Those watching the BetaShares Australian Equities Strong Bear Hedge Fund [ASX:BBOZ] would be wise to know its fees.

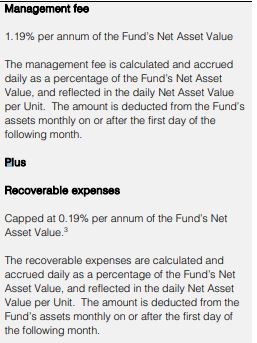

As per the product disclosure statement:

Source: BetaShares

This is comparatively expensive — average ETF management fees are in the 0.4–0.5% range.

Over a long period of time, fees can eat into your returns.

But BBOZ’s fees makes sense for a fund that would require a fair bit of work behind the scenes to achieve its stated objective.

That is, of providing a hedge against a declining market — or even making a magnified profit on a slump.

Interest in BBOZ may have fooled some

Yes, there is an immense amount of stimulus in the system, and the financial system is looking strained.

But the surging interest in BBOZ may have fooled some novice investors.

The thinking is, well a crash happened, and the worst is yet to come.

Which may be the case eventually.

However, in hindsight a quick pivot to ‘buy the dip’ thinking as the market turned in late March would have yielded better results.

Hindsight is 20/20 of course, but with the market moving sideways/edging up for a while now, this is leading to a decline in the BBOZ unit price.

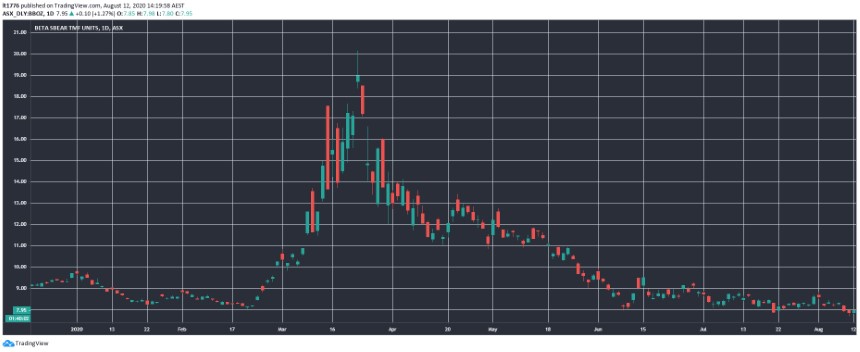

Given its short exposure of between 200–275%, this is how the chart reads:

Source: tradingview.com

A sharp spike in March and then a prolonged slide.

This could be a sort of accumulation phase.

BBOZ investors will naturally be hoping for the worst (or the best) outcome possible.

But the BBOZ chart looks like a speculative small-cap chart.

ETFs are generally favoured for their steadiness and BBOZ inverts all of that thinking.

It’s perhaps the most speculative ETF going.

And if speculative investments are your thing, you may as well consider going long on small-caps that sink or swim on their own merits.

Regards,

Lachlann Tierney,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well-placed to capitalise on post-lockdown mega-trends. Click here to learn more.