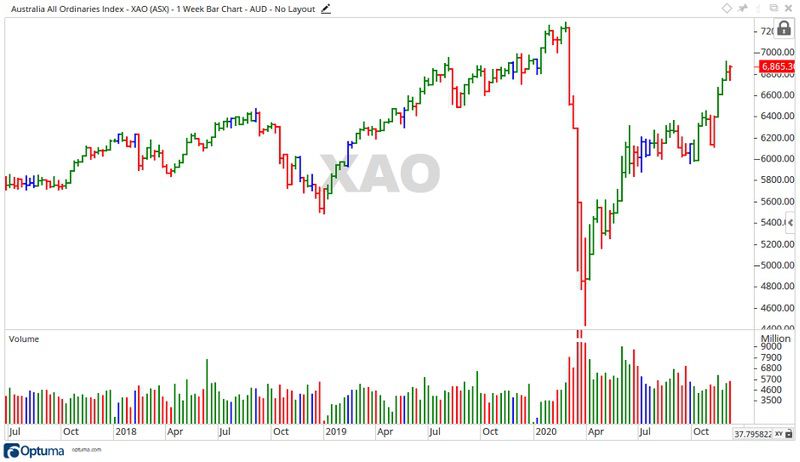

This week been saw a largely flat week unfold. The All Ordinaries [ASX:XAO] gained 48 points for the week, without breaking the high of the previous week’s trade.

Trading for the week took place on average volume. After a strong run-up over the last four weeks, this may be the first sign the market is running out of steam.

Source: Optuma

ASX outlook for the week ahead

The first week of December is here.

After such a turbulent year, Christmas may come as a welcome event this year, finally something to celebrate.

For the All Ords December may see more spending across the board as people buy gifts and travel around this time.

The classic ‘Santa Rally’.

Many companies would welcome the cash injection.

For the coming week ahead, if XAO moves above the 6,986 points level the market could be considered bullish.

Should it fall into a bearish move then the levels of 6,486 and 6,256 points may be enough to halt the fall.

Source: Optuma

A closer look at the ASX

While the All Ords didn’t have the biggest week there were still some gains.

Alumina Ltd [ASX:AWC] moved up 4.97%. BHP Group Ltd [ASX:BHP] and Charter Hall Group [ASX:CHC] gained 7.18% and 9.08% respectively.

On the downside, Ansell Ltd [ASX:ANN] fell back 5.06%. While GUD Holdings Ltd [ASX:GUD] and IDP Education Ltd [ASX:IEL] declined 3.97% and 9.65% respectively.

Moving into the sectors, Health Care and Consumer Discretionary fell back 2.43% and 1.11%, while Energy and Materials gained 1.47% and 0.48% respectively.

A broader look at the ASX

2020 is a year of surprises, both pleasant and unpleasant.

All due to the COVID-19 pandemic currently gripping the world.

The main two focuses of the pandemic are the global economy and the virus itself.

Few seem to be talking about the human change.

Divorce rates in the US alone increased by 34%. As the virus forced people globally to stay indoors it also created a pressure cooker environment.

More financial, emotional, and family stress.

Many are also packing up and moving state. With a migration taking place currently from the southern states to Queensland.

This not only redistributes people around the nation but also the flow of money.

The pandemic kick-started a huge movement in how society is structured.

It won’t be until this settles that we see the true shape of the economy.

So much so that even the RBA appears confused on the direction of house prices now.

Although the All Ords is climbing up lately, there is nothing to say it cannot all come crashing down considering the economy of the country.

If this is a market you are wanting to trade or invest in, make sure you are planning for the worst and hoping for the best.

Risk management and stop-losses are an important part of this mindset.

Regards,

Carl Wittkopp,

For Money Morning

PS: Make Profitable Trades, More Often — Trading expert Murray Dawes reveals his unique trading strategy designed to help you clock up steady gains in any market, while limiting your downside risks. Click here to learn more.