In today’s Money Morning…follow the whales…the ultimate hedge…either way, you simply cannot ignore the demand…when green sees red…and more…

I feel like I’m experiencing déjà vu…

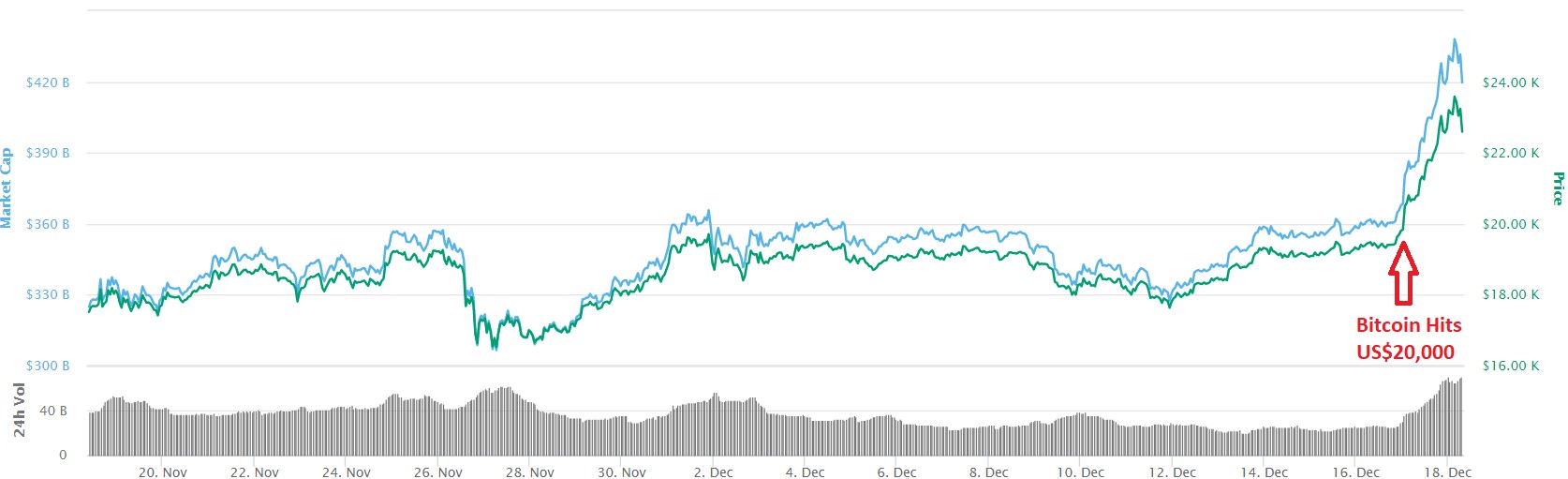

Bitcoin [BTC], just like it did in 2017, is seeing a huge December rally. Seeing the cryptocurrency not only beat its all-time high (set back in 2017), but absolutely smash through it.

As far as I can tell, the bitcoin price peaked at US$23,584.60 overnight. Not only breaking the ever elusive US$20,000 mark, but absolutely blasting through it.

In fact, it’s pretty damn clear that a lot of buyers were waiting on the sidelines for this moment. Just look at the chart for yourself:

|

|

| Source: Coin Market Cap |

As soon as it breached the US$20,000 figure, trading exploded. Sending the price ever higher.

A classic case of ‘fear of missing out’ if I’ve ever seen one.

But, for the crypto community and bitcoin especially, it is a milestone nonetheless. One that will silence many of the doubters after the last crypto bubble.

Because while many have no doubt been consoling themselves during this recent ‘crypto winter’ — others have been accumulating. Steadily building their position in bitcoin, waiting for this moment.

And let me tell you, these individuals have some very deep pockets…

Sign up to the special Crypto Fast Lane summit for free. Click here now.

Follow the whales

In bitcoin terminology, a large holder or institutional investor is known as a ‘whale’. Individual traders who can sway the market with their trading alone.

And that’s exactly what the crypto community has been abuzz about in recent times. A hypothesised flood of institutional investors looking to commit their capital to bitcoin. A long-held theory for cryptocurrency’s latest ascent throughout 2020.

Because of the anonymity of bitcoin though, knowing who these whales are can be tough. After all, privacy is one of its most touted features.

So, while we can see the money flowing in, or several large trades, it is often impossible to know who is behind it.

That is, unless the whales out themselves…

On Wednesday, investment firm Ruffer LLP revealed that it has become a big-time bitcoin buyer. Devoting US$744 million to the asset — which is just a measly 2.5% of the total fund, might I add.

Then, yesterday, it was revealed that Eric Peters — the CEO of One River Asset Management — has also delved into bitcoin. Creating a new asset company to capitalise on the trend. A company that has already stealthily acquired US$600 million in bitcoin and a range of other cryptocurrencies.

By early 2021, Peters says that holding will grow closer to US$1 billion. Suggesting that these whales may not be done accumulating just yet.

However, given that these public declarations have clearly already had an impact on bitcoin prices, I’d stay wary. Whether by design or not, it could lead to a classic ‘pump-and-dump’ scenario.

But, for long-time crypto enthusiasts and traders, these whales are exactly what they’ve been waiting for.

It is the first sign of a new wave of public acceptance. Especially during a time when other asset classes are acting rather unusually, to say the least.

The ultimate hedge

See, as the price of bitcoin was booming overnight, so too was Wall Street.

US share markets had a stellar session, largely due to Jerome Powell.

The Federal Reserve has, once again, committed itself to its unconventional asset purchase program. Part of the broader scope of Quantitative Easing (QE).

As their latest press release notes, emphasis mine:

‘In addition, the Federal Reserve will continue to increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward the Committee’s maximum employment and price stability goals.’

So, not only are the Fed still juicing the ‘economy’, they clearly aren’t happy with the results thus far. Aiming to stand by their money printing strategy until the problem goes away.

All the while the though, asset prices are reaching delusional levels. With stocks in particular climbing to obscene valuations.

The NASDAQ is up almost 4,000 points from the start of the year and has almost doubled from the March lows. And while the S&P 500’s performance has been far tamer; it is still in the black for 2020. Up about 500 points from the start of the year, and up 1,500 points from March.

It’s pretty damn clear who the Fed’s goals are really benefitting.

And with seemingly no plans to end this QE anytime soon, the stock bubble will only grow bigger.

For that reason, it doesn’t surprise me to see significant money flowing into bitcoin. Because at the end of the day, just like gold, it is a hedge against a crash. Whether it be purely in the stock market, or of the global economy.

After all, the US dollar’s decline has yet to abate. Led by the Fed’s destructive policies.

In fact, that is why bitcoin was created in the first place. Born from the wake of the global financial crisis.

Now though, these uber wealthy individuals are flocking to it. Which is why everyday investors like you and I can’t afford to ignore it.

Because while many people may be in it purely for the gains, bitcoin’s real purpose may be the ultimate hedge.

Either way though, you simply can’t ignore the demand…

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For more information on our upcoming Crypto Fast Lane summit, click here.

Comments