’s minds will be what does this mean for the property market here in Australia?

This week my colleagues — Catherine Cashmore and Callum Newman — are releasing a special report on the property market that will show you why a hiking cycle won’t derail the property boom for years yet.

I strongly suggest you check it out when it’s released tomorrow.

Stay tuned.

Until next week,

|

Izaac Ronay,

Editor, Money Morning

PS: Izaac is also the co-editor of Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Izaac’s telling subscribers right now, please click here.