In today’s Money Morning…mining has always played a crucial role in our economic mix…the unstoppable rise…booms to busts…and more…

When it comes to Australia, the term ‘mining boom’ can get thrown around quite a lot.

After all, mining has always played a crucial role in our economic mix. Long-standing as one of our predominant industries in this nation.

But when I hear someone say, ‘mining boom’, what immediately comes to mind is the mid-00s bonanza. A period that saw Chinese demand for our raw minerals skyrocket. With iron ore being one of, if not the leading commodity at the time.

And for the mining companies behind this massive boom, it was an incredible time. With the likes of BHP and Rio Tinto soaring, as well as plenty of junior miners too.

Right up until the global financial crisis, iron ore companies were going strong. Then in late 2008 and 2009, they took a beating with the rest of the global economy.

But it didn’t take them long to roar back to life. With most of the sector recovering by late 2010 or 2011.

In fact, iron ore practically saved our economy from a recession single-handedly.

And now, in 2020, we’re seeing iron ore do it again…

The unstoppable rise

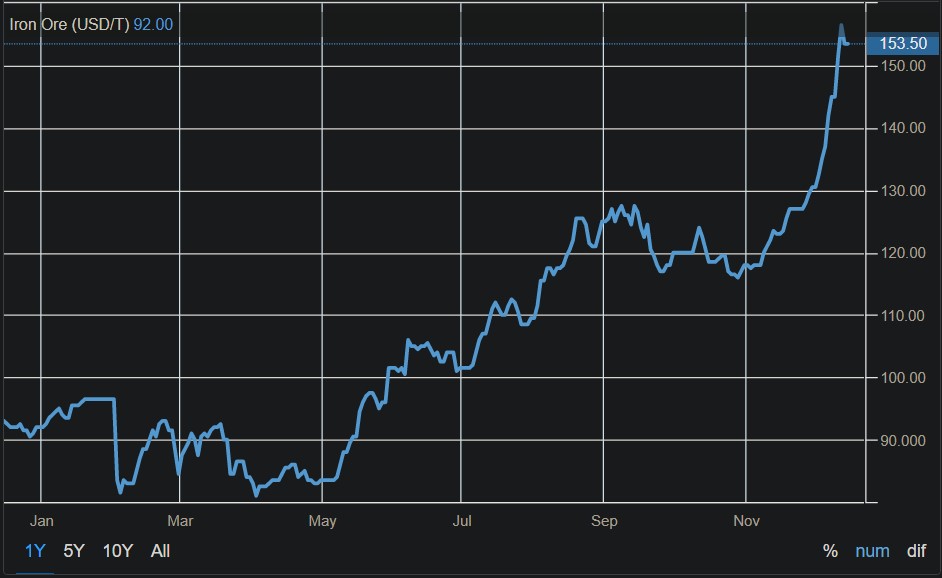

If you haven’t already heard, iron ore prices have been rising for most of 2020. Taking off from US$84 in May to US$153 as of today.

See for yourself:

|

|

|

Source: Trading Economics |

For the first time since February 2013, iron ore is trading above US$150 per tonne. Quite a remarkable result for what has been a remarkable year.

But what makes this boom truly surprising is the broader context of it all.

Despite China’s trade attacks against Australia, iron ore has yet to feel their wrath. With the Middle Kingdom seemingly gobbling up more iron ore than ever. Demand that is responsible for the huge surge in price.

Granted, there is also the caveat of Brazilian supply. With our biggest competitor still struggling to bring mines online following disruptions from the pandemic and other events.

Nonetheless though, China simply can’t get enough of our iron ore. A vexing situation for their steelmakers, I’m sure.

And while we may see China try to find some angle to restrict or limit their dependence on the commodity, I don’t expect it will work. Boycotts have been attempted in the past with some less than stellar results.

So, unless China suddenly decides it doesn’t need more steel, or finds a replacement material — our iron ore industry will likely reap the rewards. Which begs the question, will it last?

Booms to busts

Like any commodity (or market for that matter), iron ore is subject to cycles. You can probably infer that yourself from the price data I provided above.

Iron ore boomed in the mid to late 00s, only to enter into a lull — price wise, anyway — for the past several years. 2015/16 in particular was a rough patch for much of the mining sector. As close to a bust as you’ll get.

For this reason, we can pretty safely state that we’re in the midst of another boom. One that, just like the last, has been somewhat unexpected but certainly welcome.

More importantly, it has proved just how steadfast our iron ore sector is. Defying trade wars, pandemics, and Australia’s first technical recession in three decades. A commodity that seemingly moves purely on supply and demand.

As an investor, that is an important reminder.

Because at the start of 2020, few people would’ve expected iron ore to be in this position. Fewer still in the aftermath of China’s aggressive trade actions. It was a ballsy call to jump into iron ore stocks a few months ago, but those that did would have walked away laughing.

What that should tell you is that iron ore is a ‘seller’s market’.

A fact that stands in stark contrast to the raft of other industries that have been attacked by China’s trade actions. But a fact that keen investors can’t afford to ignore.

Because at this point, I’d say it’s hard to dispute we’re in the midst of another mining boom.

One that could certainly be short-lived, but is a boom nonetheless.

So, until China finds an alternative supply of iron ore, or stops needing it entirely — Australian miners will likely reap the rewards. As well as their shareholders.

And when it comes to our economy as a whole. Well…iron ore may play a big role in achieving GDP growth in 2021. A scenario that shouldn’t come as a surprise the second time around, but seemingly has.

Love it or hate it, you can’t argue against the resilience of iron ore.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

Ryan is also the Editor of Australian Small-Cap Investigator, a stock tipping newsletter that hunts down promising small-cap stocks. For information on how to subscribe and see what Ryan’s telling subscribers right now, click here.

PS: Download your free report to learn about three hot pot stocks on the ASX right now. Click here to learn more.