The Aussie dollar is flying high today.

At time of writing, the Aussie dollar is trading at 71.39 cents to the US dollar. Remember, this is after the AUD hit a low of 55 US cents back in March.

What’s pushing the Aussie dollar?

There’s some optimism around the fact that the government will be extending JobKeeper and JobSeeker until March next year.

But there is another factor, too.

One thing helping the Aussie dollar is the price of iron ore.

Australia is the largest iron ore exporting country in the world, followed by Brazil. The price of the AUD is somewhat linked to the price of iron ore, which is Australia’s biggest export, mostly to China.

China’s demand for iron ore has pushed iron ore prices above US$100 per tonne, along with the fact that Vale, the biggest Brazilian iron ore producer, has struggled to maintain operations through the pandemic. Vale has had to revise its 2020 production guidelines, released in April, from 340-355 million tonnes to 310-330 million tonnes.

We’ll have to see if the Aussie dollar keeps pushing past the US dollar.

It will depend on whether China’s demand for iron ore remains strong as global economic growth slows, and tensions continue to build over trade and the pandemic. Also, looking at the Chinese yuan, a weaker yuan would make Australian iron ore imports more expensive.

And then there are interest rates. So far, Australia and the US have left interest rates at 0.25%. If either were to move higher or lower, this would affect the exchange rate.

USD weakening against major currencies too

So far, the USD is weakening against the AUD, but also against other major currencies.

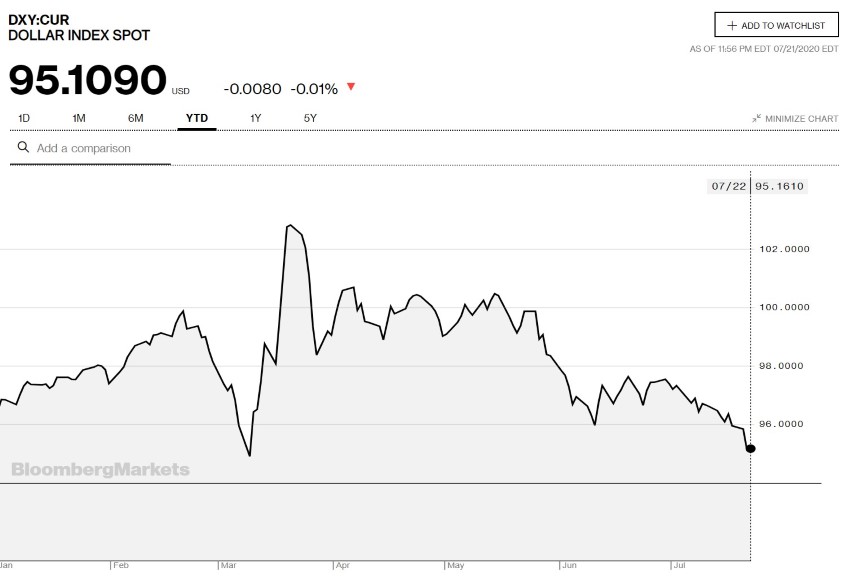

The U.S. Dollar Index keeps track of the value of the US dollar against a basket of major currencies, including the euro, the yen and the pound. It has lost close to 7.5% since March, as you can see below.

Source: Bloomberg

And it’s weakening against gold.

Overnight, the price of gold also moved higher against the US dollar, with gold at US$1,856 at time of writing, amid concerns about money printing and the debasing of the currency.

That’s why it’s a good idea to have gold in your portfolio. For a step-by-step guide on how to buy physical gold, you can check out Shae Russell’s report, ‘The Best Way to Buy, Sell and Store Gold’.

To read this FREE report, click here

Best,

Selva Freigedo,

For The Daily Reckoning Australia

Comments