BHP Group [ASX:BHP], released its highly anticipated full-year results for FY 2024 today.

Australia’s largest mining company saw its profits edge higher, but the bulk of investors’ focus seems to be on the question of China.

Despite this, BHP retained its position as the world’s lowest-cost iron ore producer. Much of that is thanks to a record performance from its WA operations.

Strong operational performance and higher realised prices saw BHP report a 2% climb in its underlying profits.

This was slightly above market expectations and helped push the share price up 1.6% to $41.51 per share.

However, shares have still fallen by 4.6% in the past 12 months as global demand and Chinese economic health remain uncertain.

For investors looking for a solid dividend payer, is BHP the income investment of choice right now?

Operational Performance and Cost Management

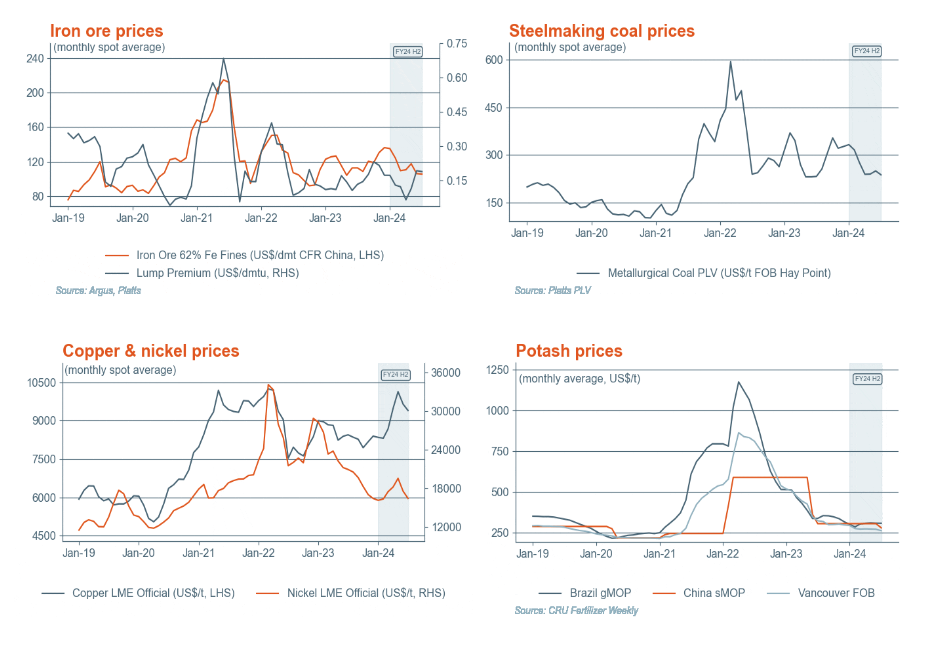

For the 12 months ended 30 June 2024, BHP’s revenue increased by 3% to US$55.7 billion. It said this was driven by higher realised prices and sales volumes for iron ore and copper.

These gains were partially offset by lower energy coal and nickel prices and reduced steelmaking coal volumes following divestments.

While Underlying earnings before interest, tax, depreciation, and amortisation (EBITDA) rose 4% to US$29 billion

However, the bottom-line profit couldn’t match that, with net profits falling 39% to US$7.89 billion.

The drop resulted from huge one-off charges, including a $10.3 billion writedown of its WA nickel assets.

These mines are now mothballed as the price of nickel collapsed earlier this year thanks to a flood of Indonesian supply.

Beyond commodity price, the company has also seemed flailing as it attempted to push towards what it called ‘future-facing metals’.

That has translated to a dogged attempt to acquire copper assets internationally.

The failed takeover bid for Anglo American’s copper mines was just one of many attempts the company has made this year to acquire copper and potash assets.

BHP declared a fully franked final dividend of US74 cents per share. For the full year, total cash returns to shareholders amounted to US$7.4 billion, with total dividends of US$1.46 per share fully franked.

The company said it was their fourth largest ordinary dividend declared, but it was still down from the US$1.70 last year. That’s their third consecutive year of falling dividend payout ratios.

With the held-back capital, BHP said it intends to fund further growth. It has already earmarked close to US$10 billion for the Canadian Jansen Potash Project and US$3.2 billion for copper assets in Argentina.

BHP said around 65% of its US$9.3 billion investing war chest would be allocated to these ‘future-facing’ commodities.

BHP’s CEO, Mike Henry, championed the strong operational performance but had some words of caution about the Chinese market, saying:

‘The longer-term fundamentals that drive demand for our products remain compelling. In the near term, we expect volatility in global commodity markets, with China experiencing an uneven recovery among its end-use sectors. The effectiveness of recently announced pro-growth policies will be an important contributor for the country to achieve its official 5% growth target.’

Hardly strong words of confidence, so what can we expect ahead for BHP?

Market Outlook and Future Strategy

BHP’s results largely met expectations, with the consensus estimates aligning with the reported figures for total revenue, underlying EBITDA, and full-year dividend.

Beyond that — ignoring the usual corporate optimism — Mr Henry’s comments clearly expressed caution.

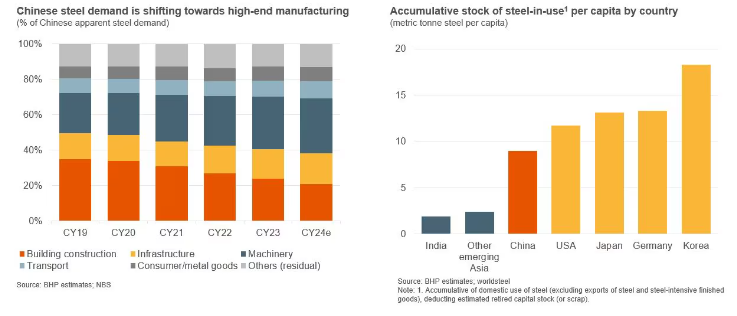

Chinese steel mills have seen their margins eroded this year, and inventory is climbing in major manufacturing nations.

Iron ore markets have watched closely for further signs of stimulus beyond the May injection by the Peoples Bank of China; however, it’s been slim beyond banking tweaks so far.

Still, some hope appears from manufacturing in China, which has clearly been a political focus of Beijing’s leaders since the third plenum meeting.

Global commodity markets are no strangers to short-term volatility. But without further stimulus from China, BHP’s coming year half-year results could face challenges.

Beyond China, Mr Henry pointed to the growth potential of the Indian market. He also anticipates ‘gradual relief from the lingering effects of higher interest rates in the coming years’ for developed economies.

The company’s common refrain during this time has been that it is focused on ‘longer-term fundamentals to drive future growth.’

For BHP, that’s been leveraging its tier 1 assets and holding a robust balance sheet to invest forward.

Copper and iron ore prices have begun to recover in the past week after a tough couple of months of lows. But beyond this shorter time frame, commodity prices should see a return to modest growth in the coming years.

BHP’s strong operational performance should position the company well to face any challenges and opportunities that lie ahead in the global resources sector.

Opportunities in smaller players

It’s not just BHP that is holding a deep war chest and looking for quality mining assets to grow.

The season of mergers and acquisitions is here for the commodity sector.

Our resident geologist and Editor of Diggers and Drillers has been hunting for quality assets.

He successfully predicted BHP’s takeover bid of Filo Mining in Argentina and has identified in a few more potential takeover targets for large players.

He’s built a shopping list of the small-cap players you may want to own if miners like BHP come knocking.

If you want to find out which junior miners you should consider investing in before the big players potentially come knocking…

Then CLICK HERE to find out about three potential buyout situations that could come this year.

Regards,

Charlie Ormond

For Fat Tail Daily

Comments