After scaling to a lofty height, the cryptocurrency edged down over the last four days.

It’s a natural move after lift-off was achieved.

Now some on the crypto-Twittersphere are screaming ‘everyone panic!’

For some, this might be out of self-interest, but others are deeply cognizant of a 2018 repeat.

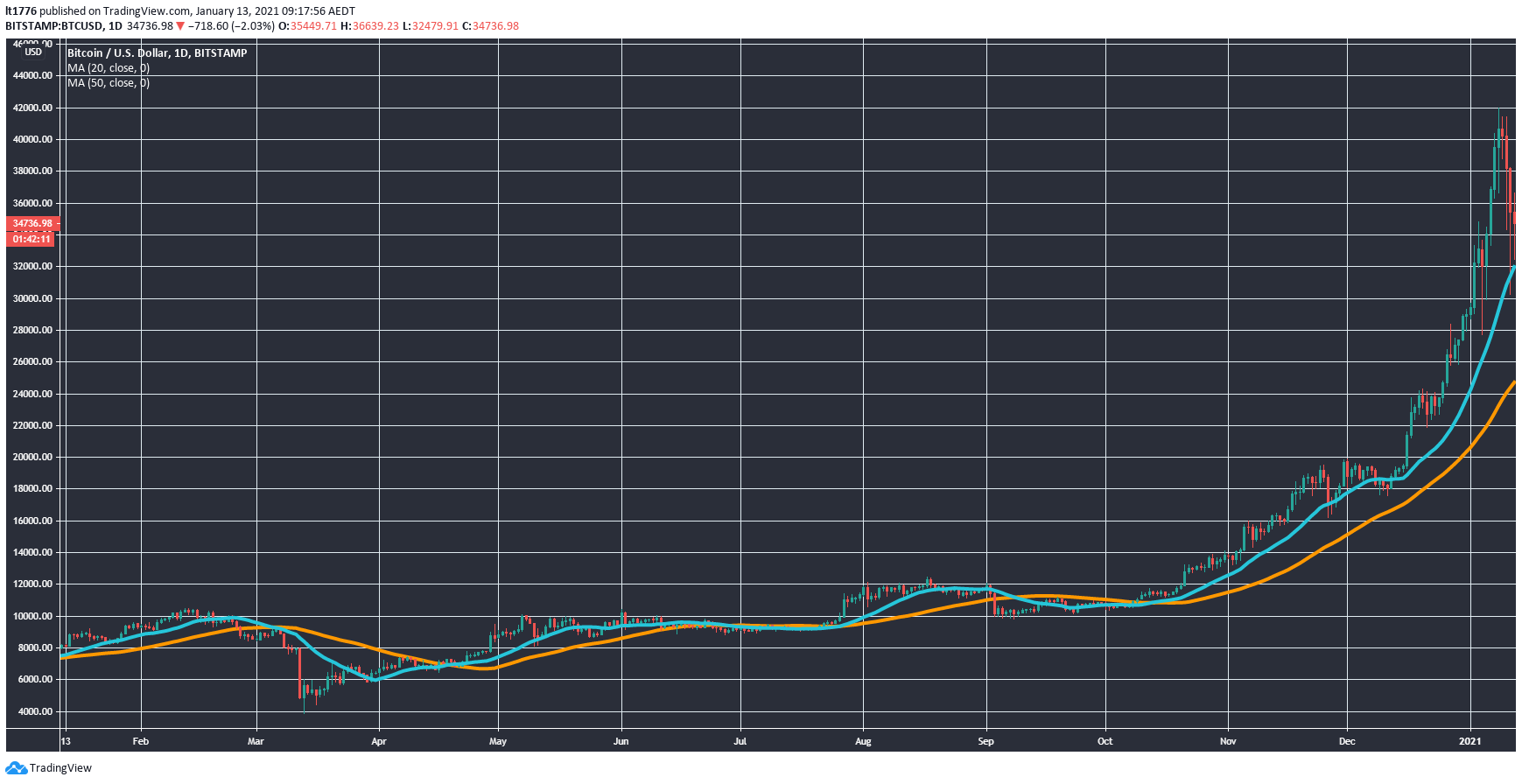

Really quick, here’s the Bitcoin [BTC] chart (in USD):

|

|

|

Source: Tradingview.com |

You can see the Bitcoin price is hovering around the US$35,000 mark at the moment.

And it’s not a truism to say that the world is very different to what it was in 2018.

I’ll get into the fundamental differences in the monetary landscape in a bit.

But for reference, let’s also take a look at the price of BTC in AUD right now.

It’s hovering around the $44,000 mark.

Now, there’s a strong case to be made that if you are a HODLer you shouldn’t be thinking in terms of fiat currency differences.

You should simply just focus on accumulation, aware that the crypto future will be very different from the fiat present.

That’s a great step change in thinking to make, I might add.

Bitcoin vs Gold: Which Should You Buy in 2021?

Fiat currency and the monetary system could lead to this…

However, for now it’s important to look at the AUD/USD chart:

|

|

|

Source: Tradingview.com |

The AUD/USD pair is pushing higher and now sits at 77.7 cents.

It snapped a downtrend as the US Dollar Index [DXY] slipped hard and pushed through two resistance levels.

The next level to think about would be around 80 cents.

That would be quite something, but it’s still hard to bet against a weakening USD given the imminent Biden ascension to the US throne with more aggressive tax and spend to come.

I’ve read a fair bit about a lot of short positions on the USD.

Now, you may wonder why I’m bringing fiat into the discussion?

It’s because short-term fluctuations make your trading returns very different.

The long-term story on the other hand, is the global race to the bottom currency wars, which the RBA is now appearing keen to join with a near-zero cash rate and QE.

It may sound far-fetched, but I think that the degree of fiat currency weakness combined with economic circumstances and the potential for super ‘hot’ inflation, will feed directly into a cascading series of events in the monetary system.

And I’m also going to suggest that the countries with a combination of the direst economic conditions, lowest rates (sub-zero), and least capitalised banks will be the first to see the following…

That is, the rollout of central bank backed digital currencies (CBDCs), the demise or rapid evolution of traditional banking, and the ascension of mega-fintechs.

The rapid changes in the monetary system are something Ryan Dinse and I discussed in our analysis of the Ant Financial IPO and DeFi here and here.

Keeping in mind, this was well before the BTC price went bananas.

Which is why I don’t think this is 2018-redux for BTC HODLers.

History won’t repeat and what to do with your crypto portfolio

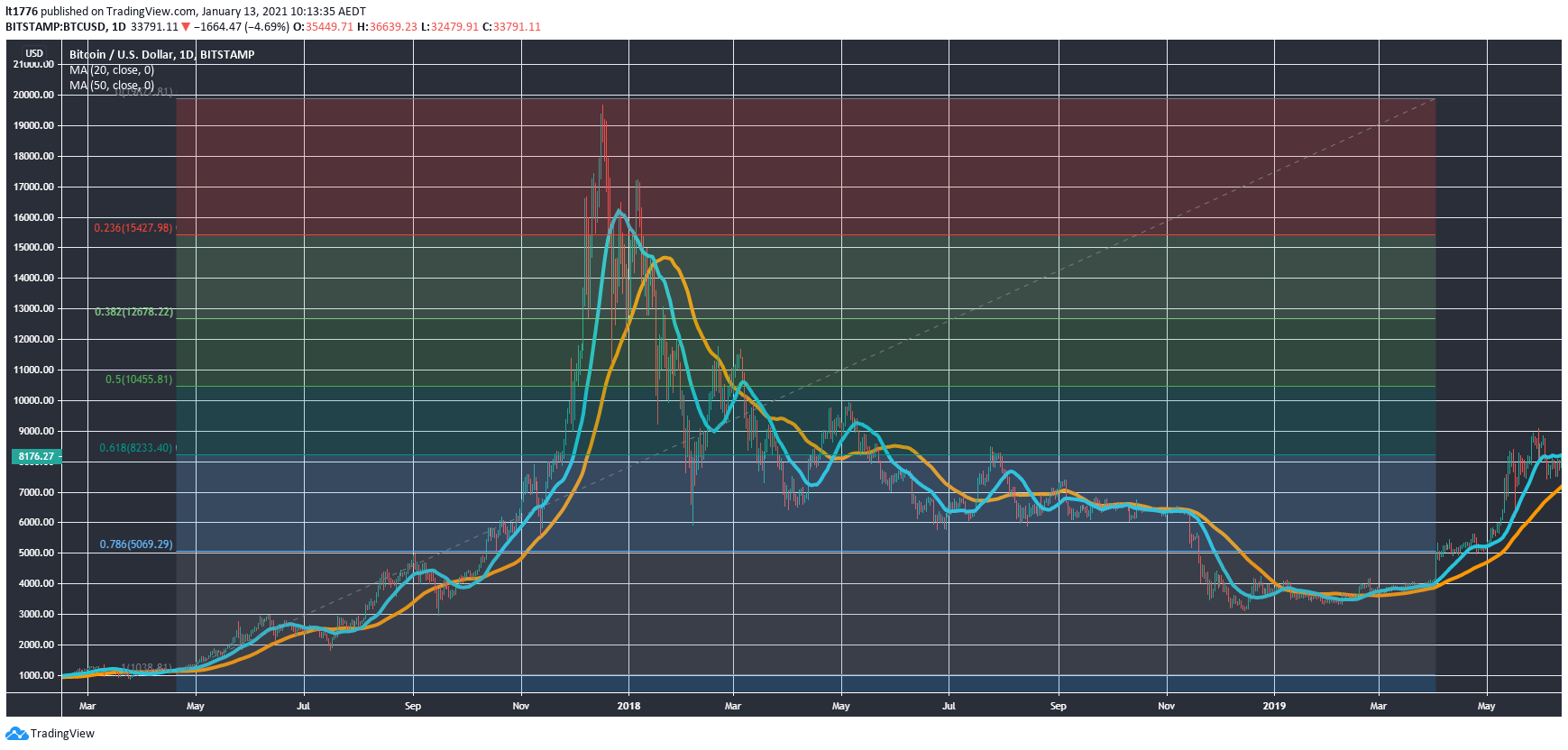

Here’s a chart showing how much BTC/USD sold off in 2018:

|

|

|

Source: Tradingview.com |

And here’s a chart showing how much BTC/USD would need to sell off to achieve the same feat:

|

|

|

Source: Tradingview.com |

Now these are rough charts, but you can see in the first chart from my two chosen points of a low to a high, over 2018, the BTC price sold off to just below the .786 Fibonacci level.

In the second chart, using the low, I put in a new set of Fibonacci levels to the recent high.

The ellipse in the right-hand part of the chart would be one place where the BTC price could go to if history were to repeat the 2018 sell-off. That’s around the $10,000 mark.

Now it may not be the best explanation, and there are a lot of assumptions built into this analysis, including market demand fundamentals etc.

But simply put, there are too many differences between 2018 and 2021, in my opinion.

So, no need to panic.

What if this happens?

The only things that in my eyes could see this scenario play out would be multiple coordinated exchange hacks or a quantum hack.

Not to mention, central bankers magically coming to their senses.

Here’s how I think you should consider approaching crypto in light of the recent pullback though…

You see, there would be many investors out there who only know BTC, not the myriad of other altcoins.

Because BTC has that name-brand recognition.

Many of these altcoins are legitimate and exciting projects, capable of doing very intricate things.

I alluded to flip trading on Monday.

This is the process whereby you convert BTC holdings into altcoin holdings to benefit from the cycle of traders entering and exiting from BTC and altcoins ad infinitum.

There’s a whole lot of risk to be sure, but imagine this one thing…

What if the current mini BTC market panic leads to the new funds that have entered the BTC market to start engaging in flip trading too (in order to preserve gains)?

What if we are witnessing the early stages of a bona fide crypto and blockchain revolution?

Remember this is not 2018, this is 2021.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Learn more about our Crypto Flip Trader service, which will reveal to you a fascinating new cryptocurrency trading strategy, designed to help you exploit heavily-fluctuating prices across all digital currencies like Bitcoin, Ethereum, and Litecoin using a unique trading strategy. Click here to learn more.