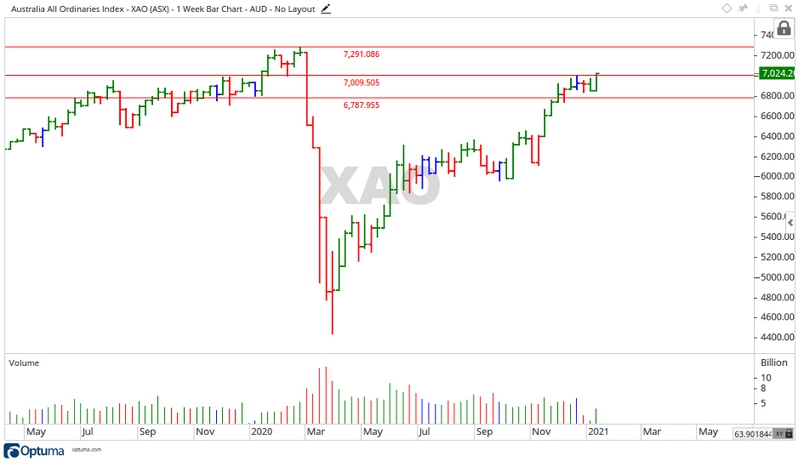

The week been saw the All Ords [XAO] move up 173 points, being dragged along with the rest of the global markets on the back of Joe Biden being confirmed as the next president of the US, and progress of a COVID-19 vaccine.

Source: Optuma

ASX outlook for the week ahead

The coming week for the All Ords may be a sideways movement. Over the last five trading weeks the price consolidated between 6,787 and 7,000 points.

From the march low in 2020 the All Ords so far have had an incredible recovery.

Recently the recovery looks to have found resistance to a further move up.

If the price can break through the 7,000-point level, then it may go on to challenge the all-time high of 7,291 points.

Should the price fall back, then the level of 6,787 points may be enough to halt the fall.

A closer look at the ASX

The first week of 2021 saw a mixed bag of results in the All Ords.

ALS Ltd [ASX:ALQ] gained 9.05%. While BHP Group Ltd [ASX:BHP] and Bendigo and Adelaide Bank Ltd [ASX:BEN] moved up 9.99% and 4.72% respectively.

On the downside, The a2 Milk Company Ltd [ASX:A2M] fell back 4.45%, along with Altium Ltd [ASX:ALU] and EML Payments Ltd [ASX:EML] retracing 8.09% and 8.85% respectively.

Moving into the sectors, Energy moved up 7.83%, along with Financials and Consumer Discretionary moving up 3.46% and 2.18% respectively.

Falling back were Information Technology, declining 3.78%, and Real Estate, down 0.72%.

A broader look at the ASX

Back in February 2020 the All Ords sat at 7,241 points; an all-time high.

At the time there were concerns the market was overheated and due for a drop.

Australia’s cash rate sat at 0.75%. Housing prices were high and wage growth low.

COVID-19 appeared and shattered everything.

In the following months the All Ords along with most global markets recovered well.

Now in my opinion, people are starting to overreact and go a little crazy over shares.

Jesse Livermore once said: ‘Markets are never wrong — opinions often are’.

With the pandemic still raging around the globe, assets such as Bitcoin [BTC] are going berserk.

Sitting at US$37,701 at the time of writing.

Here at home Afterpay Ltd [ASX:APT] is trading at $112.74 at the time of writing, up over 1,300% from the march low.

On the surface it all looks fantastic, what seems to be forgotten are the phases of a bull and bear market.

In a bull market the usual phases are:

- Renewing confidence

- Improved earnings

- Rampant speculation

In a bear market:

- Abandonment of hope

- Decreased earnings

- Distressed selling

Right now, I feel it’s safe to say we are in the ‘rampant speculation’ phase of the market.

If so, it is only a matter of time before we move to the abandonment of hope and start the slide back.

Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here.

Regards,

Carl Wittkopp,

For Money Morning

Comments