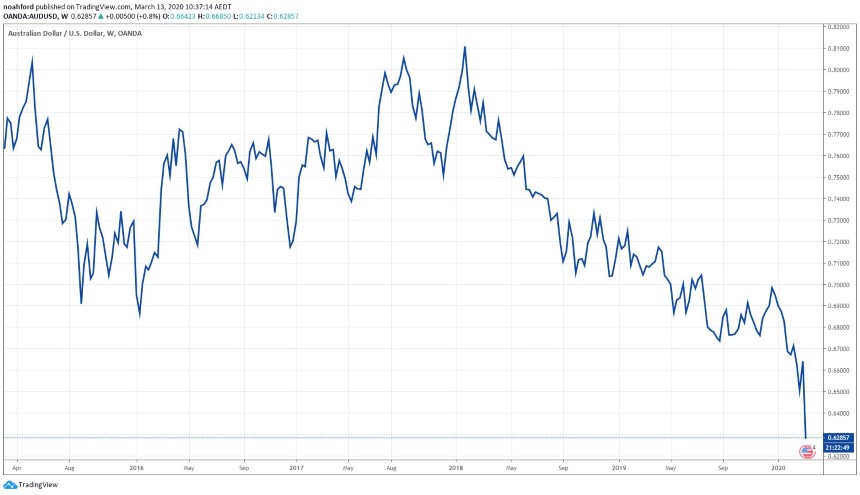

The Australian dollar has sunk to a near 12-year low overnight, tumbling to 62.13 US cents amid panic surrounding the coronavirus pandemic.

The AUD has not seen similar lows against the US dollar since the GFC. As of this morning, the Aussie dollar has dropped more than 11% from 70.31 US cents on 1 January.

The reason for the fall could be that traders are unwinding their positions in funding currencies like the Swiss franc, Japanese yen and euro in favour of the Greenback.

Growth sensitive currency markets, like Australia, took the biggest hit as the US dollar spiked, as evidenced in the chart below:

AUD has rapidly declined against USD since 2018

Source: Tradignview

Gold price set to suffer?

Australia’s declining cash rates, falling commodity prices, and forecasted low growth has put tremendous downwards pressure on the AUD.

It is certainly possible that we will continue to see the value of the USD increase amid the current crisis as investors typically consider USD as a safe haven — leaving the AUD vulnerable over the short term.

Typically, a weaker Aussie dollar is preferable for many Aussie industries (tourism, farming, mining) because our exports become cheaper.

But with the current COVID-19 pandemic, demand for these types of Australian goods is not likely to increase in the short term.

This could mean a further weakening of the Australian economy, potentially leading to a recession.

Learn why a recession in Australia is coming and three steps to ‘recession-proof’ your wealth. Click here to download your free report

Perhaps of more interest is the impact a strong US dollar will have on the price of gold.

Usually, as the USD appreciates in value the price of gold suffers. This is because gold becomes more expensive in other currencies. As the price of any commodity moves higher demand tends to recede.

Indexed USD (blue) vs. percentage change in Gold/oz (orange)

Source: tradingview.com

Given the unique circumstances in which we find ourselves, the behaviour of gold and the broader US currency is not as predictable as before.

US 10-year Treasury yields have continued to slide, helping to prop up the gold price.

The Fed has also slashed benchmark interest rates and is expected to cut rates further when they meet later this month.

This helps support the case for holding gold as the opportunity cost of holding non-yielding bullion is reduced when rates are lower.

However, the highlighted area of the chart above suggests the USD versus Gold Price has developed a strong negative correlation recently.

This could cause a bit of worry in the gold markets if the USD continues to appreciate.

The latest fall in the price of gold was potentially caused by traders selling off the precious metal to cover margins for stock market losses.

I expect gold to continue its march upwards amid current recession fears.

Regards,

Lachlann Tierney

For The Daily Reckoning

PS: Discover how some investors are preserving their wealth and even making a profit, as the economy tanks. The special interview with Jim Rickards can be downloaded here.

Comments