Get out your pink, people.

I watched Barbie the other day. With my daughter, of course. We had a good laugh…me especially.

I know – I’m a bit behind here.

Barbie is a juggernaut in terms of revenue. It was the highest grossing film of 2023 – over a billion in sales. The tally is still going up now.

Go Margot Robbie!

Here’s the other thing about Barbie the movie. It’s sent sales of Barbie dolls skyrocketing.

That’s not all…

No doubt every cinema in the world did extra trade in popcorn, ice creams and…apple juice.

I’m sure fashion retailers with any sort of line in pink dresses, scarves, headbands, hats or shoes got a nice tailwind too.

In other words, even if you weren’t a producer, actor or investor in the movie, there are tangential ways to make a buck off it.

It’s the same in the investment business.

What’s the ‘hot’ space right now, besides Ken doing ‘beach’? (That won’t make sense if you haven’t seen it.)

That’s right, it’s not pink, it’s gold!

The US dollar gold price is up a barnstorming 30% since its US$1,819 low in October last year.

This is giving a powerful tailwind to Aussie gold miners on the ASX.

The direct way to benefit from this – in theory – is buying gold miners.

Sometimes that can be easier said than done. One problem is there is a lot of gold miners to choose from. Another is that gold miners are notorious for disappointing.

My colleague Greg Canavan writes this week that gold miners are capital intensive and often don’t generate a lot of free cash flow.

He points out that some of the bigger gold stocks have underperformed the Aussie gold price over the last 5 years.

In other words, you could have just bought a chunk of the metal itself and saved yourself a lot of hassle.

I’m not saying don’t consider buying gold stocks.

They can provide outstanding opportunities if the cards fall your way. Gold developer Spartan Resources [ASX:SPR], for example, is up 400% in the last 12 months.

But we can copy the Barbie scenarios above too.

We can look for tangential ways to find opportunities off the gold bull market.

Here’s what we know…

High gold prices are driving a tidal wave of revenue through the miners currently.

Some of that is going to go into the mining services sector. These are the companies that help run the mining operations.

The more miners make, the more contracts they can hand out to the service companies.

There looks to be good value in the space. The team at investment fund LongWave recently wrote that mining service stocks are out of favour with investors. But…

‘Our medium-term expectations are that ongoing commodity demand growth should be met by a more disciplined mining service sector and continued improvement in financial performance.’

Some stocks in this space include Perenti [ASX:PRN], NRW Holdings [ASX:NRW] and MLG Oz [ASX:MLG].

You might want to put them on a watchlist and start following them.

Here’s another angle…

What happens when you get a barnstorming gold bull market?

Every geologist and mining exploration company wants to get in on the action!

An exciting gold find means big dollars, career advancement and the potential for wealth creation.

The gold companies also have big cash flows to fund exploration…and build out their gold reserves.

Yep…any company that can help gold miners find more gold is in the same sweet spot as Barbie’s wardrobe manager.

I have one candidate for you on this.

Imdex [ASX:IMD] is a mining technology company.

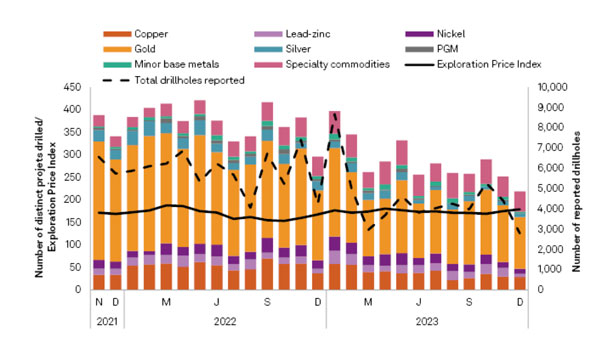

You can see from the chart below that gold is the most important commodity by drilling activity…

| |

| Source: Imdex |

What’s good for gold is good for Imdex…in the same way what’s good for Barbie is good for Mattel.

Imdex was one of the stocks I included in my February special report. It’s up nearly 50% in two months.

And while there are no guarantees, like the gold bull market, I think Imdex has a long way to go, for a long time.

Certainly, the stock market isn’t as carefree as Barbieland. It’s risky and volatile. But that doesn’t mean you shouldn’t try to benefit off stocks like IMD.

You can get the full details as to why here.

Best,

|

Callum Newman,

Editor, Small-Cap Systems and Australian Small-Cap Investigator

Comments