The large fintech Block Inc [ASX:SQ2], which recently acquired the buy-now-pay-later company Afterpay, beat earnings estimates in its September quarter results, with SQ2 shares rising by more than 10% on Friday.

Block, formerly known as Square, reported a 17% rise in total net revenue from the prior corresponding quarter to US$4.52 billion in the September quarter.

Despite the revenue bump, SQ2 ended the quarter with a net loss of $US 2 cents a share.

SQ2 shares — dual listed on the ASX following the Afterpay acquisition — are down 45% year to date.

Source: Tradingview.com

Block beats estimates in September quarter

Block reported net revenue accrued over the past three months, to a total of US$4.51 million, to be an improvement on the US$3.84 million reported for the same period last year.

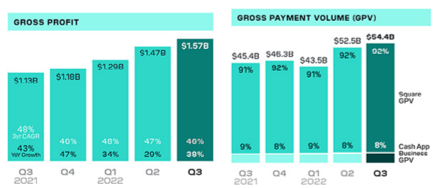

Analysts were predicting Block’s top-line performance to reach $1.53 billion — based on the $1.13 billion reported by SQ2 in 2021. The fintech has, in fact, surpassed such predictions by delivering $1.57 billion.

Gross profit also improved year on year, rising by 38% to US$1.57 billion. Block’s Cash App was a strong segment performer, generating a gross profit of US$774 million, up 51% year on year.

The Cash App is Block’s one-stop platform solution where users can transact, transfer funds, and invest.

SQ2 ended the quarter with $7.1 billion in available liquidity and $6.5 billion in cash and equivalents.

Aside from its positive progress after the Afterpay acquisition, Block said it will focus on improving its product for the international markets, especially in expanding its Square Banking segment.

SQ2 stated:

‘We delivered strong growth at scale during the third quarter of 2022. Gross profit grew 38% year over year to $1.57 billion, up 46% on a three-year compound annual growth rate (CAGR) basis. Excluding our BNPL platform, gross profit was $1.42 billion, up 25% year over year and 42% on a three-year CAGR basis. Our Cash App ecosystem delivered gross profit of $774 million, an increase of 51% year over year and, excluding our BNPL platform, 37% year over year. Our Square ecosystem delivered gross profit of $783 million, an increase of 29% year over year and, excluding our BNPL platform, 17% year over year.’

Source: SQ2

Fintech stocks to watch

2022 has been tough for the fintech sector, but the result from Block today shows not all is doom and gloom.

Fintechs can still provide valuable opportunities — at the right price and with the right growth prospects.

There’s no doubt that in recent years many fintechs suffered from overconfidence in the ‘growth-at-all-costs’ business model that caught them off-guard when the markets turned.

You could argue Block’s BNPL acquisition Afterpay and its peers like Zip were victims of this strategy.

Clearly, profitability is back as a priority for the sector.

With the right choices, some fintechs can grow into very sturdy, lucrative businesses.

Our market expert, Ryan Clarkson-Ledward, has done the necessary research required for discerning these.

He’s discovered three profitable fintech stocks flying under the radar. One of them, he says, is a start-up ‘wrestling with the big banks — and winning.’

Download Ryan’s free research report on three exciting fintechs here.

Regards,

Kiryll Prakapenka,

For Money Morning