At time of writing, the Bod Australia Ltd [ASX:BDA] share price is down just over 1%, trading at 45.5 cents.

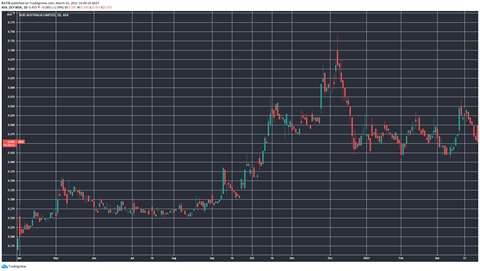

BDA shares caught the pot stock renaissance wave starting in October 2020 but have since settled and are tracking sideways:

We take a quick look at BDA’s latest announcement and their half yearly. Record sales it seems were not enough for the company to punch higher today.

Highlights from BDA’s announcement today

Here they are:

‘▪ 3,789 MediCabilis™ units sold during Q3 FY2021 – a 61% increase on the prior quarter (Q2 FY2021: 2,360)

‘▪ Bod retained a 54% share of the Australian full plant high CBD product market during Q3 FY2021 ▪ Total of 7,730 MediCabilis™ units sold during FY2021 – a 93% increase on total FY2020 volumes (FY2020 prescriptions: ~4,000)

‘▪ 62% of quarterly sales were repeat prescriptions – highlights patient and physician product satisfaction

‘▪ Total of 11,810 MediCabilis™ units sold since first prescriptions in January 2019 ▪ Growth underpinned by strong relationships with authorised prescribers and ongoing nationwide clinical study into anxiety, insomnia and Post Traumatic Stress Disorder

‘▪ Upward trajectory expected to continue as medicinal cannabis product uptake across Australia and the United Kingdom increases’

They are some strong numbers, but perhaps not strong enough given the market’s reaction today.

Retaining market share, particularly in light of the TGA move to down-schedule CBD products, could be viewed as a sideways step.

It may also reflect increased competition in the domestic market.

Still, a 61% increase in MediCabilis™ sales is a strong result quarter on quarter.

Outlook for BDA shares and financials

After an initial surge for pot stocks, something I flagged back in November 2020, I’ve noticed a lot of these companies are now treading water.

The US election has come and gone and regulatory action outside of the country is still progressing reasonably slowly.

So the outlook for BDA shares is a bit murky — think of it as being ‘on hold’.

It’s also worth noting that after a long-dormant period for these companies, many investors may be waiting for strong signals that profitability is possible.

In light of that, let’s take a quick look at BDA’s recent half yearly.

Revenue for the half year ended 31 December was $3.3 million, up 62.2%.

BDA’s loss was still $1.29 million, down 8.4%.

The half yearly says that ‘Health and Happiness Group Limited … attributed $1,450,517 to revenue’.

So that’s nearly half of their revenue.

That’s while R&D spend increased to meet regulatory hurdles in the US and Europe to $656,634 and a decent cash balance of $10.5 million relative to their loss.

The challenges are clear in this case for BDA — increase margins, reduce the loss, expand revenue, get regulatory approval for products in the US, while also growing CBD market share in Australia.

All of which are tied together.

It’ll be interesting to see how it all plays out — and more strong growth numbers may see a share price surge followed by a capital raise to really get things going.

Of course, this is just one scenario — and with a market cap of $48 million, some could see that as a bit stretched given its loss.

If you are looking for more on the outlook for pot stocks, be sure to check out our pot stocks report. It covers the regulatory environment in the US as well as three potential winners from a market boom.

Regards,

Lachlann Tierney

For Money Morning