The oil market caught my eye late last week.

Some strong US economic data — a 3.3% GDP figure — saw oil prices move higher.

Ongoing tensions in the Middle East also helped as traders bet on potential disruptions ahead.

This all saw the price of Brent crude oil push past the US$80 per barrel mark; a key ‘psychological price level’ according to Oil Price Intel.

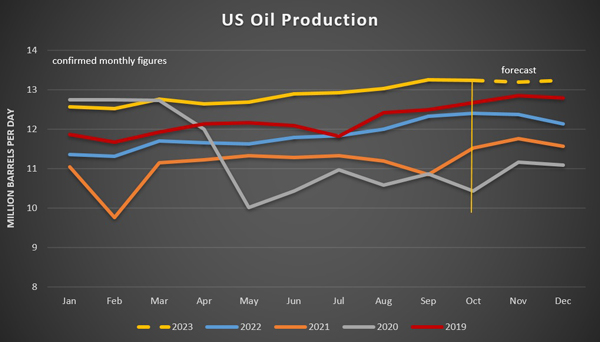

Interestingly, oil production from the US remained at highs for all of 2023.

Check it out:

| |

| Source: Oil Price Intel |

As you can see, production levels remained consistently higher than the previous four years.

Not the sign of a slowing economy…as the GDP figures backed up.

It also means the US oil sector has been a big winner of the continual elevated oil prices, in the face of geopolitical turmoil in Russia and the Middle East.

Funny that…

Anyway, this all led me to thinking.

What if the price of oil remained high over the entire 2020s?

How could investors take advantage of that beyond the obvious?

As I delved in deeper, this line of thinking led me to a surprising idea and an area where some big name investors are already laying their bets.

And it could have implications for a speculative area of the Aussie market too.

Let me explain…

Big tech meets big oil

Right now, there’s a wave of merger and acquisition (M&A) activity sweeping through the US oil sector.

There was a whopping US$190 billion of M&A activity in the US oil sector over 2023.

As Rig Zone reported last week (my emphasis):

‘Oil and gas is undergoing a historic consolidation wave comparable to what occurred in the late 1990s and early 2000s, giving rise to the modern supermajors.

“After a decade of lowered investment in exploration and with the major U.S. shale plays largely defined, M&A has become the preferred tool to replace declining reserves and secure longevity in these companies’ profitable upstream businesses,” Dittmar said in the release.

“For the best quality resource, there are also now more buyers than sellers, driving prices upward,” he added.’

It seems the oil majors are trying to lock in future supply right now.

However…

This key sentence (I’ve highlighted) stood out to me: ‘…with the major U.S. shale plays largely defined…’

I wonder how true this is?

It suggests there’s not that much to be made from new exploration.

But what if that rationale is wrong?

One famous group of investors are betting it could be.

And not just in oil, but the entire resources sector…

You see, billionaires Bill Gates, Jeff Bezos, Michael Bloomberg, and Ray Dalio are some of the famous backers of a little-known company called KoBold Metals.

KoBold Metals is using artificial intelligence (AI) to accelerate the search for copper, nickel, lithium, and cobalt across 60-plus projects over three continents.

As their website states:

‘KoBold is building the world’s largest collection of geoscience information. Using AI systems, KoBold interrogates that data to model the sub-surface in the most statistically valid manner ever.’

Basically, they think that AI will help pinpoint new deposits much more efficiently than human geologists.

And the power of big data and machine learning will be able to crunch the data and find hidden value lying beneath the surface.

Veracio is another company in the resources space using AI.

They’re an AI-focused offshoot of well-known drilling company, Boart Longyear [ASX:BLY]. This Aussie listed company has just been taken over by a private US fund.

Anyway, Veracio has a global workforce of geoscientists, data scientists, and operators supporting leading mining technologies in five continents around the world.

Like KoBold, Veracio think the tools of AI can unlock hidden value across the exploration space.

It wouldn’t be the first time this kind of thing has happened.

There’s a long history of tech opening up new greenfield sites in the mining industry.

For example, the 2000s saw notable tech breakthroughs in mining such as gravity gradiometry, electromagnetic survey techniques (including airborne), 3D electric surveys and portable geochemical analysers.

The 2010s saw the beginning of computer modelling and big data techniques begin to make their mark.

And the advent of AI marks the continuation of this trend.

Only time will tell if AI can meaningfully alter the economics of resource exploration.

But imagine if it does…?

A re-rate for an entire sector

Imagine some of the ASX’s small-cap resource explorers — the kind of companies sitting on massive plots of land but with little knowledge of what sits underneath — can suddenly more accurately find, map, define, and process a potential deposit?

It could mean a re-rate for the entire small-cap resources sector!

Veracio’s Chief Innovation Officer, Michael Ravella, thinks this is the potential on offer.

He said recently:

‘Digital sensing and AI can drive discovery. But once discovered, they can also move resources forward from discovery to resource to reserve to processing.’

In fact, AI is already used in much of the processing side of things.

Copper-giant Freeport uses AI systems in many of its concentrators — the final process in ore processing — and is looking to roll out further AI systems across the processing chain.

The ultimate goal is simple: to lower costs.

Mikko Tepponen, COO at large mining equipment supplier FLSmidth & Co said that machine learning has helped deliver 10% throughput efficiencies.

‘If you think about some of the big producers of the world…it leads to $100-million-dollar-plus yearly benefits,’ Tepponen said.

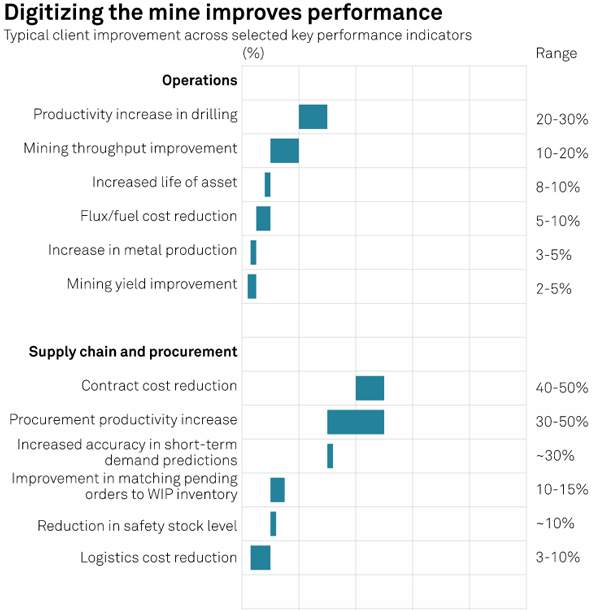

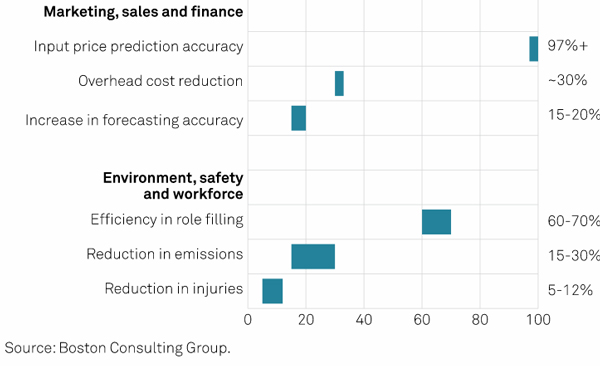

According to the Boston Consulting Group, AI and digital automation could result in cost savings across the entire mining supply chain.

| |

| Source: Boston Consulting Group |

| |

| Source: Boston Consulting Group |

As you can see, the economics of mining — from exploration through to marketing and processing — could all be about to undergo a massive transformation over this coming decade.

And AI is set to be a big part of it…

A decade of transformation ahead

Of course, these transitions don’t happen all at once.

And along the way there will be experiments that go wrong, failed business models, and waves of investor hype and disappointment in equal measure.

Such is the process of transformational tech change.

But as I’ve spent the last year delving into all things AI, one thing seems clear to me.

This technology is real, and it’s going to have big impacts across all sectors including mining.

Finding out where these impacts strike — and where value will accrue — will be a multi-year opportunity for investors who can start to understand this change.

That’s why I’ve just released a special presentation on where the immediate opportunities lie and how I think this story will play out.

You can watch that presentation here…

Good investing,

|

Ryan Dinse,

Editor, Crypto Capital Premium, and Crypto Capital Foundation

Comments