In today’s Money Morning…take a wild guess who these people are…the philosophy of money and how money works…time’s up on fiat…and more…

|

Crash talk. More like trash-talk.

A few days ago, I stumbled upon this Forbes article.

If you only read the headlines, then this would’ve spooked a couple of novice crypto types:

|

|

|

Source: Forbes |

Forbes proves once again that it isn’t above clickbait. Well, they sure sucked me in. But only for the humour.

Here are the quotes from those issuing the ‘crash alert’:

‘Private money usually collapses sooner or later.’

‘And sure, you can get rich by trading in bitcoin, but it’s comparable to trading in stamps.’

‘Whoever receives bitcoin in exchange for a good or service, we believe that is more akin to bartering because that person is exchanging a good for a good, but not really money for a good.’

‘People will not want their purchasing power, their salary to go up or down 10% from one day to another. You don’t want that volatility for purchasing power. In that sense, it is not a good safeguard of value.’

Take a wild guess who these people are

None other than Diaz De Leon and Stefan Ingves, the Bank of Mexico governor and the Riksbank governor (Sweden), respectively.

You could rewrite the Forbes headline as follows:

‘Central banker says fiat is better and crypto will crash because they get paid in fiat and also, boo crypto, can I keep my job, please?’

Doesn’t quite have the same ring to it.

But let’s examine these claims.

Maybe De Leon is onto something with the ‘crypto is like bartering’ chat.

It could be just like that — an unmediated exchange. No government standing in between two people freely exchanging two things that they assign value to.

It’s like if two hunters meet by a river in a pre-civilisation time where one wants a bow and the other a knife. They swap and the deal is done.

Except this time, there are lots of computers involved. Crypto’s peer-to-peer system is very similar — that’s part of why it appeals.

It’s like the good old days.

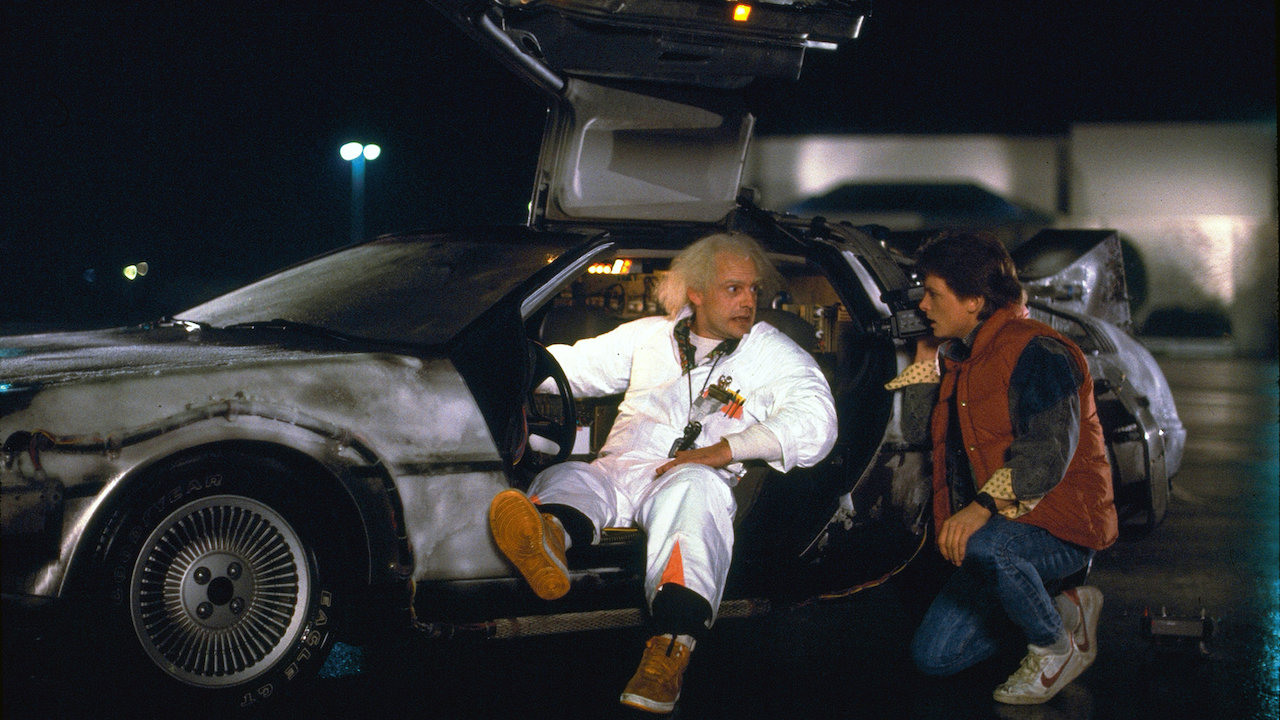

Or call it back to the future.

‘Wait a minute, Doc. Are you telling me you built a time machine…’

|

|

|

Source: Netflix |

So everyone get in the DeLorean! Crypto is taking us back to our roots.

The philosophy of money and how money works

People know they want money, but rarely think about how it actually works.

At least until crypto came along.

But back in 1900, there was one particularly bright guy who spent some time on the matter.

Georg Simmel, a German philosopher, wrote a book called The Philosophy of Money, which is worth consulting if you want to wrap your head around the concept.

Here’s a passage which is worth a look (emphasis added):

‘One of the few rules that may be established with some degree of generality concerning the form of social development is this: that the enlargement of the group goes hand in hand with the individualization and independence of its individual members. The evolution of societies usually commences from relatively small groups which hold their elements in strict and equal bonds and then proceeds to a relative larger group which affords freedom, independence and mutual differentiation. The history of family formations such as that of religious communities, the development of economic co-operatives and political parties all illustrate this type. The importance of money for the development of individuality is thus very closely related to the importance that it possesses for the enlargement of social groups.’

In layman’s terms, think about those two hunters I mentioned before.

That was just an exchange between two people.

Money was one of the primary building blocks of civilisation.

It was so powerful because it allowed us to enlarge social groups.

It was a coordination mechanism.

But then in the early 21st century the central bankers started breaking their own rules (GFC).

And governments and corporations decided they wanted to know everything about your transactions.

Is it really a surprise that some money users decided to say, ‘stuff this!’?

And here we are today…with De Leon et al crash talking/trash-talking from their high horses about what is and isn’t money.

The Bitcoin [BTC] price is sitting pretty at US$45,000 right now:

|

|

|

Source: Tradingview.com |

You can see it shed around 15% from the top.

But that green square? Let’s zoom out:

|

|

|

Source: Tradingview.com |

That’s 15% carved off a 500% increase in the last five months.

That’s not a crash.

So when you see these deceptive headlines about crypto, it just makes you chuckle.

Markets are about time and timing.

One person’s crash is another person’s bonanza depending on when you got in.

And time’s up on fiat.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Lachlann is also the Editorial Analyst at Exponential Stock Investor, a stock tipping newsletter that hunts for promising small-cap stocks. For information on how to subscribe and see what Lachy’s telling subscribers right now, please click here.