The Brickworks Ltd [BKW] shares are at all-time highs today following record expected property earnings in FY21.

Brickworks Ltd [BKW] shares are currently up 8%, having traded as high as $23.14 per share in early trade — a new record for the building manufacturer.

Brickworks forecast strong earnings for its property trust and expects robust activity from its building product segments in Australia and the US.

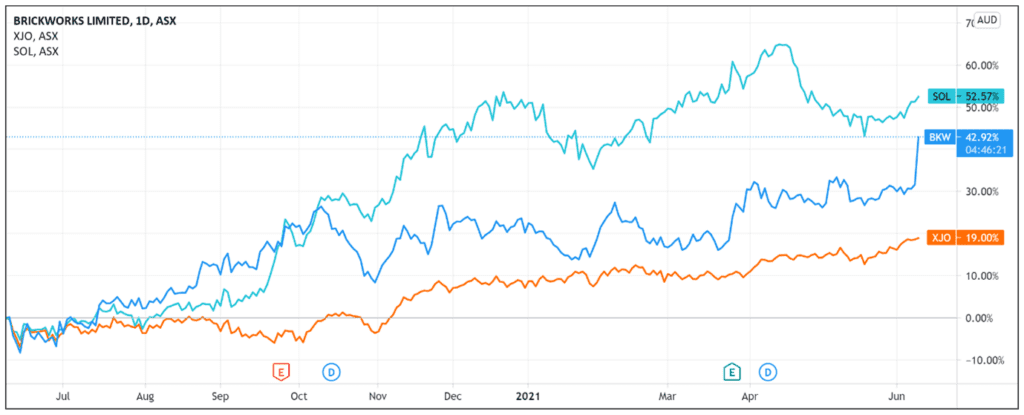

Today’s spike continues a positive trend for BKW, with the stock up 19% year-to-date and 40% over the last 12 months — solid gains for a company with a market capitalisation of $3.4 billion.

Source: TradingView.com

Record EBIT guidance

Brickworks disclosed a significant revaluation profit with its joint venture industrial property trust today.

BKW’s share of the profit is now expected to be around $100 million.

The windfall will contribute to record underlying earnings before interest and tax (EBIT) of $240– 260 million for FY21, up from $129 million the year prior.

If one takes the lower range of $240 million, the expected FY21 EBIT represents an 86% gain on the previous year.

Brickworks also expects its Building Products Australia and North America segments to post higher EBIT in FY21 in local currency terms.

However, the company qualified that ‘it is too early to accurately forecast the extent of the EBIT uplift’ as two months of trading activity remain.

The fact that Brickworks struggled to forecast earnings for the upcoming two months highlights how COVID-19 continues to cloud visibility.

The company admitted its building product divisions remain ‘exposed to unpredictable COVID-19 related impacts’, ranging from rapid reopenings across the US and snap lockdowns in Melbourne.

This and the further lack of visibility of BKW’s investment earnings in the second half led Brickworks to forego net profit after tax (NPAT) guidance.

Apart from manufacturing bricks, Brickworks also holds a diversified portfolio of assets, including industrial property assets and a long-standing investment in Washington H Soul Pattinson and Co Ltd [ASX:SOL], which has evolved into a diversified ASX 100 investment house.

Property earnings to rise in FY21

The continued increase in the value of BKW’s property trust reflects several significant industrial property transactions in western Sydney, according to Managing Director Lindsay Partridge.

Mr Partridge stated that the ‘number of sales and the steep movement in transaction pricing’ reinforced a strong investor appetite for prime industrial property assets.

The managing director further disclosed that property earnings are expected to rise further when developments at Oakdale East are completed, scheduled for July.

Mr Partridge also highlighted a market shift brought on by the pandemic:

‘We have seen strong demand and sustained growth in the value of our Property Trust over a number of years.

‘The COVID-19 pandemic has only fuelled this growth, by accelerating industry trends towards online shopping and increasing the importance of well-located distribution hubs and sophisticated supply chain solutions.’

The trend towards online shopping certainly helped industrial REITs weather the turbulence of last year.

For instance, Goodman Group Ltd [ASX:GMG] is up over 80% since the March 2020 lows.

Brickworks isn’t only benefiting from a trend towards industrial property though.

As BKW’s Mr Partridge noted, a significant uptick in housing approvals in Australia is ‘translating to increased building activity, with our sales particularly strong in Queensland and Western Australia over recent months.’

Brickworks expects EBIT from Building Products Australia to finish FY21 higher than last year, with US dollar EBIT from Building Products North America to finish FY21 higher than FY20.

Construction is booming across the world as fiscal and monetary policies aim to stimulate economies recovering from COVID-19.

Infrastructure spending is also set to rise, as governments set their sights on big projects and private enterprises pivot to industrial hubs as online shopping continues to grow.

So it pays for savvy investors to keep up to date on how these macroeconomic factors can be leveraged for investment ideas.

That’s why I recommend reading this free report on Australia’s property market.

In the report, Australian real estate expert Catherine Cashmore reveals why she thinks we could see the biggest property boom of our lifetimes over the next five years.

Click here to read further.

Regards,

Lachlann Tierney,

For The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.