In 1849, Thomas Carlyle dubbed economics as the ‘dismal science’.

A label whose origin and initial meaning is still up for debate. All we really know is that Carlyle was musing on the topic of slavery at the time. A rather heavy topic indeed.

For better or worse though, the moniker stuck.

To this day, some people still refer to economics as the dismal science.

However, the meaning behind such name-calling is far looser. In fact, I’m sure some would even argue that economics is not a science at all.

Which is entirely my point. The main reason economics is still seen as ‘dismal’ is because it may as well be arcane.

No matter what kind of conclusions one may think they can make in regard to economics, they can never be certain. Even hard data or statistics are never truly certain. It simply offers guidance for interpretation.

Granted, that doesn’t mean this kind of information is useless.

Far from it.

We would be far worse off with no insight at all. But, we do have to remember that what little insight we do have, sometimes we have to take it with a grain of salt.

Because when it comes to economics you don’t need to be dismal, just adaptable…

Deceptive figures

Now I realise that intro was rather cryptic. But that was mostly intentional.

I just wanted to provide a preface before diving into the heart of today’s article: unemployment.

See, you may have heard that Australia’s unemployment rate dropped to 6.8% in August. A remarkable improvement from the 7.5% posted one month earlier.

Not only would that suggest that the bottom of the recession may be behind us, but that we may be in for a much quicker turnaround. Hell, even the government and RBA economists were surprised by the result.

Four Innovative Aussie Stocks That Could Shoot Up after Lockdown

Granted, their surprise isn’t surprising in and of itself. If they were halfway decent at their jobs, they’d probably have an inkling of what is going on and what to do next.

But I digress…

The fact is, unemployment improved. At least, that’s what the data tells us.

Sadly, that data isn’t as binary as most would like.

The dismal reality is once again masked by the complexity of modern economics.

Because while more people may be working, it is the type of work that they’re doing that also matters. After all, not all jobs are created equal.

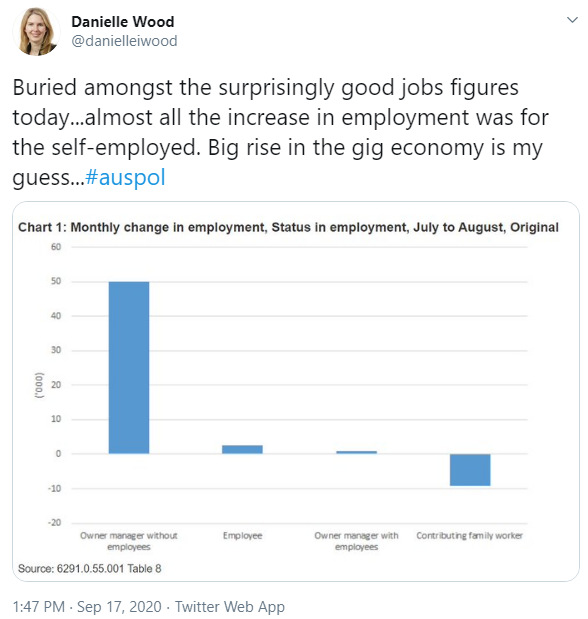

As Danielle Wood, CEO of the Grattan Institute pointed out on Twitter, the rise in employment is highly centralised:

|

|

| Source: Twitter |

The accompanying chart highlights this distinction in the data. With the ‘Owner manager without employees’ section towering above the others. Topping out at 50,000 new workers in this category.

And while we can’t say for certain what these workers are doing, as Wood notes, the gig economy is the likely pick. What’s the gig economy, you may ask?

Well, it is any work that falls under task-based demand in contrast to traditional commitments.

So, rather than working 9–5 for five days a week, a gig economy worker will only work when work is available. Ideally, giving them the freedom to choose when and how long they wish to work for.

However, their work is dependent on demand for the services they provide.

For example, a typical gig economy job is food delivery. With plenty of people working for the likes of Uber Eats, Deliveroo, Menulog, and more. An industry that has been instrumental in the midst of this pandemic. Which is why, it is no surprise that demand for more delivery drivers has grown.

The caveat though, is that these delivery drivers aren’t employees. Rather, they are classified as self-employed contractors.

An important distinction, especially because the gig economy is notorious for its underemployment.

Adapting to the new normal

Despite how progressive or flexible the gig economy may market itself as, it has its problems. Namely, that most workers apart of it can’t get enough work.

Choosing when you want to work is all well and good until the moment you can’t choose anymore. A situation that can lead to some gig workers only putting in a few hours each week.

For example, as the recent data for unemployment showed. While unemployment fell in August, the number of hours worked only lifted by 0.1%.

So, the number of people employed definitely rose. But in reality, these new workers may not be working enough to make ends meet. A situation that isn’t healthy for the individual or the economy as a whole long term.

A perfect case of the dismal science living up to its name.

For investors, especially those that look at macro influences, this is an important reminder. Not just because it highlights why you can’t trust data blindly, but also why you need to grasp the whole picture.

Keep in mind, it doesn’t have to be all doom and gloom either.

You need only take a look at the gains in stocks like Marley Spoon AG [ASX:MMM] and Collins Foods Ltd [ASX:CKF] to see the real winners of the gig economy. With the former seeing a huge increase in demand for their home-delivered meal kits. And the latter (Australia’s largest KFC franchiser) returning to their pre-covid levels of trading thanks to a food delivery boom.

For that reason, and many more, as dismal as economics may be as a science — it doesn’t have to be dismal for your wealth.

As long as you can stay objective and look beyond the façade of data or stats, you can thrive. And at the end of the day, that is what a good economy is all about…

Thriving individuals.

Regards,

|

Ryan Clarkson-Ledward,

Editor, Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Comments