In today’s Money Morning…is BTC a risk asset anymore?…where could the BTC price go from here?…here’s the punchline…and more…

Editor’s note: In today’s video I discuss the future of money and some major crypto headlines investors should be aware of. I also look at the impact of PayPal’s and Square’s recent BTC moves on the charts and the weakening of the USD. Please click the thumbnail below to view.

As I write, the Bitcoin [BTC] price is threatening to punch above the US$14,000 mark.

Now, this won’t be a mindless cheerleading piece for the cryptocurrency, I promise.

But I believe things are starting to align for a renewed push up the charts.

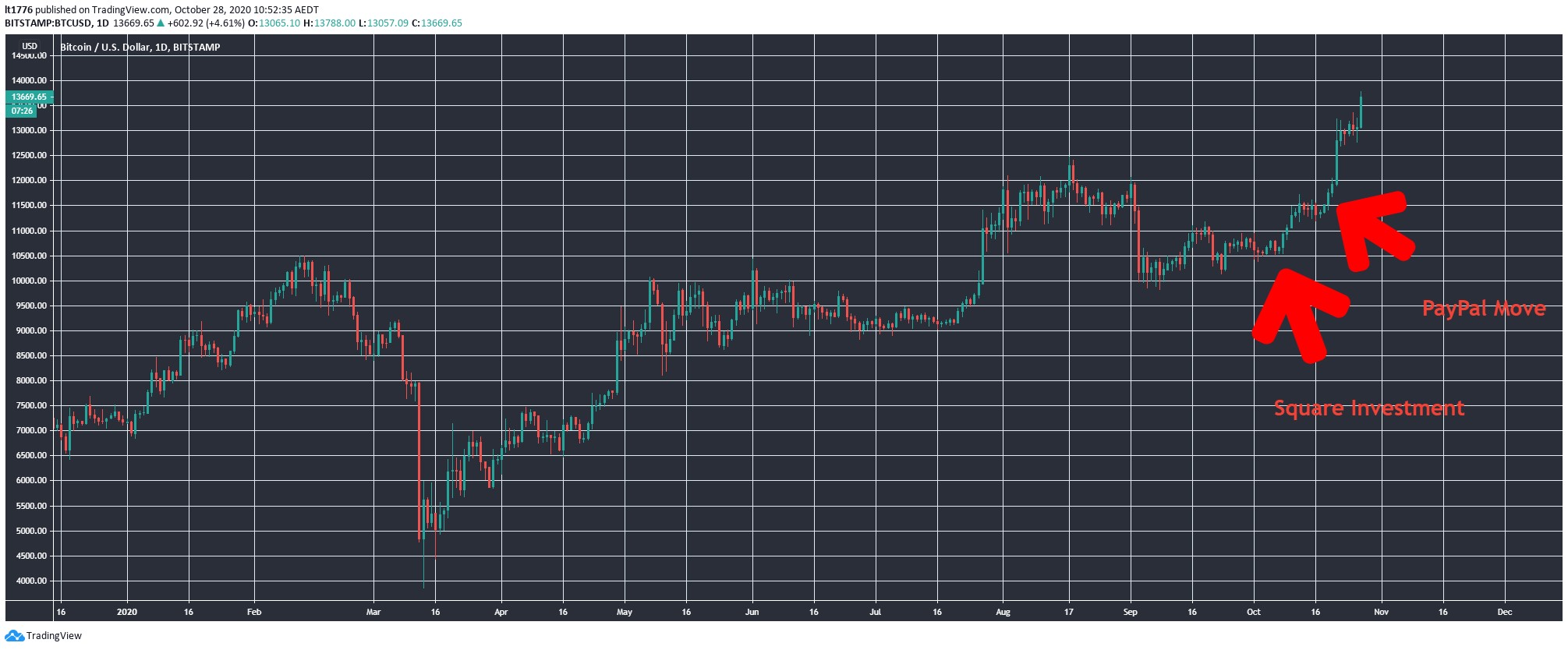

Take a look at the BTC/USD chart below:

|

|

|

Source: Tradingview.com |

Here are a few things to consider about the chart:

- Sell-off into March market lows

- Strong rally

- Threatening to punch above US$14,000

Now, I’d be tempted to say the chart looks a bit like the NASDAQ chart.

A lot of hay is made about BTC being a ‘non-correlated’ asset, meaning it moves independently of the market.

Over the long term I think this is still the case.

But over the last seven months or so, the correlation is relatively strong.

The two arrows refer to the recent move by Square Inc [NASDAQ:SQ] to invest US$50 million into BTC and PayPal’s announcement that it would enable the buying, selling, and holding of cryptocurrencies on its platform.

Two big, big moves that could spur wider adoption.

Which brings me to the following question…

Is BTC a risk asset anymore?

It’s a legitimate question to ask.

Markets are up and gold is up, meaning the ‘risk on’ ‘risk off’ dynamic that was the case for so long is starting to fray.

BTC is often considered a speculator’s playground.

This may be changing though.

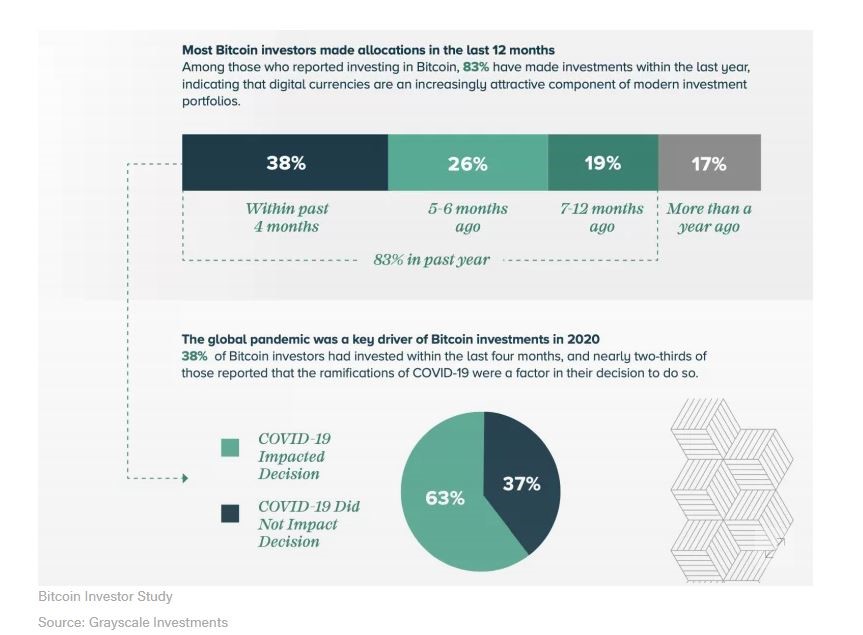

Consider the following from Grayscale Investments:

|

|

|

Source: Coindesk.com |

As you can see, 38% of the bitcoin investors surveyed have invested in the last four months, with nearly two-thirds reporting that the pandemic motivated their decision.

Likely, it is more the monetary policy that drove the decision.

Or it could even be fears of a broader societal breakdown.

But the point remains that BTC may not be the speculator’s fever dream so many financial bigwigs dismissed a few years ago.

It may now be a sort of macro hedge.

Among other titbits of information in Grayscale’s survey were these two:

- ‘The total number of bitcoin investors in the U.S. also rose to 32 million, up 11 million from the previous year’s 21 million.

- ‘Almost half of respondents said they believe digital currencies would become mainstream by the end of the decade.’

At the same time there is a split in demographics in Grayscale’s survey data:

- ‘The study was not without its negative insights, however, finding that, of people aged 55-64, only 40% were familiar with bitcoin and just 30% would consider investing.

- ‘Common concerns among survey respondents who were not interested in investing in bitcoin tended to reflect the views of older investors generally, the study showed.

- ‘Among the older age bracket, 81% thought bitcoin was too volatile, while 84% said it was too risky for their investment appetite and profile.’

These older investors are likely to favour gold, as they are more familiar with it.

Together BTC and gold represent what I term the ‘trust quotient’.

Meaning their rise points to an increasing reticence to buy what the Fed is selling.

I.e. more cheap money.

Where could the BTC price go from here?

While we may be a long way from individual Satoshis (the smallest unit of BTC) being used like US$1 bills, there are some important levels to be aware of on the chart:

|

|

|

Source: Tradingview.com |

The two levels above are the US$14,000 and US$17,000 marks.

A push past either of these may mean the US$20,000 level may be punctured.

Interestingly as the BTC price rose after the March chaos, the US Dollar Index [DXY] slid.

Inverse correlation doesn’t mean causation, of course.

But as confidence wanes in the power of the USD, more investors are embracing BTC as the Grayscale survey indicates.

Here’s the punchline

PayPal’s and Square’s moves are not to be sniffed at.

While only 15% of PayPal’s user base is from generations older than the millennial bracket, that’s still a big whack of users.

Around half of PayPal’s 300-million-person user base is in the US.

Meaning by a back of the envelope calculation, around 22.5 million older people will have the opportunity to invest in BTC.

So, it’s not hyperbole to suggest this may be the most pivotal moment in BTC’s history.

Politicians talk a lot about being on the ‘right side of history’.

Investors should try to be on ‘the right side of history’ as well.

Regards,

|

Lachlann Tierney,

For Money Morning

Lachlann is also the Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.