Australian Vintage [ASX:AVG], the company behind popular wine brands Tempus Two, McGuigan, and Nepenthe, has announced the initiation of a strategic review to explore options to unlock shareholder value.

Investors were relieved at the news, with the share price jumping by 10% today, trading at 43 cents per share.

The decision comes in light of the challenging business environment faced by AVG, including inflationary impacts, pressure from consumer trends, and tough market dynamics affecting pricing.

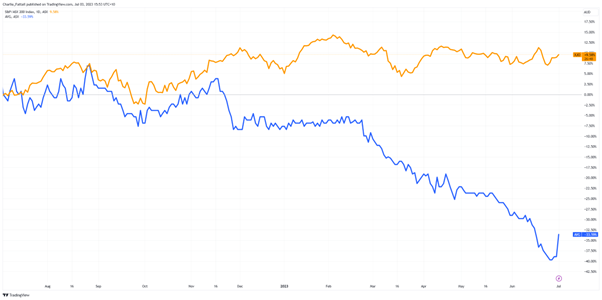

The market has reacted to these challenges, with AVG’s shares declining by nearly 40 % over the past year. While the company experienced a surge in demand during the pandemic as consumers shifted to at-home consumption, reaching a 13-year high of 89 cents between March 2020 and June 2021 — it remains a far cry from the highs witnessed in the early 2000s.

Source: Trading View

Australian Vintage explores alternatives

Australian Vintage announced today the beginning of a strategic review by corporate advisory firm E&P to explore options to unlock shareholder value in a challenging environment.

The decision to undertake the review comes in the wake of a challenging mid-June trading update for Australian Vintage, which highlighted the impact of the cost-of-living pinch on demand for affordable wines among Australian consumers.

The company responded by cancelling its final dividend and announcing a $9 million cost-cutting plan to mitigate ongoing inflationary pressures and the negative effects of excess wine capacity on margins.

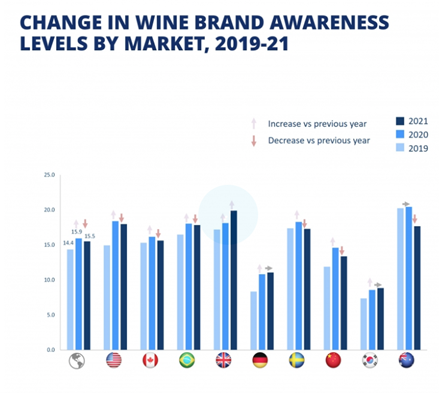

Despite these challenges, AVG has managed to increase its market share across all key geographies, particularly in the rapidly growing Zero and Low-alcohol wine markets.

Craig Garvin, the former Australian CEO of Parmalat dairy business, leads Australian Vintage as its CEO. In a recent interview, he remarked that he believed consumer habits had changed after COVID.

‘People are becoming more sensible with lifestyle choices,’ he remarked, signalling his interest in the continued move towards low-alcohol markets.

The company said it remains committed to its strategic plan and the initiatives outlined in its recent trading update, with the goal of improving overall business performance.

However, AVG’s Board of Directors believes there is significant scope for value creation through industry consolidation.

Recognising its asset base, production facilities, and brand portfolio, the company believes it has the unique ability to lead or participate in industry consolidation.

To aid in this process, AVG has appointed E&P Corporate Advisory to assist in the strategic review.

The review will comprehensively evaluate strategic, business, and financial alternatives to maximise shareholder value.

It may also attract potential interest from domestic and international parties — either partially or in full, for the company.

AVG confirms that it is engaged in discussions regarding broader industry consolidation but has not received any change of control proposals thus far.

Outlook for a fine Vintage

While it is too early to determine specific outcomes, the guidance suggests that the strategic review goals could shake up business as usual.

Recent share price history paints a bleak picture, but the company still holds some cards in the deck.

The company has established itself as a key player in the wine industry, boasting significant assets such as vineyards, production, and consumer-facing brands.

Additionally, AVG has carved a niche in the zero-to-low alcohol category, further strengthening its position in the market.

Potential industry consolidation is being explored. One logical candidate for consolidation is Accolade Wines, owned by The Carlyle Group.

However, any deal with Accolade Wines would likely require a substantial cash investment, as the private-equity-backed group plans to sell one of its prestigious brands, House of Arras, to address its own debt levels.

As the strategic review unfolds, investors and industry observers will closely monitor the developments to gauge the potential impact on Australian Vintage and the broader wine industry.

The outcomes of the review could shape the future trajectory of the company as it navigates the challenges and seeks to create value for its shareholders.

So, before you open a bottle of wine to celebrate AVG’s share price — have you thought about your future?

Future prospects for you

Australian Vintage may be cheering its share price gains, but what about your own gains?

With a bearish market that has roiled investors for the past year — where can you look to secure your future?

Our experts have been searching for the ultimate play in a bear market and are excited to show you their smartest play you can make today.

Editorial Director and investment guru Greg Canavan has released his brand-new report designed to help you how to capture value AND potentially make great dividends along the way.

And the best thing is, we are offering it today.

So, if you want the opportunity to stay ahead of the market with the latest strategies, click here for our latest play for smart investors.

Regards,

Charles Ormond,

For The Daily Reckoning