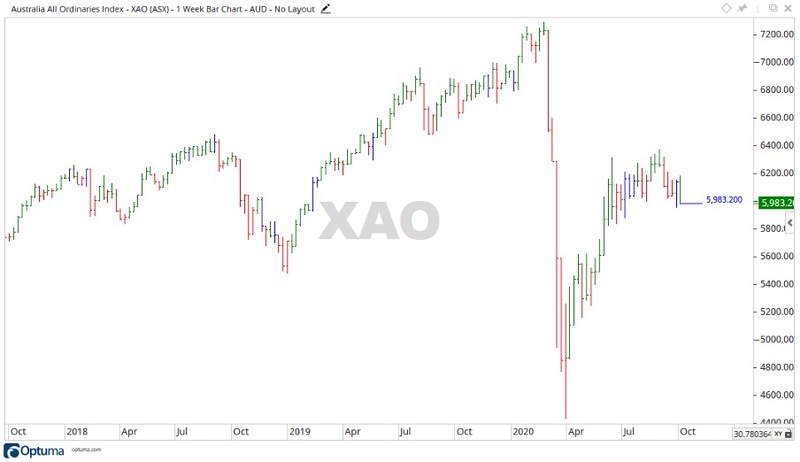

Last week saw the All Ordinaries [ASX:XAO] fall back 157 points for the week, to close at 5,983 points.

With the most recent high being back at the end of August, the market now looks to be moving into a downward trend.

Source: Optuma

ASX outlook for the week ahead

Although at the start of trading today the XAO was up more than 2%, the coming week could see the market move down by the end of trading on Friday. With the previous week having a close very near the bottom of the bar, from a technical perspective, the indications are reasonably strong that a further move down is gathering steam.

Much could hinge on the upcoming Federal budget though.

Source: Optuma

If XAO continues its fall, then the levels of 5,870 and 5,670 points may be enough to provide support.

Interestingly, these levels formed around a sideways distribution pattern back in 2017. At the time the market found it difficult to break out from these levels, so they may prove strong again in the future.

On the upside, the price would have to break through the level of 6,372 points and form a new high for the All Ords to be considered bullish again.

A closer look at the ASX

Last week in stocks there were some big movers on both sides. Boral Ltd [ASX:BLD] gained 6.76%, and Premier Investments Ltd [ASX:PMV] and Janus Henderson Group [ASX:JHG] both put up double-digit gains of 11.89% and 16.73% respectively.

On the downside, Metcash Ltd [ASX:MTS] fell away 5.57%, and BHP Group Ltd [ASX:BHP] pulled back 6.60%.

The a2 Milk Company Ltd [ASX:A2M] was the big loser, declining 18.53%.

In the sectors, there was not a lot of positivity to be found with no gains to be seen.

Energy declined 6.94%, along with Consumer Staples falling back 4.88%.

Financials and Materials both took minor falls, pulling back 3.73% and 2.13% respectively.

Trump and financial uncertainty at home

The rest of 2020 is shaping up to be a wild time.

President Donald Trump was hospitalised with COVID-19 recently, along with his wife, which does nothing to calm the uncertainty in global markets.

Here at home, the end of September just passed, meaning lower JobKeeper and JobSeeker payments are now in effect.

Along with the banks starting to lift the mortgage freeze.

It’s as if we’re starting to thaw out after a financial ice age.

I believe what we are about to walk into is something unseen by any generation still alive today.

While it will be difficult and challenging, like all uncertainty there is opportunity hidden within it.

Those with their money saved — and an investment plan in place — may be well placed to profit from this on the way out of it all.

Regards

Carl Wittkopp,

For Money Morning

PS: Four Well-Positioned Small-Cap Stocks: These innovative Aussie companies are well placed to capitalise on post-lockdown megatrends. Click here to learn more.