Australian energy corporation Beach Energy [ASX:BPT] has revealed its sales revenue moved up 3% for its first half 2023 results, and yet earnings crept down 4%, with underlying net profit slumping by 10%.

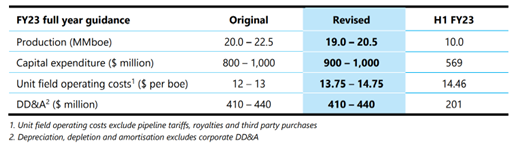

The energy firm has subsequently lowered its FY23 full-year production guidance down from an original 20.0–22.5 MMboe (million barrels of oil equivalent) to 19.0–20.5 MMboe while capital expenditure guidance has raised to the upper end of original guidance to $900 million–1 billion.

The BPT share price was barely budging by the early afternoon, nearly a half percent drop with a share worth 1.5 cents.

Over the last month, the energy stock decreased by more than 5%. It is also down in its sector by 25%.

Source: tradingview.com

Beach Energy struggles to profit in 1H FY2023

BPT has shared its sales revenue for the first half of FY 2023, posting that its revenue has increased by 3% to $813 million.

Despite the small uplift, the group said earnings before interest and tax (EBITDA) crept down 4% to $491 million, and underlying net profit after tax (NPAT) slumped even further by 10% with a total of $191 million.

Beach has moved its FY23 full-year production guidance down from an original 20.0–22.5 MMboe (million barrels of oil equivalent), to 19.0–20.5, with there being 10.0 MMboe delivered in the first half of FY ‘23.

Capital expenditure has been rising while the money-making side of businesses has been dropping. Expenditure guidance has been brought to the upper range of original guidance, from $800 million–1 billion to the upper range of $900 million–1 billion, with the group already at $569 million for the first half.

Beach said its net cash position and total liquidity value was $609 million at the end of the six-month period. The company believes its balance sheet holds enough to support further investments in growth while still delivering on shareholder returns.

The energy group has introduced a new dividend policy linked to free cash flow generation, aiming to target a payout ratio of 40–50% of pre-growth free cash flow.

BPT will distribute franking credits to shareholders while maintaining a net gearing of under 15%.

Source: BPT

BPT’s future production

Beach stated Otway and Perth basins are progressing as planned, and it is working to derisk major growth components.

The Perth Basin gas exploration campaign is still to commence early in Q4 of FY23, and rig negotiations for the Kupe development well have brought a spud target to Q2 of FY24.

BPT’s CEO, Morné Engelbrecht, expects the Waitsia Stage 2 project and the offshore Otway Thylacine wells to trigger a step-change in production and to reach free cash flow generation from FY24.

BPT warned that production is subject to the timing of major project delivery, already impacted by regulatory changes and Clough’s administration.

The company won’t be referencing its FY24 production target until its full-year report in August.

Australia’s boom in commodities and how to capitalise

It’s a hot time in the commodities market, and things are only just heating up.

Our in-house resources expert and trained geologist, James Cooper, thinks the Australian resources sector is set to enter a new commodities boom brought on by the ‘Age of Scarcity’.

James is convinced ‘the gears are in motion for another multi-year boom in commodities’…and better yet, this is a boom where Australia and its stocks stand to benefit greatly.

The next big mining boom is predicted to happen in the next few years. The question is, are you ready for it?

Don’t let the same people who got rich last time be the only ones for a second time!

You can access a recent report by James on exactly that topic, AND access an exclusive video on his personalised ‘attack plan’ — right here.

Regards,

Mahlia Stewart,

For The Daily Reckoning