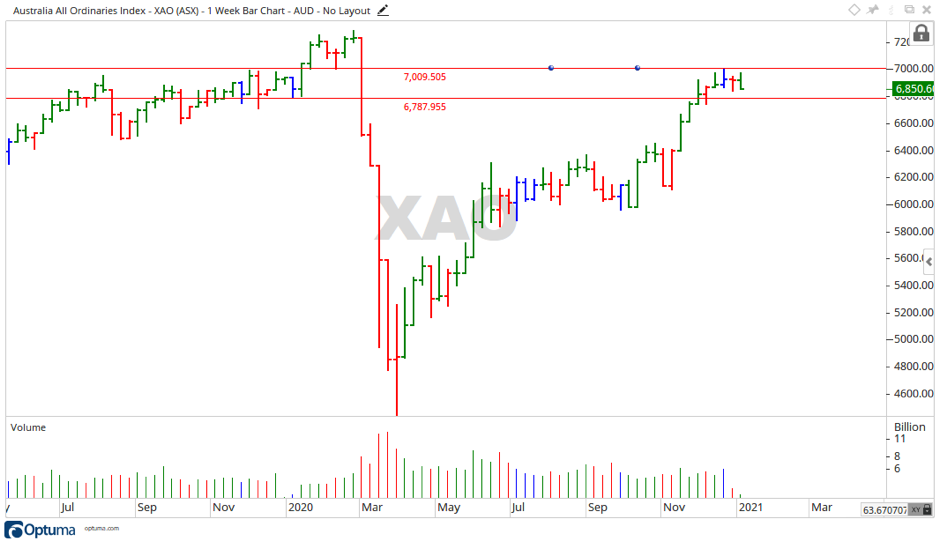

The last week of 2020 saw the All Ords [ASX:XAO] close down slightly, falling away 66 points to see out the year at 6,850 points.

Source: Optuma

ASX outlook for the week ahead

This week ahead may see the All Ords fall away.

The price has moved sideways for most of December, with the final week of trading being a move down.

The Christmas just been was unlike any other I can remember.

While the shops were busy leading up to Christmas, it was the Boxing Day sales that looked to be quiet.

Doing a little shopping myself and speaking with some retail employees, most said things were ‘dead’.

It will be interesting to see the retail sales data when it comes out.

Source: Optuma

The All Ords will have to break the 7,000-point level to be considered bullish still and keep the uptrend intact.

Should it fall through 6,787 points though, then we may be looking at the start of a fall.

A closer look at the ASX

The final week of 2020 saw many stocks fall away.

Cooper Energy Ltd [ASX:COE] declined 6.84%, while Gold Road Resources Ltd [ASX:GOR] and Mineral Resources Ltd [ASX:MIN] fell back 4.33% and 4.64% respectively.

On the upside, QBE Insurance Group Ltd [ASX:QBE] gained 3.72%, while Ramsay Healthcare Ltd [ASX:RHC] and Waypoint REIT Ltd [ASX:WPR] moved up 3.42% and 3.19% respectively.

Looking at the sectors, everything moved down in the final week of the year, with Real Estate falling 2.58%, and Healthcare and Financials declining 2.04% and 1.45% respectively.

A broader look at the ASX

2020 will be remembered for many reasons, most notably the COVID-19 pandemic that took over the world.

Infecting millions the world over, this airborne virus caused people to be forced to stay at home and away from others.

In taking these measures businesses have suffered and governments around the globe have had to step in to help.

Here at home the federal government implemented the JobKeeper and JobSeeker programs.

There were a raft of other changes made as well to help businesses, and a major one that is set to change looks to have gone unnoticed…

Insolvency laws.

At the start of the pandemic the Australian government suspended a lot of the rules that apply to companies going under.

Through 2020 going insolvent has been a difficult thing to do, no matter how much the business owes.

Now, as of 1 Jan 2021, the rules are back to normal.

One of the biggest insolvency companies is KordaMentha. They recently surveyed the industry about their expectations. Despite official data showing growth, insolvency professionals thought the recession was not over.

‘Australia’s recession is really just commencing,’ said Chris Martin, Partner at KordaMentha.

With the insolvency laws back up and running, the JobKeeper program looks to be the last thing holding many businesses up.

Like a watermelon balancing on a toothpick — keeping this all up will prove to be increasingly difficult.

While 2020 was the year of COVID-19, 2021 may be the year of business failings — which will affect the All Ords.

Our publication Money Morning is a fantastic place to start your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Regards,

Carl Wittkopp,

For Money Morning