At time of writing the AWN Holdings Ltd [ASX:AWN] share price is trading at $1.48, up 45.10%.

AWN Holdings recently announced a deal that will see them be the exclusive distributor for Tembo Electirc.

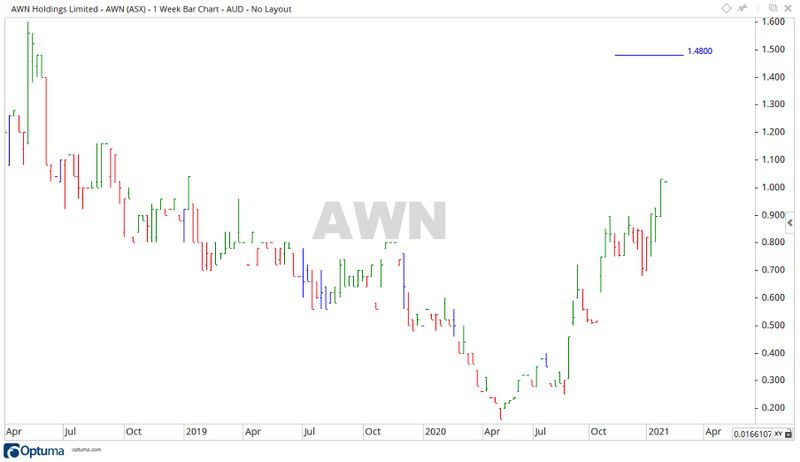

Source: Optuma

AWN Holdings and electric power

Electric cars are becoming more popular by the day as the world looks to cut down on emissions.

In mining, cars are used extensively to travel around the large geographic space of a mine.

The most common car to be found on mining sites is the Toyota Hilux and Toyota Land Cruiser.

With mining companies looking for places to cut back their emissions these cars have become targets for electric conversion.

AWN Holdings through their subsidiary VivoPower International PLC [NASDAQ:VVPR] have recently announced a deal to attack the issue.

VivoPower and 51% subsidiary Tembo have signed a definitive agreement with GB Auto Ltd which will expand GB Auto’s position as Australia’s exclusive distributor of the Tembo electric Toyota Land Cruiser, electric Toyota Hilux, and Tembo electric vehicle conversion kits.

GB Auto is expected to purchase at least 2,000 Tembo electric conversion kits in the first four years of the agreement. Combined with the value of the converted Toyota vehicles, it is believed these orders will be worth an estimated US$250 million.

The new deal is believed to be the largest of its kind in Australasia to date.

The future of AWN Holdings and electric vehicles

The Land Cruiser and Hilux are the light vehicle of choice for mines around the world.

As future emission standards get tighter the combustion engines already in these cars aren’t built to meet the future targets.

The conversion will see a lot of these cars go to 100% electric power.

AWN Holdings through VIvoPower and Tembo are looking to capitalise on the market.

Source: Optuma

Looking at the chart above, the price moved up significantly to where is trades at time of writing.

If the price continues to move up, then the levels of $1.60 and $2.01 may provide future resistance.

Should it fall back, then the levels of $1.29 and $1.01 may become the future focus.

As the globe shifts its attention more and more to a green future, companies like AWN are positioned to capitalise on the changes.

With a market cap of only $58 million at time of writing, the company will be looking to expand into the new green markets of the future.

Regards

Carl Wittkopp,

For Money Morning

PS: Energy expert Selva Freigedo reveals three ways you could capitalise on the $95 trillion renewable energy boom. Download your free report now.

Comments