So, I came across a fact this week that blew my mind…

Apparently, the colour purple does not exist.

‘What are you smoking, Ryan?’ I can hear you thinking.

I mean, you probably see purple all the time. I know I do when I gobble down a certain popular brand of milk chocolate.

But I’m telling you, it’s true.

Purple does not exist – at least not in the real world.

Unlike other colours, no wavelength of light is ‘purple’.

It’s a fiction your brain creates when it sees a certain combination of red and blue light simultaneously.

In other words, purple exists only in our heads.

Can you believe it!

You’ve lived your whole life, thinking purple was a real thing and now you know it’s just a figment of your imagination.

If that’s blown your mind – like it did mine – get this…

Money is not a real thing, either.

It has no intrinsic value, is not backed by anything, and does not exist in nature in any form.

And although many people would do anything for it, if you were ever stuck on a desert island, it’s the last thing you’d want!

Money is simply an abstraction created by humans over time to make life easier.

But here’s the point….

This abstraction isn’t a fixed concept.

Over the decades and centuries, we’ve seen money change numerous times.

It’s been shells, stones, sticks, gold, silver, paper notes, and digital numbers on a screen.

Money changes with time, economic circumstances, technology, politics, and the rise and fall of empires.

But isn’t it funny…

To think that the thing you slave away for your whole life isn’t real.

But that doesn’t make it any less important.

After all, the ‘imaginary’ colour purple isn’t real either, and it has been associated with royalty since ancient times.

Fine, you say, but what am I getting at?

Well, money – that made-up abstraction – is in the process of changing at an increasing rate.

History tells us, if you hold the wrong type of money at the wrong time, you’ll see your wealth go backwards.

If you don’t realise this fact soon, you’ll find out how imaginary your ‘legal tender’ actually is.

This isn’t just some outlandish statement from a ‘tin foil-hatted’ financial newsletter editor (me!), either.

Not these days, anyway.

You see, some powerful people are currently preparing for this eventuality.

You should, too…

Trump walks into a bar

This first titbit of news might seem trivial at first.

But think deeper and you’ll realise – in the midst of a presidential campaign – it’s no joke.

Here’s a picture of Donald Trump from last week.

| |

| Source: Crypto Slate |

He’s at a downtown bar in New York City called Pubkey.

What’s he doing?

Shouting the bar a heap of burgers and cokes, that’s what.

But it is how he’s doing it that is interesting.

You see, Trump is paying for all this using Bitcoin!

Pubkey is a Bitcoin bar and accepts Bitcoin over the Lightning Network (as well as regular cash and cards).

To be clear…

This transaction never touches regular banking rails and it doesn’t use the US dollar.

The whole transaction takes place on a parallel financial system!

Trump is one of the latest in a string of high-profile Bitcoin converts.

As you might know, he recently declared his support for the US setting up a strategic Bitcoin reserve.

He said:

‘If I am elected, it will be the policy of the United States of America to keep 100% of the bitcoins the U.S. government currently holds or acquires in the future.’

The US government has 183,000 Bitcoins in its possession (approx. US$11.5 billion worth at current prices).

Now, love him or loathe him, Trump’s a 50/50 shot at becoming the next US president.

So if he wins, the price of Bitcoin could go ballistic on sentiment alone!

Not convinced by Trump?

How about Blackrock…?

The safe haven

Blackrock is the biggest financial firm in the world.

They manage US$10.5 trillion worth of assets and exert considerable power and influence on financial markets.

And like Trump they’ve pivoted to being very pro-Bitcoin over the past year.

What’s interesting in their case is the ‘why’.

Why would a master of the current monetary order care about an asset class that is still miniscule in the grand scheme of things?

Answer: They’re worried.

As reported in Forbes Magazine on Friday:

‘Now, as fears swirl the U.S. dollar is on “the verge of a total collapse,” the world’s largest asset manager BlackRock has warned of “growing concerns” around the spiralling $35 trillion U.S. debt pile that’s predicted to drive “institutional interest in bitcoin.

‘“The growing concerns in the U.S. and abroad over the state of U.S. federal deficits and debt has increased the appeal of potential alternative reserve assets as a potential hedge against possible future events affecting the U.S. dollar,”

‘BlackRock’s exchange-traded fund (ETF) chief investment officer, its head of crypto and its head of fixed income global macro wrote in a paper outlining the investment case for bitcoin.’

Yep, you’re reading that right.

Blackrock is pushing Bitcoin as PROTECTION against a US economy in the midst of an unstoppable debt spiral.

This probably goes against everything you’ve heard about Bitcoin in the mainstream.

Bitcoin is ‘risky’ you’ve constantly been told.

And yet now, here’s the biggest money manager in the world saying, ‘No, it’s actually a safe haven asset.’

They’re acknowledging the elephant in the room.

The US debt situation.

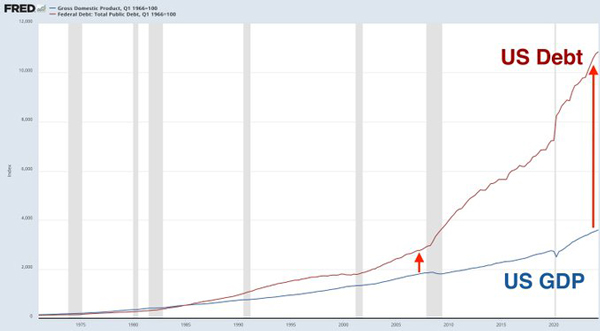

Ex-hedge fund manager, James Lavish, laid out how bad the US debt situation is in a recent Twitter post.

He shared this chart:

| |

| Source: James Lavish |

Lavish noted:

‘A system that relies on exponentially increasing levels of debt for each incremental unit of productivity eventually becomes so unstable that it simply collapses under the weight of its own leverage.’

They won’t say it, but my guess is this burgeoning debt load has some influence on the Fed’s larger-than-expected 0.5% interest rate cut last week.

After all, the lower the interest rate, the less the US government pays in debt costs. This slows the debt spiral for now.

Can they do this while managing inflation, though?

That’s the big question.

But I don’t think they really care about inflation (it’s all just for show!).

Inflation and debt are two sides of the same coin in a way.

Both devalue money, which is what the indebted US wants to happen.

Historically, sovereigns have always debased money to rid themselves of their debts sneakily.

But back to my original point…

Change is coming

Money is not real. It’s like purple – a figment of our imaginations.

That doesn’t make it unimportant.

I think realising this fact opens you up to the possibility that money is not a fixed thing.

It’s a collective illusion.

When the rules of money are too badly abused, the illusion falls apart.

Some ‘serious people’ in the mainstream are finally preparing for this.

In my opinion, we’re in the early stages of money morphing into something else.

What that ends up looking like and over what time scale is still the big unknown.

A return to gold, CBDCs, universal basic incomes, rampant inflation like in the 1970s, a debt jubilee…these are all possible outcomes.

But as I showed you today, some very powerful people – who can influence trillions of dollars of assets – think Bitcoin will also be part of our future money.

I’m no longer a lone voice in this, and it seems that the sands are shifting quickly.

The good news is you can still front this possibility.

Later this week, I’ll show you how you can incorporate this unique asset class into your financial strategy in a sensible way.

Regards,

|

Ryan Dinse,

Editor, Crypto Capital and Alpha Tech Trader

Comments