If you’re unaware of it already, the bull market in gold is now well underway.

This has sparked renewed buying of gold stocks from the broader market investors.

For some time, gold stocks have trailed behind gold. There’s a yawning valuation gap between them.

Now we’re watching the gap close, potentially delivering exceptional returns last seen in 2019–20.

While many will have a newfound love for gold stocks, which they once shunned, few realise the hidden dangers of buying into a raging bull market.

What dangers are there?

Unbeknownst to many, bull markets pose more danger to investors than bear markets, especially in the bubble phase.

Some fear exiting their positions too early. However, many end up giving back most, all or more than their gains by overstaying their welcome.

I’ll write about how to avoid this risk in today’s article.

On the verge of a powerful gold bull market

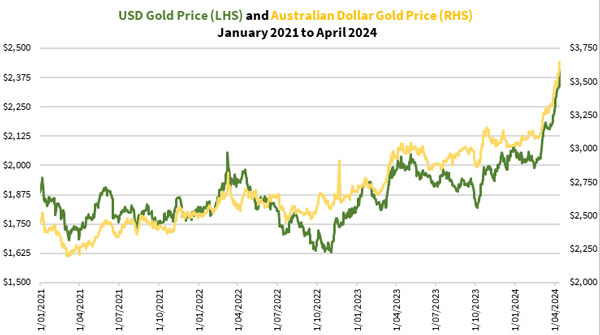

Gold has done well since 2021. It’s trading more than 25% higher in US dollar terms.

In our currency, gold’s up by over 40%, making it a phenomenal run the past three years.

If you look closer at the figure below, you’ll see that gold is in a bullish setup, though it experienced a lull during 2022:

|

|

|

Source: Refinitiv Eikon |

This lull coincided with the central banks attempting to control inflation by aggressively raising interest rates.

However, that rate rise cycle appears to have ended. But inflation has recently reared its ugly head again with the US CPI readings for March coming out last week.

Add to that the Federal Open Market Committee releasing a statement last month suggesting that it expects to cut the Federal Funds Rate three times this year.

This is why you’re seeing gold shift to high gear, setting up for what appears to be a parabolic move.

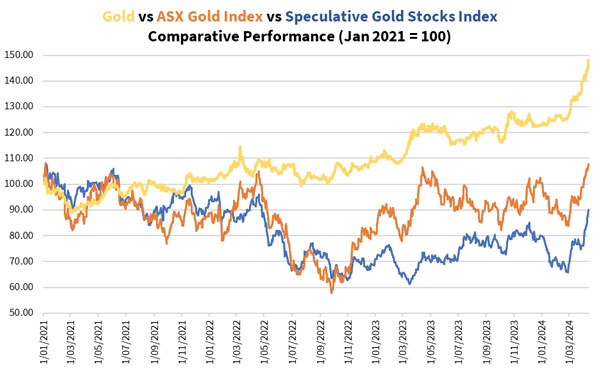

Now you’d expect that gold’s run would have taken gold stocks with it. However, that hasn’t been the case…until recently.

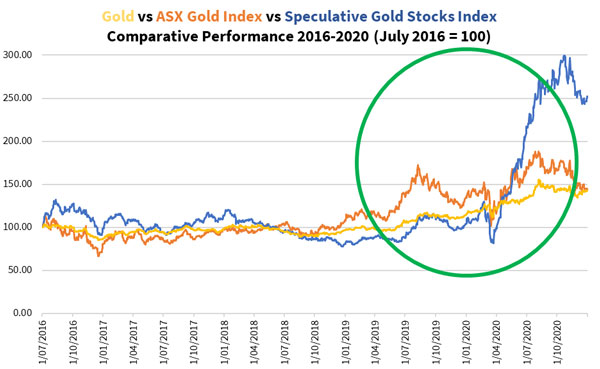

Let me show you the relative performance of gold, the established gold producers (reflected by the ASX Gold Index [ASX:XGD]) and the early-stage explorers and developers (reflected by my in-house Speculative Gold Stocks Index) over the same period:

|

|

|

Source: Internal Research |

Notice a significant gap between gold and gold stocks?

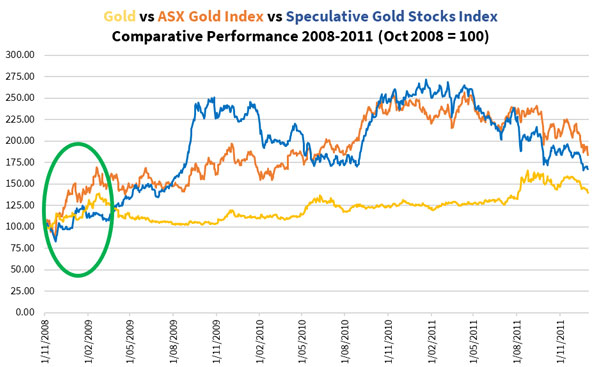

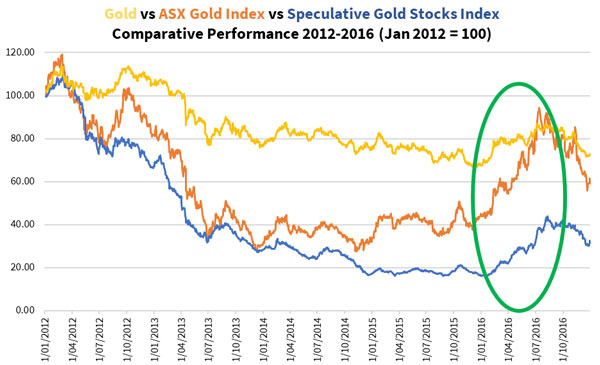

This starkly contrasts the last three gold bull markets of 2009–11, 2015–16 and 2019–20.

Let me show you what I mean:

|

|

|

|

|

|

|

Source: Internal Research |

During those periods, there was a shorter latency between gold gaining momentum and gold stocks following suit.

This time, gold has come off its lows almost 18 months ago. Meanwhile, dozens of gold stocks, especially the smaller explorers, are barely trading above their recent cyclical lows.

But the tide is turning quickly. There’s potential for it to become a violent rally.

Look no further than what happened to gold explorers in 2020, as you saw in the above figure.

Keeping your wins…and focusing on asset values.

This leads to the question everyone wants an answer to: How can you capture as much of the potential windfall gains in the coming bull market as possible?

For every bull market, many more investors rode it up, rack up significant paper gains only to give most of it back, if not more.

Few can walk away with their massive gains intact.

When there’s momentum in the rally, euphoria kicks in. In such times, staying rational and not losing your head is difficult.

I can speak from experience, having lived through two gold bull markets. While I was happy with my gains, I think I can do better in this coming one.

Now I’m not just saying this for the sake of it.

I’ve got a plan.

I’d like to share a little about this plan. But the intricate details will be in my newsletter. I’ll tell you how to become a member later.

But it comes down to this.

In every bull market, there are typically three stages.

The first stage is ‘overcoming the wall of worry’. As a particular group of assets begins rallying, the market is in doubt. They believe it’s merely a bounce and that there’ll be a correction or pullback that erases the gains.

The next stage is when the market sees the rally is genuine. Many investors who were initially watching the action will participate. Their buying will provide further momentum.

The final stage is the ‘manic phase’ where the momentum begets more buying to the point prices go parabolic. At this stage, the mood for this asset class is one of unbridled optimism. Valuation and fundamentals are out the window. Prices are driven predominantly by momentum, rather than sensible valuations.

My observation is most investors are late to the first stage and hang out for too long in the final stage.

The problem is that they don’t know how to value these assets, often their decisions are based on following the crowd.

This makes them easy prey to a discerning investor who profits from the collective ignorance.

But if you base your investment decisions on value, this will help you avoid becoming a victim of herd mentality. You’ll tend not to overstay your welcome in a bull market or dump good stocks in a bear market.

Value provides an anchor to help you keep your head when others lose it.

From my experience investing in gold stocks over the past decade, I’ve learned how to estimate the value of gold stocks across different stages. I’ve even developed my own unique metrics that account for economic conditions, company operations and financial position, and investor sentiment.

I deploy these tools in the hope that I’ll steer my portfolio and that of my newsletter readers to better returns.

If you’re interested in finding out more, why not check out my precious metals’ investment newsletter, The Australian Gold Report?

I’d like to invite you to watch this video where my colleague, Greg Canavan, and I talk about the recent events in this space and the opportunities at play.

I’ve even discuss three gold producers to help you build your portfolio.

Don’t hesitate! The moment for gold to shine is happening right in front of us.

God bless,

|

Brian Chu,

Editor, Gold Stock Pro and The Australian Gold Report