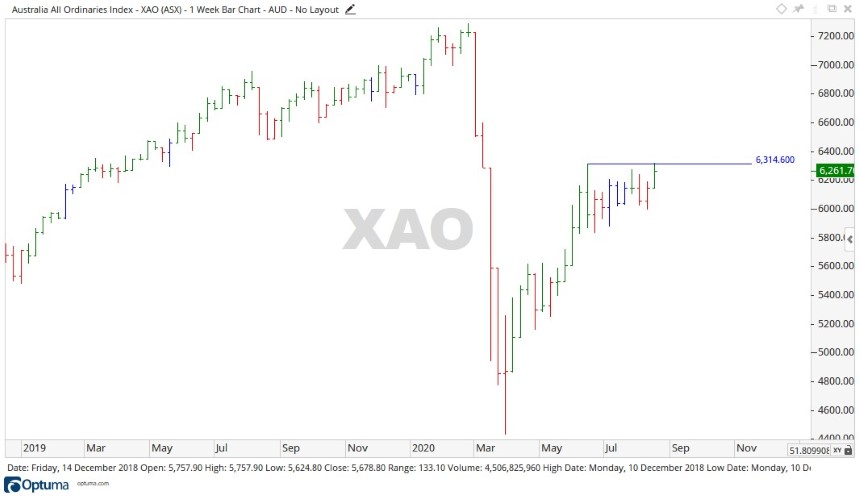

The All Ordinaries [XAO] pushed into its ninth week of a sideways move, closing at 6,261 points last week.

Briefly cracking the high of 6,314 points set back in June, the continued sideways movement in the market may indicate a lack of confidence from the top end of town in investing more and pushing the market higher.

Source: Optuma

ASX outlook for the week ahead

The week ahead will see a lot of companies report their earnings, which should make for interesting reading.

With COVID-19 tearing through the business landscape over the last six months, there will be some real winners and losers to come out of this in terms of earnings.

This may push the All Ords into another week of sideways movement as the mixed fortunes of companies come to light.

A closer look at the ASX

A mixed bag unfolded in the sector this past week. Financials and Consumer staples both moved up 3.87% and 4.19% respectively, while Utilities and Communication services fell 2.44% and 4.86% respectively.

Looking into the stocks, Qantas Airways Ltd [ASX:QAN] recorded a rise of 10.84%, while Corporate Travel Management Ltd [ASX:CTD] and QBE Insurance Group Ltd [ASX:QBE] moved up 7.07% and 10.46% respectively.

On the downside, Seek Ltd [ASX:SEK] pulled back 8.60%, as did AGL Energy Ltd [ASX:AGL] and Challenger Ltd [ASX:CGF], recording declines of 8.81% and 8.60% respectively.

A broader outlook for the ASX

With a flurry of activity about to take place in the form of earnings reports, it may make for a surprising week.

The COVID-19 virus appeared on our doorstep around February 2020 and now being August, we are roughly six months in.

The housing market is looking a bit shaky, the country now has mass unemployment, and business confidence is low.

All up, there may be some big surprises both good and bad to come from the earnings reports.

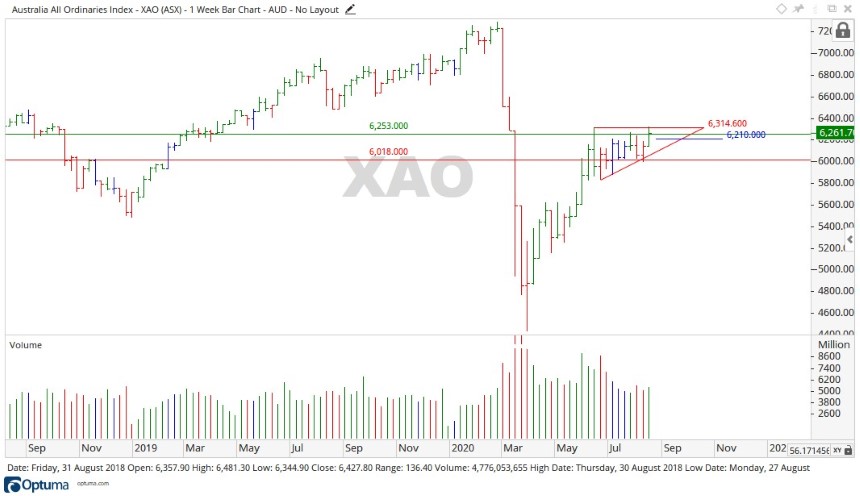

Source: Optuma

At the time of writing, the All Ords was trading at 6,210 points, down 52.3 from the previous close.

Over the last nine or so weeks the price moved between 6,018 and 6,253 points roughly, and along the way formed a pennant pattern (red triangle).

As time moves along and the price moves further into the pennant, what could happen is there is a vacuum in about the last third of the pattern where price gets squeezed, where the market forces it to pop above or below — which gives a very good indication of the future direction.

At this stage, I personally still hold a bearish outlook, but time will tell.

Regards,

Carl Wittkopp,

For Money Morning

PS: Our four well-positioned small-cap stocks: These innovative Aussie companies are well-placed to capitalise on post-lockdown mega-trends. Click here to learn more.