With the Australian property market, it seems one day the sky is falling, the next you should buy everything in sight.

So today we are going to take a look at what’s happening with A-REITs at the moment.

I think part of the wild swings in sentiment and headlines is a direct result of how much exposure Australians have to property.

A small change becomes a crisis in this environment.

For years it was an expensive home, an expensive office and lots of debt backing the entire property-financial complex.

For context, you can see how the ASX 200 A-REIT Index [XPJ] is performing:

Source: tradingview.com

That’s a really tight range, dating all the way back to 1 June.

That’s because not much has changed for the property market since mortgage repayment holidays were extended.

Commercial real estate was battered.

More so than industrial, or even residential.

Get ready for this real estate opportunity after the lockdown ends. Download your free report now.

How’s the industrial property market going?

You can see how industrial A-REIT leader Goodman Group [ASX:GMG] is performing below:

Source: tradingview.com

That’s a huge run up from the March market lows, more than 90% in fact.

This is a big move for an A-REIT, by anyone’s standard.

Does this mean the GMG share price run is as a result of miraculous growth in industrial real estate?

I’m not convinced.

It’s more that if you are obliged to have some money in real estate in your portfolio, you choose a safe bet.

Namely, warehouses and e-commerce distribution centres are more likely to be classed as essential, and you will have more paying tenants.

It’s an almost identical chart to the NASDAQ.

The tech giants leading the charge on the huge US index weren’t necessarily smashing earnings.

They became the consensus safe bet and thus developed charts that looked like growth companies, but were actually defensive plays.

So that’s industrial covered.

How’s the devastated commercial property market going?

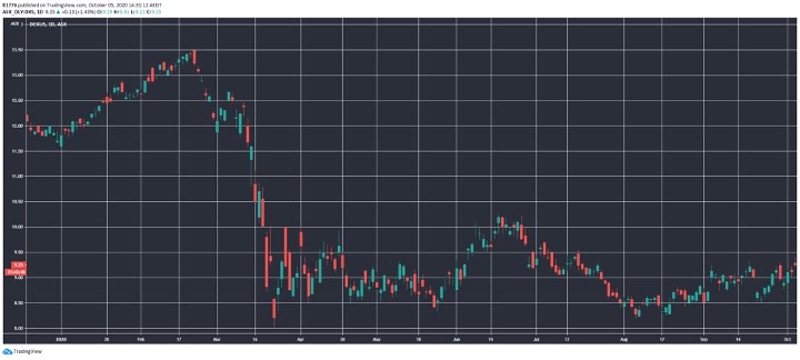

You could look at DEXUS Property Group [ASX:DXS], for example:

Source: tradingview.com

That’s a dead cat bounce if I’ve ever seen one.

You can see a bit of green creeping into the chart in the last two months, but you don’t need a crystal ball to see that it could be a long time before the macro picture changes for Dexus.

Large office working arrangements, particularly in Melbourne, will be one of the last bits of the Australian economy to come back online.

There’s also the concern that any business that’s proven it can function without an office may just stay that way.

No rent to pay means lower overheads and a leaner operation.

Before the onset of the pandemic the trend was towards hot desks and flexible arrangements, which should only accelerate, even if office space returns.

For the contrarians out there with a really long timeframe, it could be a bargain though.

How’s the residential property market going?

I’m going to pull up two charts to provide a clearer picture.

The first is Lifestyle Communities Ltd [ASX:LIC]:

Source: tradingview.com

A strong move up from the March market lows.

It’s a similar story for Ingenia Communities Group [ASX:INA]:

Source: tradingview.com

These two charts reflect that residential real estate is holding up pretty well.

Low rates traditionally increase speculation in the housing markets — and US new home sales are on an absolute tear.

It’s surprised a lot of people.

Take this snippet from Reuters in August:

‘Sales of new U.S. single-family homes increased to their highest level in more than 13-1/2 years in July as the housing market continues to show strong immunity to the COVID-19 pandemic, which has plunged the economy into recession and thrown tens of millions of Americans out of work.

‘The Commerce Department said on Tuesday new home sales rose 13.9% to a seasonally adjusted annual rate of 901,000 units last month, the highest level since December 2006. New home sales are counted at the signing of a contract, making them a leading housing market indicator. June’s sales pace was revised upward to 791,000 units from the previously reported 776,000 units.

‘Economists polled by Reuters had forecast new home sales, which account for about 14% of housing market sales, gaining 1.3% to a rate of 785,000-units.’

The economists clearly got it very, very wrong.

They were off by 12.6%!

No wonder they call it the ‘dismal science’.

Anyway, I wouldn’t be surprised if the Aussie property market picks up again in defiance of conventional wisdom.

Rates are ultra-low and Melbourne is the only place in a severe lockdown.

The ‘smart money’ backing INA and LIC reflect deceptive strength, at least for now.

Regards,

Lachlann Tierney

For The Daily Reckoning Australia

PS: Australian real estate expert, Catherine Cashmore, reveals why she thinks we could see the biggest property boom of our lifetimes — over the next five years. Click here to learn more.