Uranium developer Boss Energy [ASX:BOE] has completed a $205 million share placement as it raises funds for its next move.

In addition to the tranche of fully paid ordinary shares today, the company also plans to raise an extra $10 million through a share purchase plan.

The raise will fund a bid for 30% of the Alta Mesa Project in Texas. The project is set to be restarted by Canadian-owners Encore Energy in 2024.

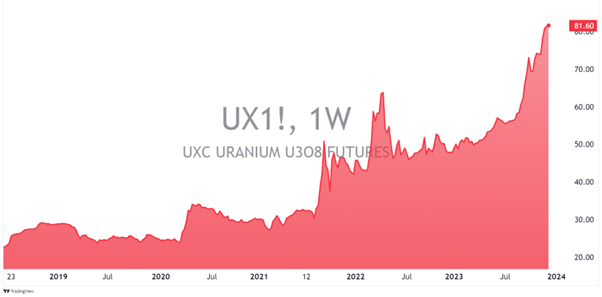

Mine restarts and M&A are underway in the uranium sector as the price of yellowcake has increased more than 60% in the past year, hitting a 15-year high.

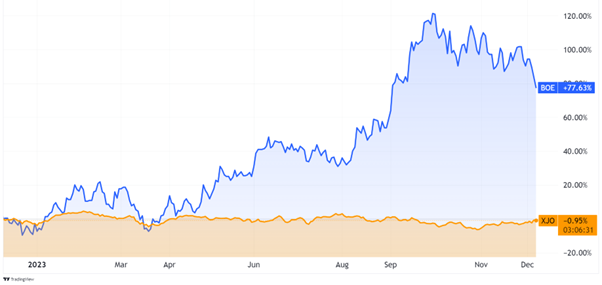

Boss has seen its share price rise by 77.6% in the past 12 months, tracking the record-high uranium prices. After today’s news, its shares are down -6.27%, trading at $3.89 per share.

Source: TradingView

Raise and restart

The raise should be a quick affair for Boss, who has a market cap of $1.38 billion.

The company said it has received strong demand from both institutional investors and existing shareholders.

At the time of the offer, it was a 4.8% discount on the last close, with the company issuing 51.9 million shares at $3.95.

Boss has great timing with spiking yellowcake prices as it is in the final stages of restarting its flagship project in South Australia.

The flagship Honeymoon Project cost Boss $15 million in 2015 and will cost the company an estimated US$80 million to restart.

But with current prices, the payback period is estimated to be three and a half years, with an all-in cost of US$31.86 per pound.

Honeymoon has a current mine life of 11 years, with a forecasted production rate of 2.45 million pounds per annum.

The target mine, Alta Mesa is also undergoing restart with a production target of 2024.

The mine has 3.41 million pounds of yellowcake at 0.109% grade and 16.97 million pounds of inferred resources.

Alta Mesa is targeting 1.5 million pounds per year in 1H24, with plans to expand production and further exploration.

Boss Energy’s Managing Director Duncan Craib, said:

‘It is a very exciting time for Boss Energy as it moves to become a multi-mine In-Situ Recovery (ISR) uranium producer by 1H 2024. We are extremely pleased with the outcome of the capital raising and we are grateful for the support of our existing and new shareholders. The proceeds will be used to drive Boss Energy’s multi-pronged growth strategy, with significant exploration spend and work towards expanding production capacity at Honeymoon.’

Outlook for Boss

It’s been an exciting time for the previously sleepy uranium sector. It has come a long way since the US$30 per pound days of 2021, and Boss has caught the wave at the right time.

In its 2020–21 feasibility studies, the company considered a base case for yellowcake pricing at US$60. With current prices, it’s understandable that many in the sector have seen their shares climb.

Source: TradingView

With EU and US uranium inventories at a decade-low due to underinvestment in the area, more mines are coming back out of idle.

Boss is ahead of the game, anticipating the long-term pricing shifts and beginning its restart before many of its rivals.

By collecting another soon-to-be restarted mine, the company should see production in early 2024 to catch these high prices.

This revival has been more than a decade in the making since the Fukushima Daiichi disaster tanked prices.

The March 2011 disaster triggered an abrupt drop in uranium consumption and changes in pro-nuclear energy policies globally. But demand is a secondary story to the real driver of uranium’s jump.

With many mines idled between now and then, the supply shortage created the setup for today’s prices.

As Canaccord analysts summarised in a note:

‘In our view, the market remains in a structural deficit, and with secondary supplies on the decline and inventory levels near recent lows (or immobile), we remain fundamentally bullish on the sector.’

While Boss had a very frothy run-up through September, the company has seen recent pullbacks, falling 20% since its early October highs.

While there is no certainty the bid will succeed— or that the restarts won’t face issues— it’s an exciting time for the company.

Looking towards the next Aussie mining boom

Junior miners have had it rough in the past year. Facing depressed commodity prices, many players can’t seem to catch a break.

But with trouble comes opportunities that could play out like uranium.

Today, in the market, massive resource holders are worth cents.

Mining juniors that could be holding some of the largest reserves in the world in a range of minerals can be collected at discounts unseen in 50 years.

While uncertainty remains high, gold and uranium miners are having a field day.

As cautious investors hedge in gold, ASX miners are standing out as great picks to balance a portfolio and diversify your holdings.

Want to know which critical minerals to look for in the next boom or which Aussie miners are holding the keys to our tech future?

Click here to learn more about the opportunities to be found in the next mining boom.

Regards,

Charlie Ormond

For Fat Tail Daily