Mining giant BHP Group [ASX:BHP] released its FY22 report this morning, reporting record underlying earnings of US$40.6 billion and record free cash flow of US$24.3 billion.

The miner also flagged rising capital expenditure on future facing commodities like nickel and copper and addressed inflation concerns.

BHP shares rose more than 4% on Tuesday.

BHP has had a turbulent 12 months, as prices for key commodities have oscillated on uncertainty around the global economic outlook.

That said, BHP shares are up 12% since hitting a six-month low in mid-July.

Source: www.tradingview.com

BHP FY22 key results

The following are BHP’s key financial and operational results for FY22:

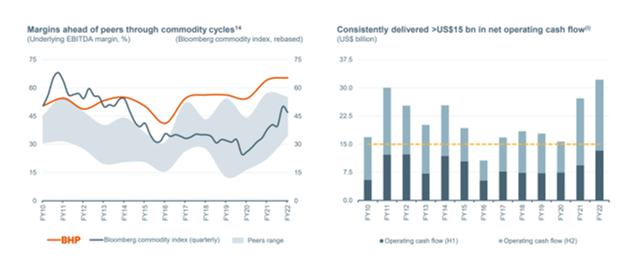

- Underlying EBITDA was US$40.6 billion for the year, up 16%

- Underlying attributable profit was US$21.3 billion, up 26%

- Profits (from operations) came to US$34.1 billion, up 34%

- Total attributable profit was US$30.9 billion, up 173% on FY21’s US$11.3 billion

- Net operating cash flow from total operations came to US$32.1 billion, an 18% increase

- Net debt reduced 94% from US$4.1 billion to US$333 million

- Capital and exploration expenditure rose 5% to US$6.1 billion

- Underlying basic earnings per ordinary share rose 25% to 421.2 cents

- Record Return on Capital Employed of 48.7% on a total operational basis

BHP’s CEO Mike Henry commented on the results:

‘BHP delivered strong operational performance and disciplined cost control to realise record underlying earnings of US$40.6 billion and record free cash flow of US$24.3 billion. We have reduced debt and announced a final dividend of US$1.75 per share, bringing total cash dividends announced for the full year to a record US$3.25 per share…

‘These strong results were due to safe and reliable operations, project delivery and capital discipline, which allowed us to capture the value of strong commodity prices. BHP remains the lowest cost iron ore producer globally and we delivered record annual sales from Western Australia Iron Ore.’

Source: BHP

BHP offers thoughts on economic outlook

Mr Henry also spoke of China’s likelihood in emerging as a stable source of commodities as demand increases, while cautioning of a ‘slowdown in advanced economies as monetary policy tightens as well as ongoing geopolitical uncertainty and inflationary pressures’.

The BHP CEO also commented on the current energy crisis engulfing Europe, noting the situation is concerning, as well as wider macroeconomic issues:

‘The direct and indirect impacts of Europe’s energy crisis are a particular point of concern. Tight labour markets will remain a challenge for global and local supply chains. Waves of COVID-19 infection continue to occur in the communities where we operate, and we are planning accordingly.’

Source: BHP

BHP increasing spend on future facing commodities

BHP said it intends to increase its capital expenditure on ‘future facing commodities’ like nickel and copper.

Coincidentally, copper and nickel are two key commodities we recently covered in our battery tech metals report.

The report was put together by our resident energy expert Selva Freigedo.

She argued that commodities of the electrified future — like lithium, copper, and nickel — are set for a supply crunch as supply will struggle to keep pace with demand.

So how best to play the emerging battery tech theme?

Read Selva’s free research report for more information and insights.

Regards,

Kiryll Prakapenka,

For Money Morning