ASX BNPL stock Splitit [ASX:SPT] rose as much as 9% early on Monday following a June quarter trading update.

In a sign of the changing times, Splitit followed its BNPL rivals in shifting focus away from top line growth and focusing on profits.

The BNPL stock, with a market cap of around $80 million, said it was ‘accelerating the pathway to profitability’.

SPT also asserted that it is ‘separating from the [BNPL] pack’ as it seeks to improve net margins and cut costs.

Over the past 12 months, the BNPL stock is down 70%, although it has seen a modest rebound in recent weeks, up 10% in the last month.

Source: Tradingview.com

Splitit thinks it’s separating from the BNPL pack

Splitit opened its June quarter release assertively.

The BNPL stock began by stating it is separating from the pack. How so?

Splitit boldly claimed the headwinds facing other BNPL stocks — like write-offs, bad debts, marketing expenses, and borrowing costs — ‘do not impact our business’.

Splitit then highlighted the ‘inherent strength of our business model’ in arguing for its status as the ‘only white-label instalment solution’.

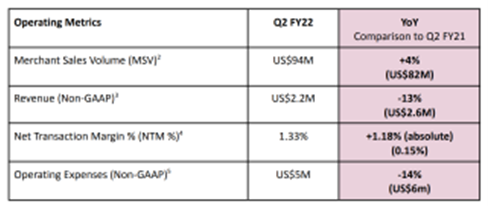

While SPT touted its inherently strong business model, its June quarter net transaction margin (NTM) sat at 1.33%. While low, it was nine-times higher than last year’s June quarter NTM.

However, while NTM rose, revenue fell.

Splitit’s revenue this quarter fell 13% year-over-year.

Year-over-year merchant sales volume growth was modest, rising 4%. Splitit partly attributed the low growth to the ‘exiting of unprofitable merchants’.

While SPT stressed its ‘accelerated path to profitability’, its Q2 FY22 revenue of US$2.2 million was exceeded by its operating expenses of US$5 million.

Splitit also drew attention to the expansion of its board, with new board member additions in Dan Charron, a ‘payments industry veteran’ as independent non-executive director, and new Managing Director Nandan Sheth.

The company also welcomed a new chief revenue officer, head of product, and head of operations.

Source: Splitit

Splitit share price outlook

Splitit aimed to position itself apart from the rest of the BNPL sector by touting its differentiated product.

Splitit CEO Nandan Sheth commented:

‘Splitit offers the most differentiated and scalable instalment business model in the industry. We have steady, predictable and growing net transaction margins (NTM) which are shielded from the rising consumer defaults hurting the rest of the industry.

‘Our differentiated business model that unlocks existing credit for merchant funded instalments is becoming the most viable alternative to the high friction and high-risk legacy BNPL services. The industry is starting to recognize that Splitit’s unique model stands apart in a crowded space of players extending unsecured loans to subprime consumers.’

While Splitit is confident it possesses enough unique qualities to set it apart from a sector struggling to regain the market’s interest, time will be the best judge of whether Splitit has a differentiated business model that shields it from the sector’s notorious bad debt issues.

Splitit reported having $30,887,000 in cash and equivalents at the end of the quarter, with a further US$86 million in unused available funding.

From BNPL to lithium’s little brother

Now, BNPL stocks aside, what are some stocks offering long-term investing opportunities?

Thanks to the global shift to an EV dominant future, there’s major demand for materials like lithium, copper, nickel, cobalt, and graphite.

And while lithium stocks have entered a deep correction after notching dizzying valuations, our team at Money Morning thinks there’s a smarter way to play the battery tech boom.

The smarter way involves what you might call lithium’s little brother. Check out the report here.

Regards,

Kiryll Prakapenka,

For Money Morning