Aurizon Holdings [ASX:AZJ] fell on Monday after releasing its FY22 results.

The Australian freight rail transport company, the largest transporter of coal since 2015, is down 4% over the past 12 months.

Source: www.tradingview.com

Source: www.tradingview.com

Aurizon’s 2022 financials

This morning, Aurizon provided its financial performance results for the full year of 2022 ending 30 June.

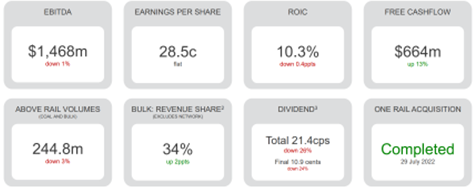

These were the financial highlights for 2022:

- Revenue for the full year came in at $3,075 million, a 2% increase on 2021’s full financial year results

- Underlying Earnings Before Interest, Tax, Depreciation and Amortisartion (EBITDA) came to $1,468 million, 1% lower than 2021’s $1,482 million

- EBIT came in at $875 million, a drop of 3% on the previous year’s $903 million

- Underlying NPAT dropped 2%, from 2021’s $533 million to $525 million in 2022

- Statutory NPAT fell further a 15% from 2021’s $607 million to $513 million

- Return On Invested Capital (ROIC) was 10.3% down by 0.4% compared to 2021

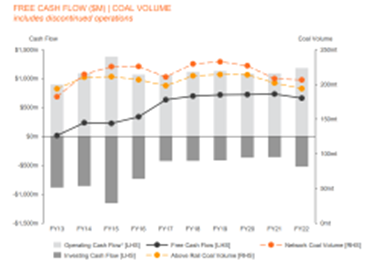

- Cash flow rose 13% to $664 million up from $589 last year

- But total dividend payout of 21.4 cents came in 26% lower than last year

Source: AZJ

Source: AZJ

The technicalities

Aurizon said the ‘key drivers’ for the financial results were down to:

- Its Network buisness providing $801 million in EBITDA, a 6% fall from the previous year due to lower catch-up revenue and volumes from its Wiggins Island Rail Project and lower fees for its Goonyella/Abbot Point Expansion.

- Bulk Busines EBITDA dropping 7% to a $130 million total, due to future investment and business growth.

- A 1% rise in Coal EBITDA — a total of $541 million for the year — which the company said is thanks to mangmenent of cost improvments and a rise in CPI and higher revenue despite a 4% decline in rail coal prices.

- NPAT was affected by Aquila interest sales last year, and One Rail Australia transaction costs.

Source: AZJ

Source: AZJ

In 2022, the company obtained several contracts and extensions with companies, including Pembroke Resources, Baralaba, CBH, and Lynas Rare Earths.

Aurizon’s CEO, Andrew Harding, said its acquisition of One Rail will assist Aurizon in doubling earnings in the company’s Bulk business by 2030.

AZJ’s share price outlook

Aurizon believes that it will be able to raise its EBITDA to the $1,470–1,550 million range in 2023.

The company expects to sustain capital expenditure within a $500–$550 million range, depending on upcoming contracts.

Harding said:

‘The Company has delivered a solid operational and financial result despite a challenging year with the ongoing COVID-19 pandemic, major flooding events and customer-specific reductions in production impacting our volumes…

‘Group earnings have remained stable through continued strong operational performance and a number of revenue protection mechanisms that are in place. This underlines the strength and resilience of the Aurizon business, and a commitment to deliver shareholder returns.’

Surviving the bear market

ASX stocks have had a tough time of it this year.

With inflation still elevated, markets everywhere are set to see further interest rate hikes as central banks fight to tamp down inflation.

Aurizon itself noted that rising inflation is affecting the price of electricity and fuel, raising its service delivery costs.

Stocks may fall further from here.

So should you stick with cash or buy the dip?

This is a common question in today’s market.

And if you’re looking for answers, I recommend reading the latest ‘Bear Market Survival Guide’ from our very own editorial director, Greg Canavan.

As Greg notes in his report:

‘What you decide to do in the next few weeks will determine the success of your portfolio in the next few years.’

If you’re feeling lost in the current market and are wondering how to protect your portfolio, click here to access Greg’s latest report ‘Your Bear Market Survival Guide’.

Regards,

Kiryll Prakapenka