Editor’s note: In today’s video update I discuss some recent headlines regarding nuclear power and the charts for ASX-listed uranium companies, as well as a few things to consider before you decide to invest. Click the thumbnail below to view.

A decision nearly 50 years in the making, the Democrats now support nuclear power.

You can catch the full rundown from Forbes here, by the way.

It’s the headline that many missed as the US continues to boil over.

This is huge news. Absolutely massive.

Bill Gates is big fan and so is Andrew Yang.

Gates I’m sure you know, but maybe not Yang.

Yang ran an ill-fated campaign to be the Democratic presidential nominee with lots of techy ideas and the promise of a Universal Basic Income (UBI).

In my book, some of his techy ideas were not as far-fetched as some would believe.

And I believe his cherished idea of thorium-powered nuclear reactors as a bridge to a renewable future was ambitious but also sensible.

As for Gates, his TerraPower company is forging ahead with a plan to launch hundreds of 345 MW ‘Natrium’ plants by 2050.

He is seeking funding from a range of sources, including Buffett’s PacifiCorp.

The price point: $1 billion.

That sounds like a lot, but in the context of current reactor costs it’s actually a fraction of the capital expenditure needed to get one up and running.

The economics can be tricky, but a figure of between $6 billion and $10 billion is often thrown around for a 1,000 MW plant (a large one).

Gates and Yang’s plans a long way off

Now, I am cognizant of the divisive nature of energy debates.

But let’s talk about this from an investment perspective.

There’s a host of uranium companies out there.

And with the bipartisan support that nuclear now has, this could flow through to the prospects of several ASX-listed companies.

Gates favours liquid sodium-cooled plants and Yang’s proposal is to use thorium not uranium as the fuel for the reactors.

Both plans are a long way off though.

Meaning that for the meantime, it could be traditional uranium powered plants that garner interest.

So, for now, let’s have a look at what’s happening on the charts for some ASX-listed uranium companies.

Charts for ASX-listed uranium companies

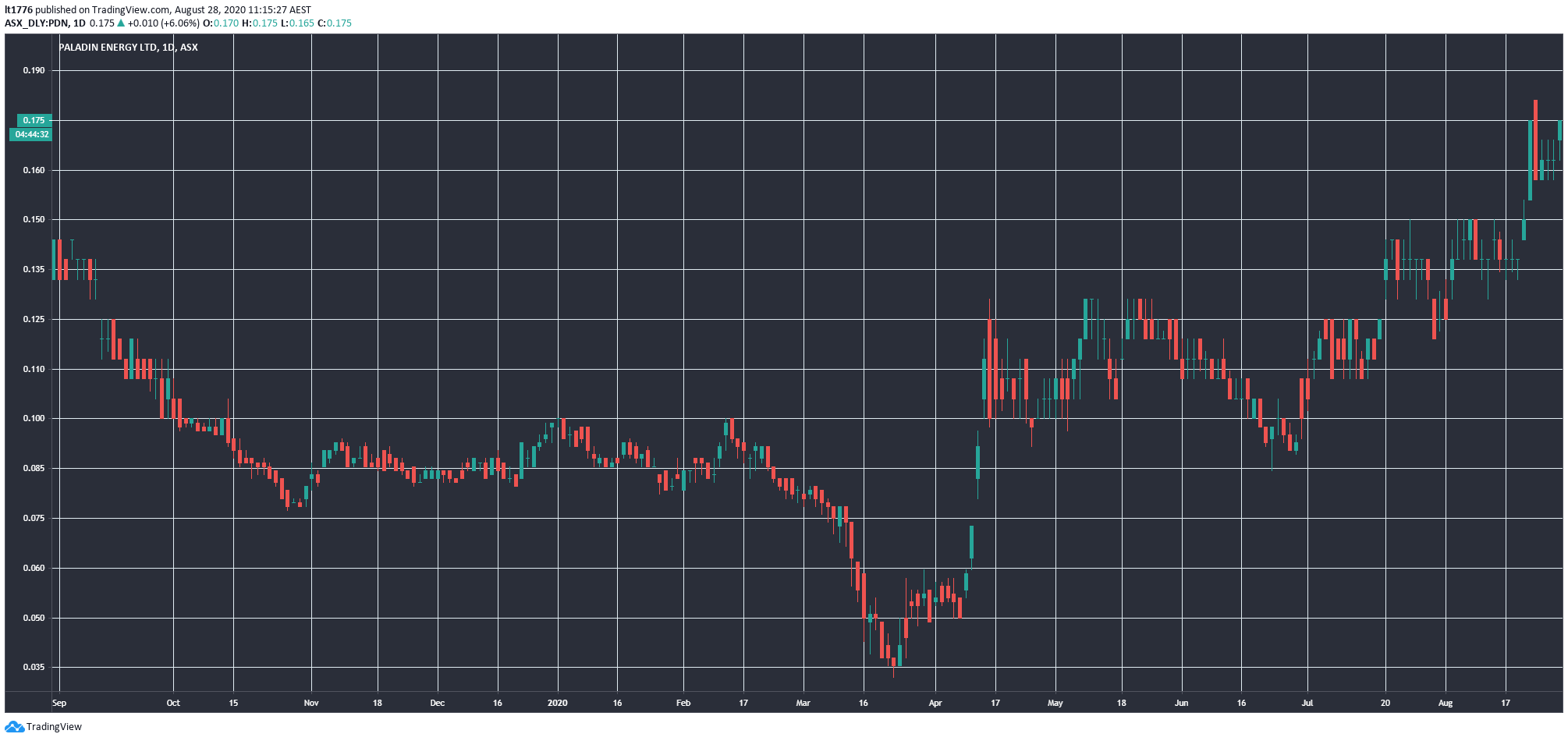

First up is Paladin Energy Ltd [ASX:PDN].

|

|

|

Source: tradingview.com |

PDN has a Namibian mine.

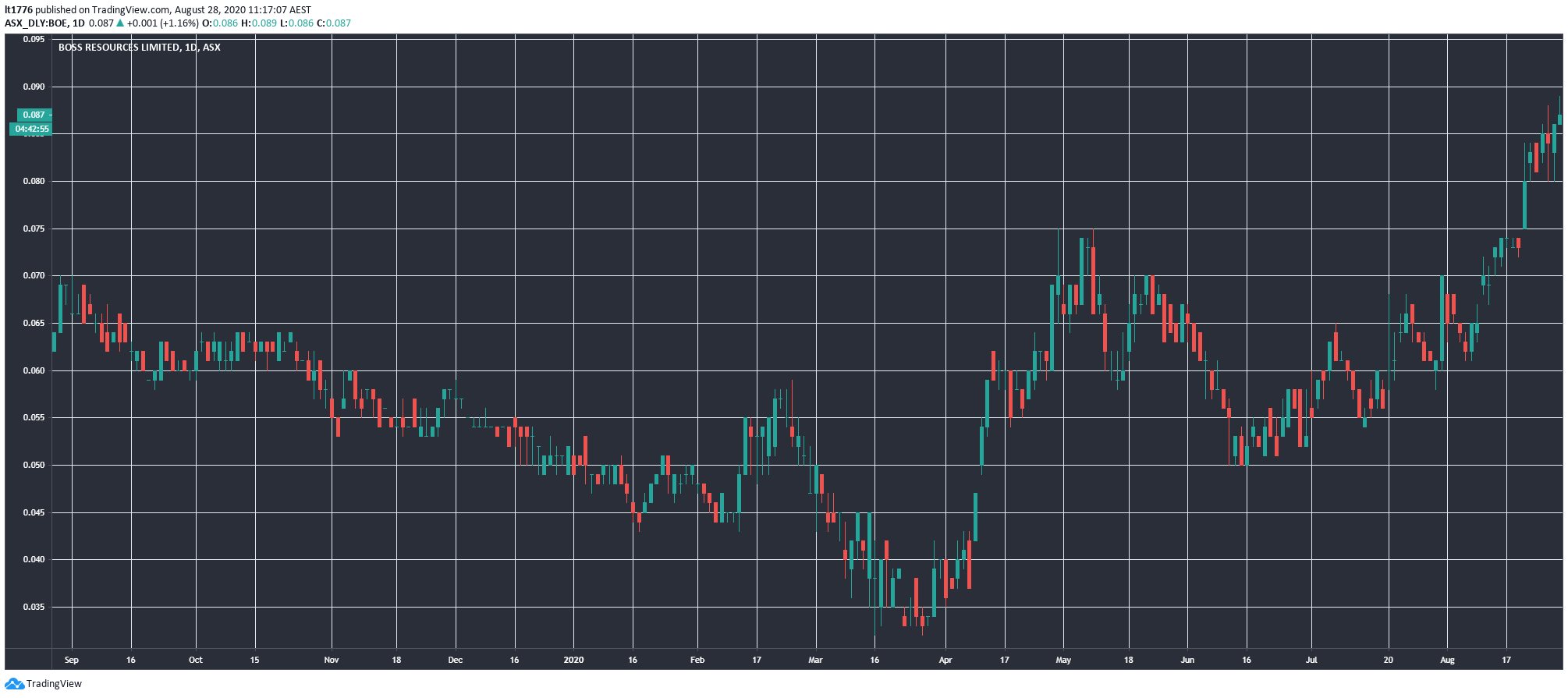

Then there is Boss Resources Ltd [ASX:BOE].

|

|

|

Source: tradingview.com |

BOE is focused on restarting the Honeymoon project in South Australia.

And also Bannerman Resources Ltd [ASX:BMN].

|

|

|

Source: tradingview.com |

BMN also has a Namibian mine.

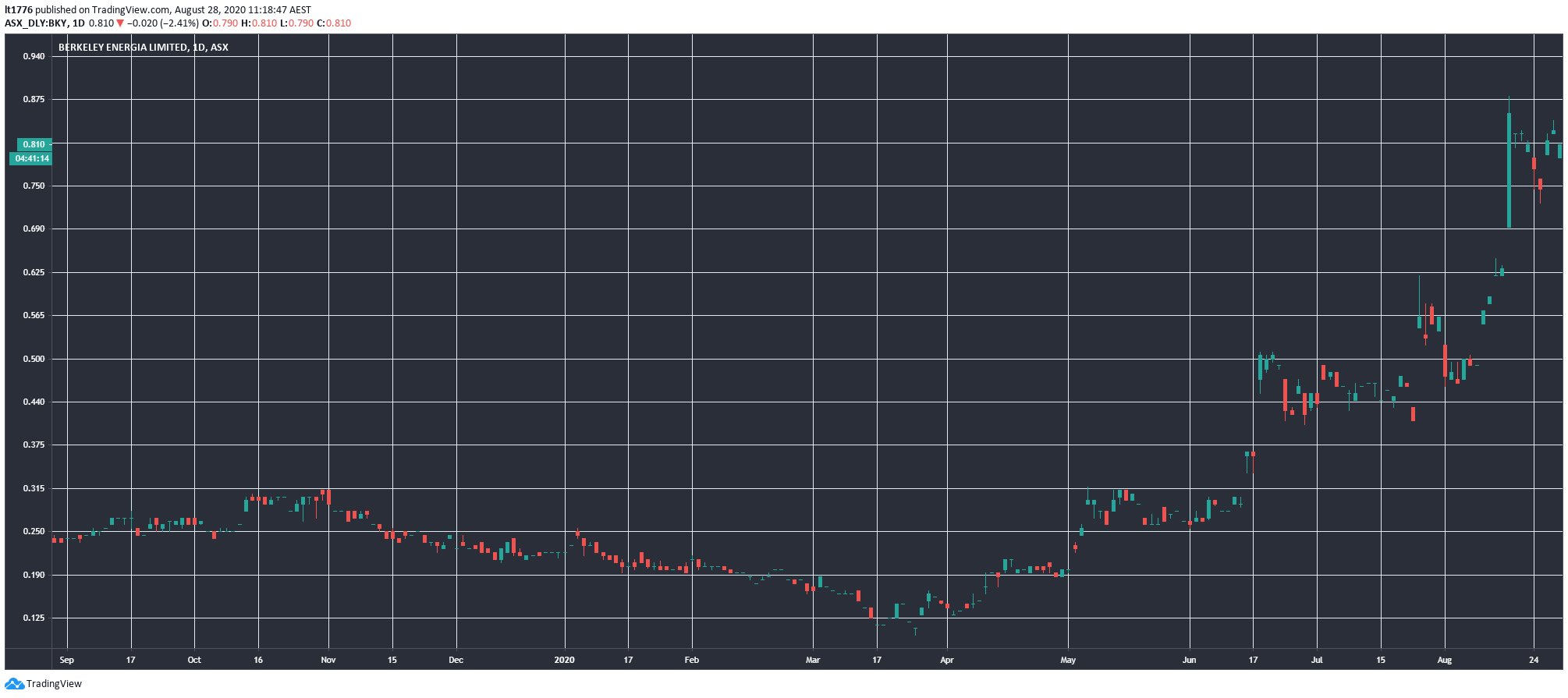

Finally, you’ve got Berkeley Energia Ltd [ASX:BKY] with the most bullish looking chart of the bunch.

|

|

|

Source: tradingview.com |

BKY is focused on a Spanish operation in Salamanca.

With perhaps the exception of Bannerman, all have strong upwards momentum.

Meaning investors are waking up to the developing uranium story.

A lot of it has to do with where the world is going with its energy choices.

There are around 450 nuclear reactors, in 31 countries.

Around 50 reactors are under construction and China is going at nuclear hard.

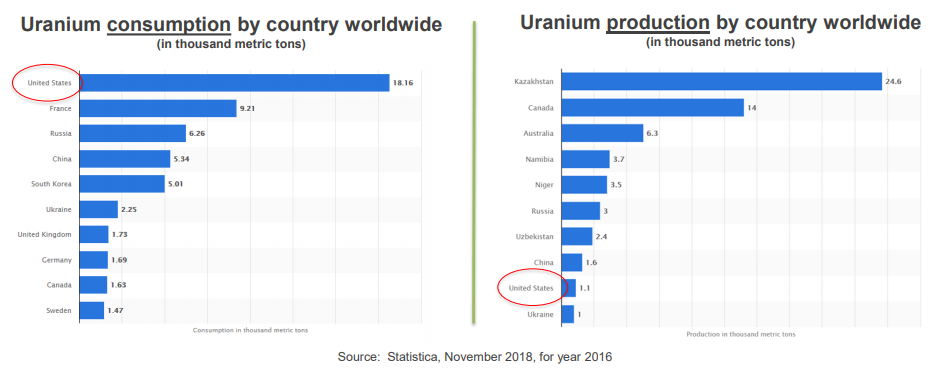

The US leads the way in total nuclear energy production, and as a result is the world’s largest consumer of uranium.

But the US hardly produces any of its own uranium, you can see the big gap between US uranium use and production below:

|

|

|

Source: newswire |

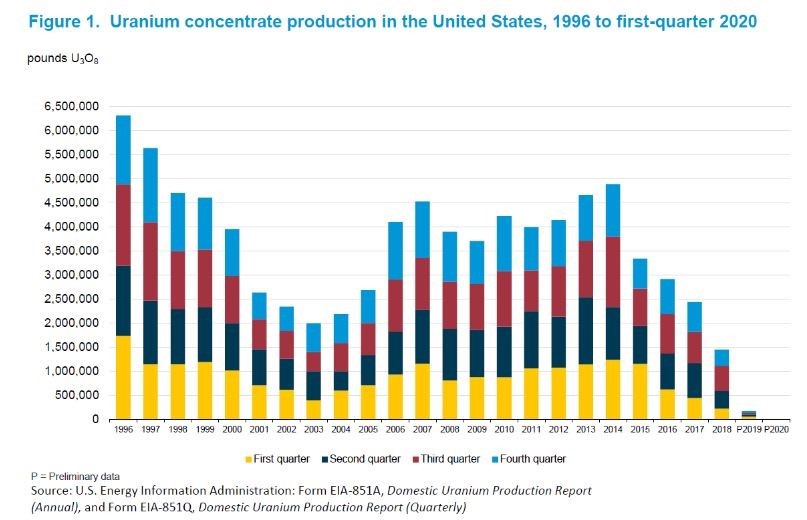

And as of 2019 US uranium production is in the process of falling off a cliff:

|

|

|

Source: World Nuclear News |

The Hill reports that US companies provide just 10% of the US uranium supply and that ‘more than 60 percent of supplies [are] imported from allies like Canada, Australia and Kazakhstan.’

And early this year, the Trump administration outlined plans for an overhaul of the US uranium supply chain.

As result, interest in US-sourced uranium is picking up and several Aussie small-cap explorers are snapping up tenements in the US.

Should you invest in ASX-listed uranium companies?

Now, the nuclear power industry is a complex beast — there are many political factors at play.

And these political risks should be front and centre of your mind should you invest in the space.

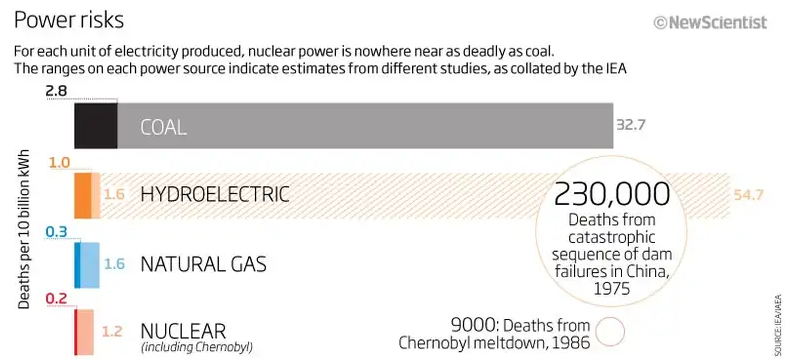

And when you look at the stats below you can see why nuclear makes sense to some people:

|

|

|

Source: New Scientist |

It’s about net effect, not the horrors of extremely rare disasters.

In some ways, it’s like people’s fear of flying.

People still have their phobias though, and with Chernobyl a smash hit on Netflix, you shouldn’t discount these fears.

In the coming weeks, you will hear more about energy questions and the investment opportunities in this sector.

We hope you stick around.

Regards,

|

Lachlann Tierney,

For Money Weekend