Dear Reader,

We left off yesterday with the idea that understanding and positioning for the real estate cycle are where some big profits are.

They’d be a lot easier to calculate if government didn’t come in and continually distort the market.

Take the initial HomeBuilder grant last year. The intention was to boost construction. But some builders opposed it despite supposedly being the beneficiaries.

Why? It hijacked their cash flow in the short term. That’s because buyers stopped committing to new projects until they could get the grant.

It’s still rattling the industry now. The chairman of Tamawood pointed out yesterday that the grant is juicing the market up just as the supply of labour and materials is restricted under COVID.

The vaunted benefits of the stimulus might be a little less in reality.

And, of course, we now live in an economy where the government can put the wrecking ball into plans whenever it wants.

For example, Western Australia has put Perth into a one-week lockdown over…one case of COVID?

That seems insane to me. Cue chaos for the mining industry as the ‘fly in, fly out’ workforce doesn’t know whether it’s coming, going or staying still.

Who can confidently invest when the rules might change week to week?

2021 is already proving volatile and I don’t see that going away anytime soon. It was an amazing day on the ASX yesterday.

Stocks were looking decidedly weak as trade opened. Many dropped sharply…only for the market to reverse and close green for the day.

Lots of cash coming in off the sidelines? Maybe.

This volatility is one reason why you need to know if you’re in for the short term or long term on stocks you’re holding.

The middle ground is likely to be a warzone. Anyone with a tight stop-loss is likely to get whipped out of a lot of trades if the market gyrates like this.

I have some stocks I’m in for short-term catalysts. And some I’m prepared to back out to 2022 and beyond, come what may.

Aussie Property Expert’s Bold Prediction for 2026. Discover More.

A Housing Market Boom Around the Corner…

The surest cycle I’m prepared to back over the longer term is the real estate cycle.

We saw one reason why last week. Data from the RBA shows lending recording strong growth, up 8.6% for Australian housing.

The Australian Bureau of Statistics says the total value of new loan commitments, at $26 billion for the month of December, is a record high.

That credit is going to keep flowing out into the market and bid up prices further. Not everywhere, of course, but enough to keep shifting the aggregate dwelling values up.

Any stock that can leverage this cycle is worth your consideration. I’m not saying they’re automatically a buy…but at least a look into how they can monetise the buying pressure in the home market.

After all, it appears the owner-occupiers are driving the current trends. What happens when investors come back in a big way? Price rises will begin to beget more price rises.

It’s blindingly obvious that neither the RBA nor the government has any political muscle to prevent another land frenzy gripping Australia.

Now think of all the subsidiaries that feed off the whole system: brokers, financiers, builders, fitters and furnishers, and homeware retailers.

Each has a brighter outlook for earnings as the real estate cycle marches upwards.

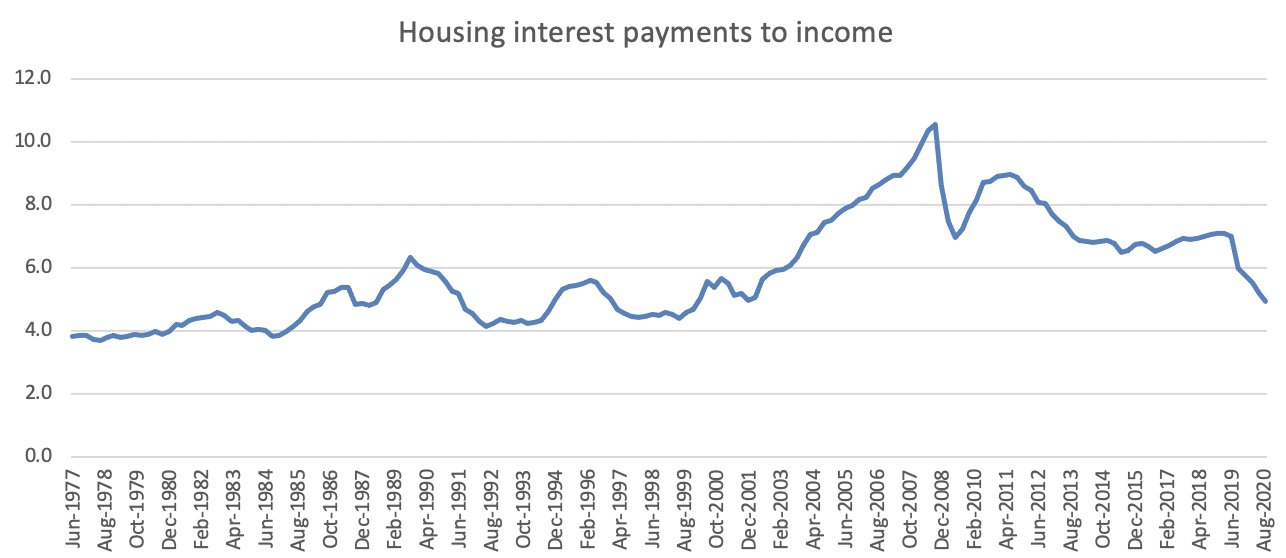

I saw an important chart from academic Dr Cameron Murray yesterday too. Housing interest payments in Australia are the lowest they’ve been compared to income since 1999. See for yourself…

|

|

|

Source: C Murray |

Land values are absorbing this benefit and will continue to do so until it reverses.

However, it will never be a smooth ride. But I know of a no more sounder theoretical framework than placing land — and the return you get from owning it — at the heart of your analysis.

So much economic activity springs from buying, renting, updating, subdividing and using land.

It drives the construction of ‘super-skinny’ towers in North Sydney to the very level of money supply in Australia via the credit creation of the banks.

And yet how many bother to learn the history and implications of this? Not many.

Today’s takeaway: As far as the Aussie housing market ‘bubble’ goes, you ain’t seen nothing yet.

Best wishes,

|

Callum Newman,

Editor, The Daily Reckoning Australia

PS: Our publication The Daily Reckoning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.