It could be almost anything, of course.

A stock market crash. A sharp rise in bond yields. Extreme weather. A new ‘variant’.

The Omicron variant, for example. An internet search this morning turned up a total worldwide death count of eight people — seven in the UK, and one in Texas. Not exactly the end of the world.

But when you have a degenerate empire sinking into an abyss, you go with the emergency you have on hand.

And those are just the known unknowns. As for the unknown unknowns, the woods are full of them. Today, we return to one of the most plausible…and most alarming.

The Fed claims it has begun a tightening cycle. That means it will be throwing less gasoline on the inflation fire than before — but still about US$3 billion per day of new money. It says it will reduce the amount of new money creation gradually, and then stop it altogether in March of next year. Then it will consider raising its key lending rate — the real rate, adjusted for inflation, is currently 6.5% below zero.

No serious person believes these baby steps will relieve the upward pressure on prices. Certainly, investors don’t believe it. Yesterday, shaking off Monday’s shivers, they bid up stocks…as if they hadn’t a care in the world.

And the Biden administration, backed by the Democratic party, and the whole elite establishment, says what is needed is more spending, not less. There are more emergencies that need to be met — with money, of course. ‘Social infrastructure’. COVID. Climate change. A record Pentagon budget…and maybe even war with Russia, China, North Korea, or Iran.

Fitter, happier, more productive

According to the fantasy, more boondoggles will contribute to growth — which as we all know, is the same as progress — with a chicken in every pot…free lunches all around…diversity, equality, and equity for all, necking in the parlour and dancing in the street.

As for ‘growth’, the idea that a group of politicians can create real economic progress by printing up money and passing it out to their cronies, friends, and pet projects has been around for a long time. But if they could really do that…what have they been waiting for?

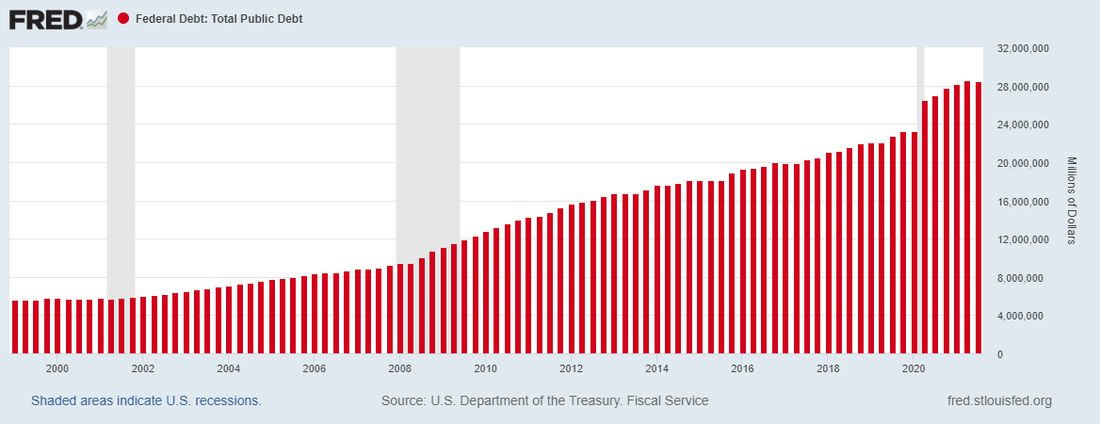

Of course, they haven’t waited at all. In this century, the US government, aided and abetted by the Federal Reserve, stimulated ‘growth’ more than any time in the US’s history. US debt has grown by more than US$23 trillion since 1999 — a 300% increase.

|

|

| Source: US Federal Reserve |

But look out the window. Do you see dancing in the streets? Are people more prosperous than they were in 1999? Happier? Freer?

We didn’t think so either.

Instead, the rich got richer…growth rates fell…and markets became more bizarre and erratic. Wall Street had to be bailed out in the emergency of the housing debt crisis of 2008–09.

And then, the whole economy had to be bailed out in the COVID shutdown emergency of 2020, and on…and on…

And now, the public, betrayed by its leaders and now bearing the cost of so much ‘emergency’ spending in the form of higher consumer prices, is becoming surly and ill-tempered.

But steeped in the holiday spirit, as we are, we are loath to sink into a pit of despair and spoil Christmas. We’ll save that for January…

This week, we’ll just keep rolling merrily along, doing our best to keep a straight face and a positive attitude.

But just to give us all a fair warning, we see a very dangerous intersection ahead — and a new emergency.

How to Survive Australia’s Biggest Recession in 90 Years. Download your free report and learn more.

Out of energy

From one direction come 7 billion people…almost every one of whom depends on the traditional fossil fuel that made our modern economy possible.

From the other comes the Fed’s inflation…distorting the prices that the energy industry needs to keep supply in balance with demand.

And there…at the crossroads itself…is the US government directing traffic!

We hardly need to say so, but in today’s world, distributing food, providing shelter, and delivering energy — with its factories, trucks, tractors, electric lines — runs mostly on fossil fuels. Take them away, suddenly or haphazardly, and the result is likely to be widespread misery.

The delivery mechanism for energy, as for other things, is exceedingly complex…with millions of components all working together, all over the world, with different climates, different religions, different languages…and all guided by prices. If prices go up, supplies generally follow. If they go down, so too go supplies.

But now, a menace we haven’t seen in the US for nearly half a century — inflation — is corrupting price signals. Suddenly, prices are going all over the place. The price for a gallon of gasoline, for example, gained more than 50% over the previous year. And last week, Goldman Sachs’ head of energy research said the price of oil could go to US$100 a barrel next year.

But instead of going up in response to higher prices, energy supplies are headed down. Rystad Energy:

‘Global oil and gas discoveries in 2021 are on track to hit their lowest full-year level in 75 years should the remainder of December fail to yield any significant finds, Rystad Energy analysis shows. As of the end of November, total global discovered volumes this year are calculated at 4.7 billion barrels of oil equivalent (boe) and, with no major finds announced so far this month, the industry is on course for its worst discoveries toll since 1946. This would also represent a considerable drop from the 12.5 billion boe unearthed in 2020.’

After working so fluidly for more than a century with only very few problems, all of a sudden, it looks like supply and demand are bound for a collision.

That will be a genuine emergency.

Stay tuned…

|

Bill Bonner,

For The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.