Melbourne’s finally been released from lockdown #5.

But the scars on the city are evident.

According to the latest ‘Walk the Strip’ report from commercial realtors Fitzroys; on Chapel St, South Yarra, and Bridge Rd, Richmond, one in five shops are empty.

The vacancy rate on St Kilda’s popular tourist spot, Acland St, has more than doubled to 14% since COVID-19 hit last year.

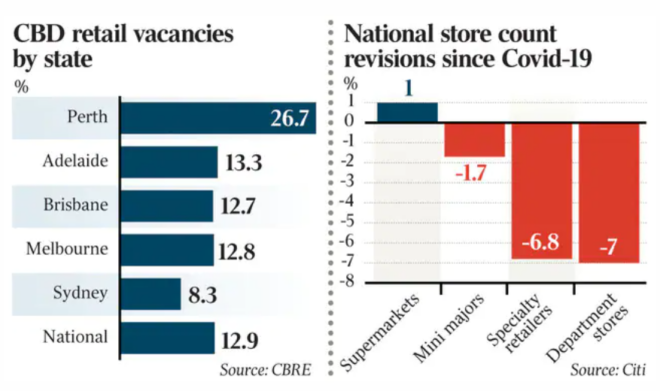

Nationwide it’s no better.

The number of empty shops across Australia’s CBDs has soared.

|

|

|

Source: CBRE — published in The Australian |

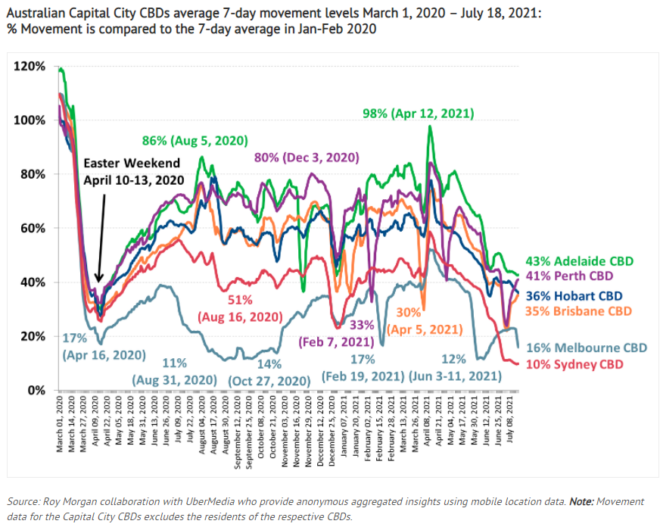

Recent data from Roy Morgan shows people’s movements in Australia’s CBDs sits at less than half the normal levels.

|

|

|

Source: Roy Morgan |

It’s going to get worse.

Who’s going to take the risk of renting retail premises under current conditions?

You can be locked down indefinitely with only a few hours’ notice — begging for government handouts.

Some commentators have warned of a rate rise.

The annual CPI rocketed 3.8% in the second quarter.

However, it needs to be taken into context.

Petrol is the biggest contributor, followed by healthcare, fresh food, and motor vehicles.

All influenced by strong demand and supply bottlenecks.

Put this aside, and the RBA’s ‘trimmed mean’ measure of inflation rose just 0.5% in the quarter — 1.6% for the year.

With Sydney’s continued lockdown potentially pushing Australia recessionary, undoubtedly, the next move on interest rates is down.

And there’s every chance the cash rate could eventually go negative.

APRA has already written to banks asking them to prepare for such an event.

They won’t raise them to curb house prices.

That’s now the job of macroprudential measures.

APRA is asking lenders ‘…to seek assurances they are proactively managing risks within their housing loan portfolios, and will maintain a strong focus on lending standards and lenders’ risk appetites.’

A reader asked me a few weeks ago:

‘If Australia go negative, can you see mortgages on 1%s interest rates? We now can see 2%s rates…’

I’d say it’s highly likely!

Borrowing rates are already at record lows across the world.

Not so long ago, UK PM Boris Johnson told citizens he wanted to ‘fix the UK’s housing market’, transforming ‘generation rent, into generation buy’ with 95% LVR loans fixed at 2.14% a year for 25 years.

But that’s already a poor deal.

Nationwide Building Society has just launched the UK’s lowest ever five-year fixed rate home loan, with an interest rate of a mere 0.99%.

Indeed, lending rates could also go negative.

It’s been done.

The Danes set a precedent.

They introduced the world’s first negative interest rate mortgage in 2019.

Gifting mortgage holders credit at minus 0.5% a year.

Yes, that means the borrower pays back less on the principle than they were loaned.

Jyske’s housing economist Mikkel Høegh stated:

‘We don’t give you money directly in your hand, but every month your debt is reduced by more than the amount you pay.’

Sure, they’ll make some of it back on fees.

But following implementation, real estate prices in the region reached their highest level on record — just before the COVID panic.

They have now exceeded that.

They’re up 15% since the start of the pandemic.

This is likely to play a role in the huge surge in land values we (over at Cycles, Trends & Forecasts) expect globally in the next five years.

Of course, the push to negative rates is part of a much bigger trend…

Cash (now a liability) will have to be removed from society for the government policies of negative rates to be completely effective.

Governments and the Bank for International Settlements are working with central banks around the world to make ‘cashless’ the new reality.

Digital dollars, yens, and pounds will replace cash.

These will be government-sanctioned blockchain protocols administered by the banks and other authorised lenders.

People will use a smartphone app or something similar for daily transactions.

Last year, global firm Research and Markets predicted that Australia could become Asia Pacific’s ‘first cashless society’ by 2022.

The CBA said, ‘more likely 2025’.

The RBA trialled that transition in January 2020 — pre-COVID:

‘The RBA used a private, permissioned Ethereum network for the project, simulating a central bank issuing tokens to commercial banks, as well as those tokens being exchanged among banks and eventually redeemed with the central bank…research is expected to continue in 2020, with the RBA potentially bringing external partners on board to participate.’

And conveniently (or not), the entire COVID panic has catapulted us toward this cashless fantasy at great speed.

IMF Managing Director Kristalina Georgieva commented in June that ‘digital is a big winner in this crisis.’

The pandemic has ‘accelerated the digital transformation by two or three years.’

That’s because, in the name of health, your virus-laden dollars are no longer considered safe.

Numerous shops and services globally are refusing to accept payments in cash already.

If you think this is no big deal because you rarely use cash, you are very much mistaken.

The cashless society is about so much more than just how we pay for things at the store. It represents the ultimate authoritative control over our lives.

Not much to look forward to in this regard — unless you’re a landowner, that is.

Global prices are already rising at their fastest pace in 45 years. (Surpassing the prior peaks in 1989 and 2005.)

That trend is not going to turn any time soon.

Better your dollars are invested in land than left in the bank. It certainly explains why I’ve had more cash buyers approach me this year than any other since I’ve been working in Australia’s real estate market.

The lesson here? Buy land.

Best wishes,

|

Catherine Cashmore,

For The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.