Banking crisis? What banking crisis?

The markets are trading now as if disaster’s averted.

UBS Group AG [NYSE:UBS] has rescued Credit Suisse already. First Citizens Bank [NYSE:FCNCA] and HSBC Holdings [LSE:HSBA] have mopped up Silicon Valley Bank. The NASDAQ Index is now in a bull market, having recovered 20% from its lows last December.

The idea is to combine failing banks into a larger bank and having the nation’s central bank provide billions of dollars’ worth of credit to paper over the cracks. This way, you’ve got another ‘too big to fail’ bank to act as the backstop. This was the strategy used in 2008–09 when we went through the subprime crisis. A few trillion dollars from central banks globally held the system together and the markets were off on their merry way.

So time to move on, bears! Come back when there’s another crisis.

Though that might not happen in our lifetime, according to US Treasury Secretary Janet Yellen when she was the Chair of the Federal Reserve back in 2018.

Hang on a minute, though, there’s one asset that’s signalling things aren’t under control.

Sounding the alarm of a system in trouble

Something stands out in this financial system above the rest, and for the longest time.

You’ve guessed it, gold.

In a distressed environment, people can dump fiat currencies, shares, bonds, real estate, cryptos, and even commodities.

But dumping gold? You need to be pretty desperate to do that!

If there’s a crisis at hand, you’ll see gold dip for a short while before it reasserts its strength. Therefore, I like to use it to gauge the health of the global financial system.

Right now, it’s telling me that things are pretty ominous.

Check out the price of gold in USD terms. It’s been trading at close to US$2,000 an ounce and has remained stubbornly above US$1,900 for almost two weeks, as you can see in the figure below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

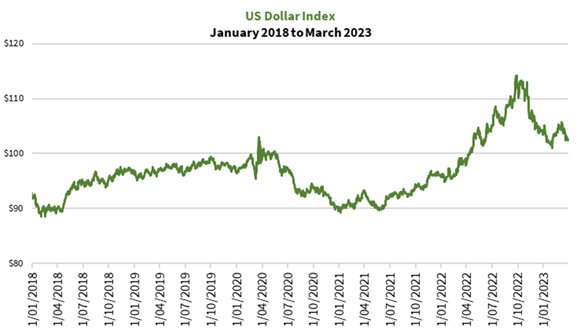

You might correctly point out that gold is higher now because the US Dollar Index [DXY] has fallen. Yes, that’s the case as it’s inched down in the past month, and looks like we might have seen the peak in mid-2022, as you can see in the figure below:

|

|

| Source: Thomson Reuters Refinitiv Datastream |

But let’s look at the intrinsic gold price, which you can calculate by multiplying the price of gold by the US Dollar Index (treating it as a percentage). As I write this article, gold is at US$1,970 an ounce, and the US Dollar Index is at 102.4. This means the intrinsic value of gold is US$2,017.

How does that sit in the historical context? Let me show you in the figure below, which outlines the intrinsic price of gold since 1971 (when the US dollar and gold effectively decoupled):

|

|

| Source: Thomson Reuters Refinitiv Datastream |

As you can see, the above figure shows quite effectively how our financial system has fared over the past five decades. The spikes in 1980, 2007–12, and 2019–20, demonstrate the times when the system seized up and the governments and central banks needed to heavily devalue the US dollar to revive the system.

Interestingly, the system appeared to be rather stable between 1983 and 2005, at least as implied by this indicator. We know for a fact that there were several crises that occurred, including the 1987 Black Monday crash, the Latin American debt crisis in 1994, the tech bubble in 1999–2000, and September 11 in 2001. But at least gold managed to trade in a relatively tight range and the US dollar was able to retain its value against it for an extended period.

The key reason for this?

The US Federal Reserve Chairman Paul Volcker famously raised the Federal Funds Rate sharply from 1979–81 to control runaway inflation caused by the 1970s oil crisis. The rate was as high as 20% in June 1981, choking the currency supply and thereby successfully bringing down inflation. This was not without a sharp yet short-lived recession in 1982.

That drastic move managed to control inflation and bring about almost two decades of economic prosperity and growth.

That’s unlikely to repeat itself. US Federal Reserve Chairman Ben Bernanke tried something to control inflation in 2012 by artificially changing the relative demand for short- and long-dated bonds (known as Operation Twist). It succeeded for a few years (I’d guess around seven years based on the above figure) in reviving the purchasing power of the US dollar without raising the interest rate during a period when the system was recovering from the ravages of the subprime crisis that began in mid-2007.

And what I see ahead of us could be the worst to come.

Waters recede before the tsunami hits

The fact of the matter is that the system never fixed itself, and neither was it the intention of those making decisions if you know how and where to look.

Playing with the currency supply via controlling interest rates and inflation to spur economic productivity is pushing on a string.

And not only that, the currency supply is unable to shrink when the global populace, whether as corporations or individuals, is hooked on debt as a way to spur growth. You can only kick the can down the road, temporarily reducing the supply of debt before heaping it back into the system.

The last three years showed us that we’re not only past the point of no return, but there’s an existential threat to the system.

The approach to keeping the system from falling apart is to plug up the most at-risk institutions and place our reliance upon them by covering debt with even more debt.

Ever tried to quench your thirst by drinking seawater? Multiply that exponentially and you’ll get the idea.

The idea of ‘safe as banks’ is dangerous. It’s been a self-propagating disaster.

Right now, we’re in a brief period of calm before that big storm. It feels like the waters are receding from the coastline before the massive tsunami.

The crisis is averted…this’ll age well!

So where does it leave us?

Some are paying down their debt to ensure they don’t lose what they already own. That’s prudent. Debt is like that jet ski you’re towing behind your yacht. When waters get choppy or your boat is springing a leak, you don’t want something to drag you down.

Some are running to the new form of money — cryptocurrencies. It went through quite a beat-up in the last 18 months and some tokens are showing signs that it’s ready for the collapse of the US dollar.

I like gold. It’s a shining beacon of light on its own solid and unsinkable island. You mightn’t be able to eat it but someone will desire it as long as there’s a living man or woman still in existence. Its value is in the primal desire ingrained within us, hence it won’t fall to zero.

It also has no counterparty risk. Gold can’t go broke and leave you with nothing. You hold it, it’s yours.

On the other hand, if you’re OK with risk and want to speculate on something with a lot more upside potential, there’s the entire market of gold mining stocks at your disposal. I’ve got a portfolio lined up over in my premium trading service, Gold Stock Pro.

And, if you’re in for an even bigger thrill, you can check out Fat Tail Investment Research’s brand-new, ultra-speculative mining trading service Mining: Phase One, which just launched last night. You can check it out by going here.

God bless,

|

Brian Chu,

Editor, The Daily Reckoning Australia

Comments