In today’s Money Morning…the lockdown bonanza…old money is dying…understanding this battle will be key to making wise investing decisions over the next few years…and more…

So it looks like the Sydney lockdown is going to be extended.

With a bit of luck, we’re talking months not weeks.

Maybe even the rest of the year!?

And if we’re really lucky, a few wondering Sydneysiders will have spread the virus interstate too.

Imagine that…a nationwide lockdown for the rest of 2021.

Aussie, Aussie, Aussie…!

But I don’t suppose we’ll get that lucky.

Vaccines and stay-at-home orders will eventually work, and the economy will probably open up again.

Unfortunately, it’ll be back to normal life once more.

Which means the golden age of investing will come to an end too.

Governments and central banks will pack away their chequebooks. Interest rates will rise to normal levels.

Markets will adjust to get rid of the speculative froth, fundamentals will matter again, and we can just forget the whole thing.

Or maybe not?

After all, debt, deficits, and low interest rates no longer seem to be considered a problem by our economic masters, here or anywhere else.

It’s like they simply don’t matter anymore…

Maybe they never did?

Perhaps this era of never-ending money is set to continue…even without lockdowns!

I suppose that might be just as good…

The lockdown bonanza

OK, in case you didn’t realise it, I was being very facetious in my opening remarks today.

I certainly don’t hope the virus spreads, I hope you’re all staying safe, and I hope NSW gets out of lockdown as soon as possible.

But I wanted to highlight a very important point.

Markets are amoral. They don’t give a stuff about right or wrong.

Just what ‘is’.

And what is — what has been over the entire COVID crisis — is that lockdowns have been an absolute bonanza for investors.

Stocks, gold, crypto, property…no matter what, they’ve all gone up.

And the richer you were, the better it’s been.

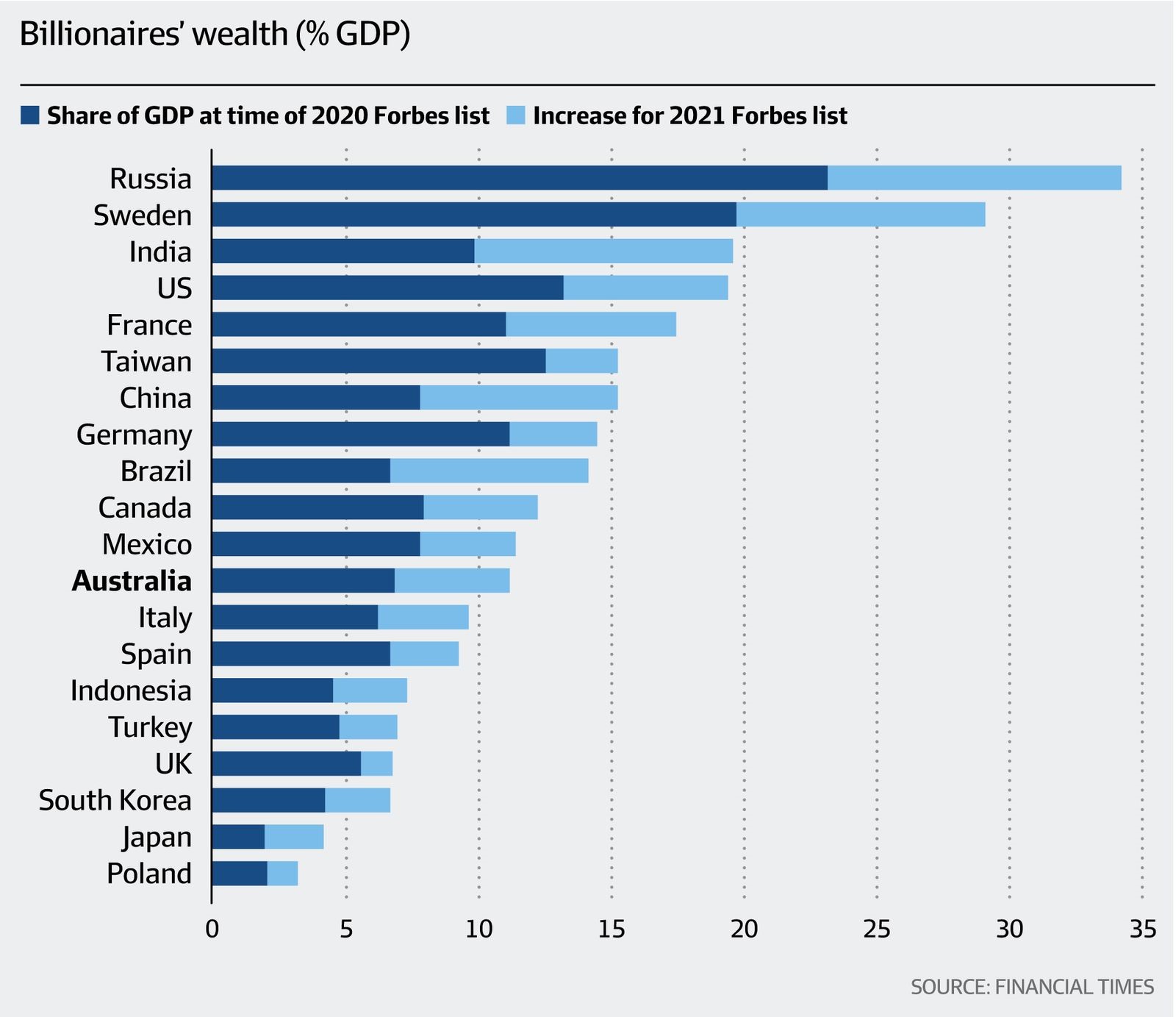

Check out this chart:

|

|

|

Source: AFR |

In every country around the world, the billionaire class has increased its share of wealth over 2020–21.

Which means relatively speaking the rest of us are all poorer. Not to mention the people that lost jobs, businesses, and incomes over this time too.

Let’s think about this fact for a minute…

The whole world goes into lockdown, economies grind to a literal halt, the oil price even goes negative for frig’s sake, and yet the richest amongst us make more than ever?!?

Something is very wrong with a system that works like that, my friend.

Elite control over money is of course to blame.

They’ve created a system of rules that games things in their favour. Heads they win, tails you lose.

We shouldn’t stand for it.

And yet many of us simply shrug our shoulders.

‘Oh well, that’s the game,’ you might say. The game being to make sure you’re in the ‘favoured’ part of society.

And maybe that’s the pragmatic way to think about it.

But will that game continue to make sense forever?

It reminds me of one summer holiday back in the day, when my dad introduced the concept of overdrafts to our family game of Monopoly (from memory, I think he was about to lose).

It changed everything…

No longer did you need to carefully select your purchases, in the hope of locking up the orange and red squares in a corner of hotels.

No, with overdrafts in the mix, you could just buy whatever you landed on. It now made sense to buy as much as you could, as fast as you could.

You couldn’t ever go broke, even with an unlucky portfolio of Old Kent Roads and train stations!

We all bought like crazy, we traded, we built hotels, we tallied up everyone’s debts as we went with a notepad and pen…

But after one never-ending game that seemed to last almost the entire summer holidays, we just packed the board away, never to be seen again.

The game didn’t make sense anymore when money was abundant.

You see the obvious analogy here, I’m sure.

Except in the real-life equivalent, not everyone gets access to the ‘overdraft’.

And in the game of life, you don’t have the option of packing up the board and playing something else either.

Like it or not, you’ve got to play…

Old money is dying

If the past two years of crisis have confirmed anything, it’s that money in our current system is a tool of power to be wielded as suits.

Of course, this cheap money has resulted in national debts that are now unpayable even with ultra-low and even negative interest rates.

Which are all just symptoms of the same thing…

The debasement of money itself.

It’s unsustainable and yet it seems the current trajectory will go on regardless. No one has the will to change it, because those who can are making too much money as is.

Money is the denominator by which all other assets are measured. So when the value of that goes down, the value of everything else goes up.

The cold hard truth is this…

If you’re not playing the game, you’re falling behind.

Money has all the value of a post-lockdown toilet paper stash, so spend it as fast as you can.

Don’t think, don’t save, just buy!

Of course, that kind of world can’t exist, at least not forever. Something has got to give, and it’s why many permabears are eagerly predicting an almighty market crash.

Park your money in cash, they say, and wait for the crash to pick up some bargains.

But I think they’ve missed the crucial point.

The real crash we’re seeing is a crash in money. Old money is slowly dying.

I think our current form of money will be sacrificed to preserve asset prices. And a new form of money will emerge this decade to replace it.

What form this new money takes, is the big question.

There’s a battle that’s started already between the forces of free markets and the forces of top-down control, to decide this outcome.

For my money (no pun intended), understanding this battle will be key to making wise investing decisions over the next few years.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

PS: Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.