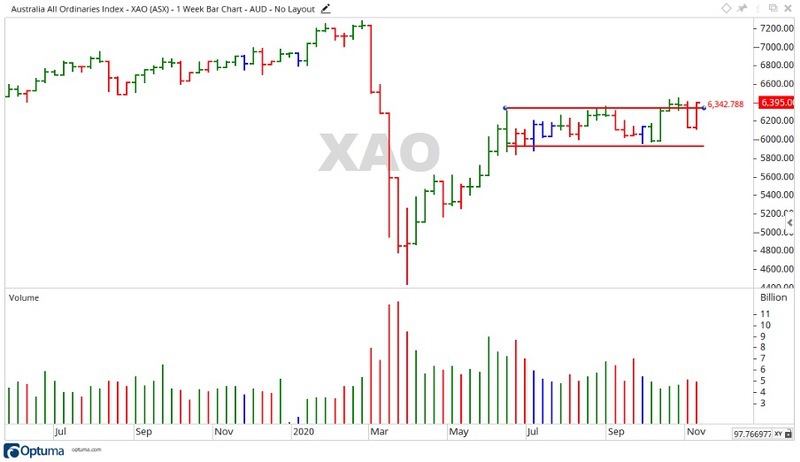

The All Ordinaries [XAO] experienced a strong week last week, gaining 261 points.

The move up took place on slightly decreased trading volumes, but nothing to be concerned about.

Outside of the market there are quite a few events causing change in society that would inspire confidence again, but that doesn’t mean we are out of the woods yet as in the long term there are still looming challenges to tackle.

Source: Optuma

ASX outlook for the week ahead

It wouldn’t be a surprise to see a positive week ahead on the market. The Queensland election is wrapped up, the COVID-19 pandemic that shut down Victoria looks to be coming under control with nine straight days of zero cases at the time of writing, and the US election took place, with Joe Biden winning the Oval Office.

I don’t want to say things are normal, but they do look a little more stable than what we have seen this last year.

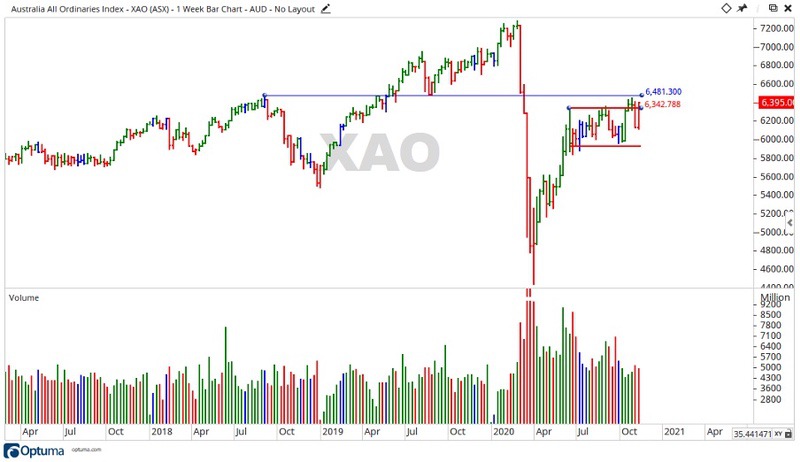

Source: Optuma

The renewed stability may see the All Ords push out of its sideways movement and test the resistance level of 6,481 points.

With the market closing out last Friday close to the top of its movement for the week, it will be interesting to see if this extends up in the price or falls back again to continue in the channel it’s been in since mid-June 2020.

A closer look at the ASX

The move up this week naturally dragged most of the stocks in the ASX 200 [XJO] with it.

Vocus Group Ltd [ASX:VOC] gained 15.07%, while News Corporation [ASX:NWS] and Tabcorp Holdings Ltd [ASX:TAH] jumped 19.24% and 24.62% respectively.

On the downside, not too many stocks retreated this last week, but there were a couple.

Pendal Group Ltd [ASX:PDL] pulled back 7.75%, while Fortescue Metals Group Ltd [ASX:FMG] fell away 4.78%.

Into the sectors, everything pushed to the positive side last week, with the large gainer being Consumer Discretionary up 6.76%.

Communication Services and Financials moved up 5.42% and 2.92% respectively also.

A broader look at the ASX

It kind of feels like we are in the eye of a new-forming storm, the calm before the other side of the destruction appears.

COVID-19 looks to be diminishing around the country with Victoria looking healthier by the day.

There are discussions about borders being opened again and on an international front the US election passed.

With Joe Biden winning it may just be a return to a more traditional world order.

While all this looks wonderful, there is still the economic destruction of the COVID-19 pandemic.

With the JobSeeker and JobKeeper payment hikes looking to end shortly and the mortgage freeze coming to an end in the new year, there is still danger on the horizon.

The financial mechanisms put in place this year to keep the economy moving look to be masking a problem that is still waiting to be dealt with.

I might be sounding like broken record, but with the RBA recently announcing a lowering of the cash rate to a historic low of 0.1%, it signals to me that when things do return to normal there will be a mountain of work to do to get the nation going again.

With this in mind, it may still be far too early to look at the market and assume the worst is over.

Regards,

Carl Wittkopp,

For Money Morning

PS: With the banks still not out of the woods, why not check out these three exciting fintech stocks? It’s a great read if you are bearish on the banks. Download that here.