Lithium and natural gas have been dominating headlines this week.

Between the Liontown takeover bid and the government’s latest policy that has made new gas projects almost unfeasible, our mining sector should be feeling pressured.

But that’s certainly not the case for our two biggest miners…

Both BHP and Rio Tinto had far bigger things on their mind this week. The CEOs of both companies — Mike Henry and Jakob Stausholm — were instead in China.

Together, the pair have led separate delegations to map out their futures in the Middle Kingdom. After all, as the world’s second-largest economy and a major importer of Aussie minerals, neither BHP nor Rio can ignore China.

For more than two decades now, iron ore has been the backbone of these two big miners. It is the vital ingredient that has kept Chinese steel mills busy with production and helped both parties become extremely wealthy.

Iron ore, and, by extension, steel, is a big part of why our mining sector is so highly regarded.

And for investors who got in on this trade early, it has been extremely lucrative.

But after years of prosperity, the iron ore and steel industries have reached a turning point. As society hurtles toward a zero-emission future, the pollutant-heavy process of steelmaking is coming into question…

A greener way forward

Finding a new ‘greener’ way of making steel was, in fact, a big reason for BHP and Rio’s visit to China.

BHP even announced a new carbon capture collaboration with steelmaker HBIS Group on Monday. And while it may only be a small $15 million pilot project for now, it proves that our iron ore miners and China steelmakers are looking for sustainable solutions.

Fortunately, there’s already a solution to this green steel dilemma. In fact, European smelters have been making headway in decarbonising their local industry. Because the simple fact of the matter is, if you can replace the coal needed to heat a steel furnace, you can drastically reduce emissions.

That’s why hydrogen, specifically green hydrogen, could be the answer BHP and Rio are looking for. The only real issue currently is the cost…

As a report from the European parliament points out:

‘Replacing coal by hydrogen generated with renewable energy would make it possible to largely decarbonise the industry.

‘At current price levels, replacing coal with hydrogen would drive up the price of a ton of steel by about one third.’

However, as governments continue to crackdown on emitters and the development of green hydrogen improves, these costs will come down:

‘This gap [between coal and hydrogen costs] will likely narrow in the coming years, and could disappear by 2030, as carbon and carbon-emission pricing could drive up the cost associated with the use of coal on one side, while, on the other side, the decreasing costs of renewable electricity,’

That’s why investment in green hydrogen itself has been booming recently. You’ve probably seen plenty of headlines about how Andrew Forrest is planning to expand Australia’s role in this industry.

For everyday investors like yourself, though, finding ways to get in on this green hydrogen trend isn’t always easy. But you can certainly invest in the key minerals that are vital to make a booming green hydrogen industry possible…

Critical minerals

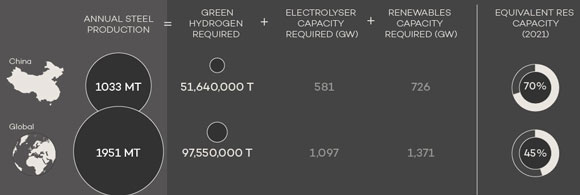

The fact of the matter is, if we really want to decarbonise the steel sector, we need a lot of green hydrogen. Here are the estimates provided by Visual Capitalist and IRENA back in 2021:

|

|

| Source: Visual Capitalist |

Suffice to say, generating 100 million tonnes of green hydrogen is no small feat. Keep in mind that the only way to ensure green hydrogen is actually green is by sourcing it from wind or solar power.

In other words, the world is going to need to up our efforts in building these renewable energy sources. Which, luckily for the steelmakers, is already happening.

Like I said though, for investors like yourself, the best way to profit from this trend is in mining. Because when push comes to shove, a hefty amount of ‘critical minerals’ are needed to build wind and solar projects. And one critical mineral is particularly integral…

It is, of course, copper.

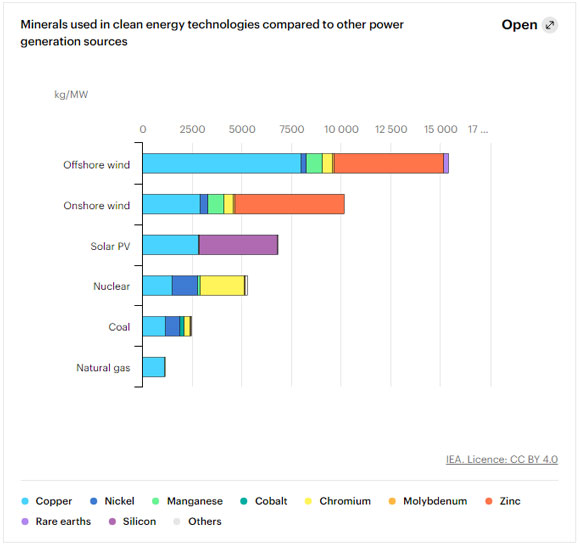

|

|

| Source: IEA |

As you can see, for both wind and solar, copper is crucial.

This is precisely why my colleague, Jamer Cooper, has declared copper the new crude oil. In his view, it will likely become the most important commodity for national energy security all around the world.

He even put together an entire two-part essay explaining why. If you missed it, check out parts one and two here and here.

Because as James’s analysis shows, investors can’t afford to ignore this trend.

If you’re looking for more insights from James, he stresses the importance of junior explorers. In his own words: ‘early exploration is the most exciting place to be. As a geologist or an investor, discovery is where the greatest value is born’.

That’s why you should check out how James picks the best ‘Phase One’ miners on the market. You can learn all about his methodology and experience here.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning