In today’s Money Morning…compare the pair…he’s not alone…when this is approved, look out!…and more…

‘The size of this fund speaks to the size of the opportunity before us: crypto is not only the future of finance but, as with the internet in the early days, is poised to transform all aspects of our lives.’

A16Z on raising a US$2.2 billion crypto investing fund last week

There’s probably no other sphere of life where opinions are more useless than investing.

It’s why when someone tells me what they think about an investment opportunity, I usually say, ‘Don’t tell me what you think, show me what you’ve got.’

Or even better, ‘Show me what you’ve made.’

That makes a lot of opinionated ‘gurus’ shut up quick smart.

The fact is raw numbers can’t be argued away.

But the venture capital company I quoted at the start is one opinion I do listen to.

For one important reason…

Compare the pair

You see, A16Z have managed to consistently create long-term value for their investors, even though they play in the riskiest part of the market.

The market of start-ups and new ideas.

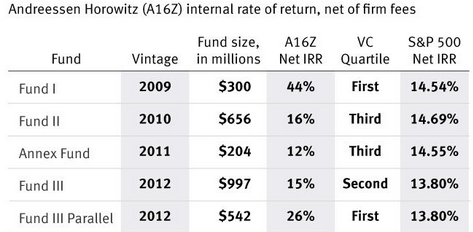

See the track record of their oldest funds here:

|

|

| Source: Cambridge Associates |

Their first fund has returned a staggering 44% per annum since inception in 2009. Most of their other early funds have outperformed the index by a decent margin.

This year they’ve had their best exit — where they sell out of, or list early investments — year ever.

The point is, show me this kind of return and I’ll listen to you.

Sure, there’s some nuance to this…

It’s not just about gains. You need to think about the comparative risks you’re taking too.

On the other hand…

When someone has been saying you’re wrong for 10 years, while at the same time they had this kind of performance…?

Well, check it out:

|

|

| Source: Yahoo Finance |

If I showed you this track record, would you listen to the opinions of its manager?

Ladies and gentlemen, I give you the EuroPac International Value Fund. Behold its decade-long stagnation.

I mean, I know ‘value’ has been out of vogue for some time, but losing money in this tape requires a rare skill.

That’s some serious underperformance right there for your 1.75% per annum fee. Not to mention a whopping 4.5% upfront fee to boot.

Double ouch!

Now there’s a reason I bring this up today.

You see, the first company, A16Z, has been a backer of crypto for a few years now. The manager of the second fund, a very vocal and opinionated crypto critic…

Bitcoin vs Gold: Which Should You Buy in 2021?

He’s not alone

The EuroPac fund is run by a bloke called Peter Schiff.

You might’ve heard of him?

He’s a Twitter personality and the ‘blue ticked’ Schiff has amassed a 526,000 following. He even has his own radio show.

|

|

| Source: Twitter |

In other words, people listen to what he has to say.

Now here’s the thing…

Our friend Peter Schiff has spent most of those same 10 years talking down Bitcoin [BTC].

For example, in 2013 he turned up on CNBC to say:

‘A bubble is a bubble. And there’s a bubble in bitcoins.’

This was at a time when you could get a bitcoin for under US$1,000, and he’s not stopped talking it down since.

Remember what I said at the start…

Don’t tell me what you think, show me what you’ve got and what you’ve made.

Instead of bitcoin, Schiff has been a big gold investor over the same time period.

As this meme shows, this is the result for those who heeded his advice:

|

|

| Source: YouHodler |

This is an old image I found from last year, but it shows the value of bitcoin since Schiff first became aware of it and the value of gold.

As you can see, one has surged, and one has stagnated.

Today that bitcoin figure would be US$35,000 (or even as high as US$60,000 at one point), while gold still mulls around the US$1,700 mark.

Like I said at the start…

Opinions?

Nice to have, interesting to listen to, but don’t be fooled into thinking they’re right. Especially with a track record like that!

To be fair to Schiff, he’s certainly not alone in bagging bitcoin.

There are plenty of crypto naysayers that believe it’s all still one massive bubble, even some I work with!

Unfortunately, a lot of professionals have backed themselves into a corner over this; so their egos are unable to entertain the fact they could be wrong.

Hubris and ego are the enemy of all investors, including yourself.

The naysayers get caught up in another trap — confirmation bias. They search out every titbit of negativity to support their iron-clad view.

Which means, not only have they missed the trade of the last decade, but they’re also probably likely to miss the defining industry of the roaring ’20s too…

When this is approved, look out!

It’s not just the high-risk A16Z who are bullish on crypto.

None other than the runaway favourite for the New York mayor race, Eric Adams, said last week (my emphasis):

‘I’m going to promise you in one year … you’re going to see a different city. We’re going to become the center of life science, the center of cybersecurity, the center of self driving cars, drones, the center of bitcoins.’

The city that’s home to Wall Street had been losing its lustre as a financial innovation hub of late.

And other regions like Miami, Texas, and Wyoming are quickly attracting crypto capital.

My take is the next mayor of New York has realised that bitcoin and crypto are the future of finance and he wants that crypto capital back.

And the big Wall Street firms are ready to move in hard when the regulators start to play ball.

For example, Van Eck Associates are already pushing for a Bitcoin ETF, with its CEO Jan Van Eck telling CNBC:

‘We really think the SEC should approve a bitcoin ETF. The only alternative investors have is a closed-end fund that trades it at a 40% premium or 20% discount.’

Ric Edelman, the number one registered investment advisor in the United States and the founder of Edelman Financial Engines, thinks Wall Street is just waiting on the right products being approved too.

But he also said there’s a time limit to waiting:

‘Over the next couple of years, it’ll be a routine part of any diversified portfolio. But you can’t do that until you understand what it is and how it works and how you fit it into an asset allocation strategy.

‘It’d be so much easier and simpler if there was a bitcoin ETF. That’s not here and it’s not going to be in the foreseeable near future, so you can’t continue to sit on the sidelines waiting for it because by the time the SEC says yes to it, bitcoin might be 100,000. You’re going to miss out, so, you’ve got to move on with the investment opportunities that do exist.’

To understand why an ETF matters, look to the US’s north…

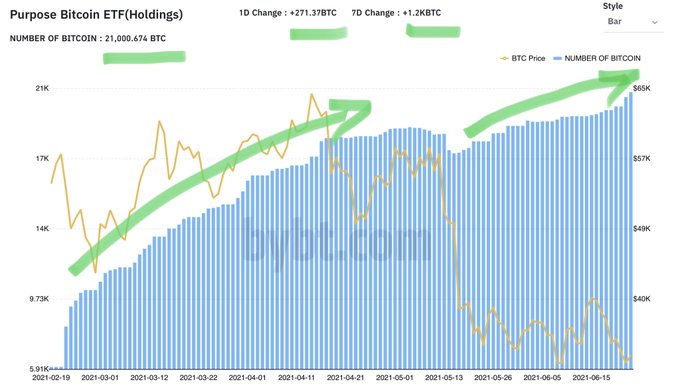

This chart shows how the Purpose Bitcoin ETF in Canada has been buying roughly 100–200 BTC every day, even through the current price volatility:

|

|

| Source: Bybt.com |

The ETF holds 21,000 BTC (approximately worth US$700 million) and the regular buying is probably the result of regular investment by pension funds allocating new money to the fund.

Now imagine the scale of this buying when the big US firms get involved.

Imagine when bitcoin forms a part — albeit a small one — of every single person’s superannuation or pension fund.

If things go the way I think they will, this is the world that awaits.

Will Peter Schiff change his mind if this happens, I wonder?

Or is this what the future could look like for Schiff!?

|

|

| Source: YouHodler |

Of course, as a wise investor, you’re probably thinking ‘But hey, Ryan, who says your opinion is any good either?’

That’s exactly the right response.

I could very well be wrong.

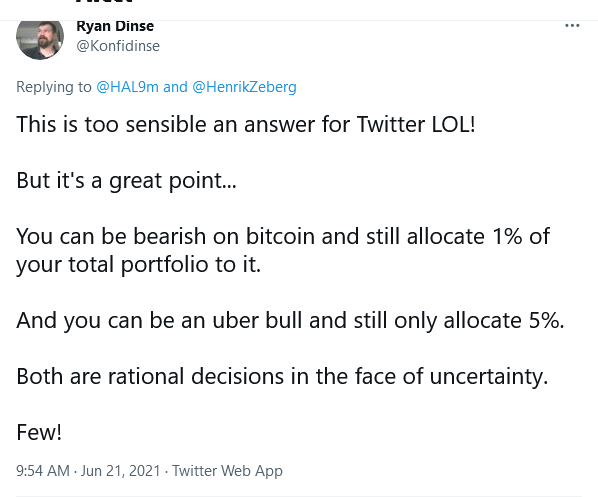

This is how I answered a tweet (to my more meagre 1,284 followers) on this very question recently:

|

|

| Source: Twitter |

If Peter Schiff had done this, he’d be sitting on some very hefty gains right now, even with a small allocation.

But it’s not too late for Schiff or any other doubter.

Because the same will be true over the next 10 years too, in my opinion.

Good investing,

|

Ryan Dinse,

Editor, Money Morning

Ryan is also editor of New Money Investor, a monthly advisory aimed at helping investors take an early-mover advantage as decentralised finance and digital money take over the world. For information on how to subscribe and see what Ryan’s telling his subscribers right now, click here.