AVZ Minerals [ASX:AVZ] rose on Wednesday after its Manono Lithium Project received a ‘favourable technical opinion’.

The lithium stock was up 7% in afternoon trade, trading at $1.10 a share.

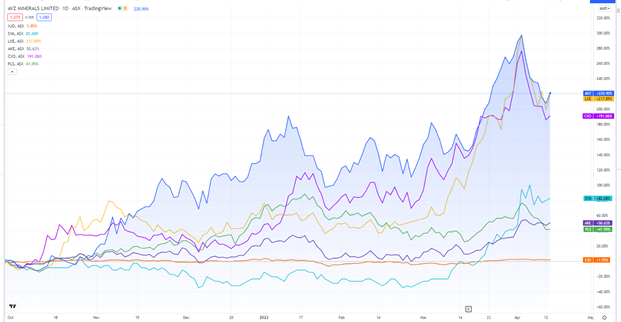

Like many of its lithium peers, AVZ is benefiting from strong capital inflows into the lithium sector, with AVZ shares up more than 500% in the last 12 months.

Although lithium stocks are well up over the past year, some — like AVZ — are trading below their 52-week highs. Has the lithium sector peaked, or will there be new highs ahead?

Source: Tradingview.com

AVZ’s Manano Project receives ‘favourable’ opinion

AVZ announced today that it received positive technical results regarding its Manono Lithium Project.

AVZ holds 75% of Manono, which is located in the Democratic Republic of Congo.

Today, AVZ announced it received a ‘positive technical opinion’ from the DRC’s Department of Mines.

AVZ thinks this welcome opinion ‘paves the way for an imminent decision on award of the Mining License’ for the project.

The lithium developer is optimistic, having secured ‘favourable outcomes’ on all four elements required for a mining licence award.

The four elements are environmental approval, proof of financial capability, favourable cadastral opinion, and a favourable technical opinion — today’s announcement.

The Manano Project comprises of an open pit that provides hard rock lithium, tin, and tantalum, expected to provide resources for 29.5 years.

Nigel Ferguson, AVZ managing director, commented:

‘The receipt of the favourable technical opinion for the DFS is the final procedural hurdle ahead of the Minister of Mines pending decision on the award of the Mining Licence which we now eagerly await.

‘This will also be the catalyst to advance the Collaboration Development Agreement which will underpin the partnership between the Government and the developers of the Manono Project.’

AVZ presents at the Battery Minerals Conference

Last week, AVZ presented at the Perth Battery Minerals Conference.

The miner reported it was operating without debt, having an available cash balance of $72.8 million.

It was highlighted that long-term binding offtake arrangements with major lithium converters will play a large role in supporting Manono.

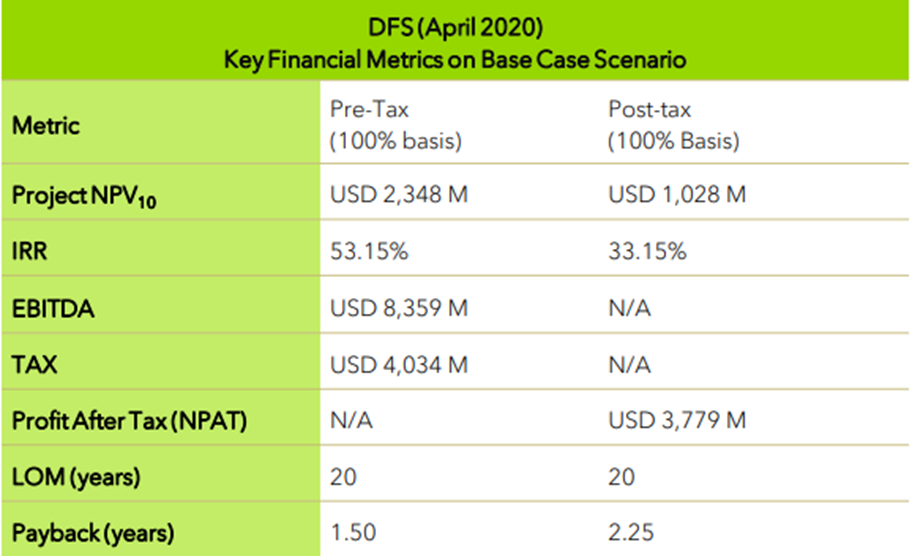

Again, AVZ reiterated the figures from its April 2020 definitive feasibility study, which estimated Manono’s net present value (discounted at a rate of 10%) to be around US$1.03 billion post-tax on a base case scenario:

Source: AVZ

AVZ share price outlook

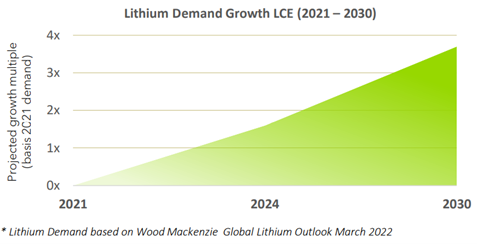

Unsurprisingly, AVZ was quick to note that demand for lithium remains strong.

In fact, AVZ shared figures suggesting demand will quadruple by 2030:

Source: AVZ

Debt-free and with $72.8 million available in cash, AVZ looks to be in a good position to bring the Manono Project to production.

The favourable technical opinion is also a positive regulatory sign.

However, taking a mine all the way to production is never easy.

As AVZ itself noted, the project has an estimated capital requirement of $US545 million.

An injection of funds will likely be required down the track.

On the topic of funds, AVZ has stated its in ‘advanced financing discussions’.

Now, as the EV revolution kicks into gear and entrepreneurial miners seek to benefit, it pays to keep abreast of the fast-paced lithium indsutry.

Are investors overlooking any lithium stocks on the ASX?

According to our latest research report, yes. In fact, the report identifies three of them.

Access the report — freely available — here.

Regards,

Kiryll Prakapenka,

For Money Morning