In today’s Money Morning…is this a cruel joke?…blue chips favoured in Bizzaro Economy, no joke…how small-cap investors can have the last laugh…and more…

|

Yesterday, I wrote to you about how there could be more in the chamber for ASX small-caps despite what’s happening in the broader economy. Both in the short term and in a 2–5-year window.

With NAB recently saying the Aussie economy may already be in a double-dip recession and the market flying higher still, is this a cruel joke?

The market up, economy down divergence may have some laughing and others crying.

But this is the new normal.

Fact is, though, there’s a grain of truth in most jokes.

And the truth is, the ASX is not made up of listed hospitality and retail entities — the businesses that get hit hardest.

Mom and pop cafes and restaurants are part of the economy, but not the ASX.

Which is why we’re in what I’d call the ‘Bizarro Economy’.

Today, I’ll explain how Australia is uniquely positioned to throw up some ASX small-cap gems after we exit the Bizarro Economy, once the vaccine rollout is completed. And what you can do to invest if you’re sold on this narrative.

Blue chips favoured in Bizzaro Economy, no joke

There are a couple of comics syndicated in the local newspaper that my family (Tierney clan) favours.

These include the frequently super-funny Bizzaro and Non Sequitur.

A few months back, a scanned clipping from Non Sequitur showed up in my inbox which featured this gem:

|

|

|

Source: Gocomics.com/nonsequitur/2021/05/13 |

I almost rolled over in laughter — because it was so spot on.

This is what the new normal economy is like.

You’ve got the SPAC frenzy, the QE, the crypto, the stimmy cheques, now the infrastructure bill which looks like it’s done.

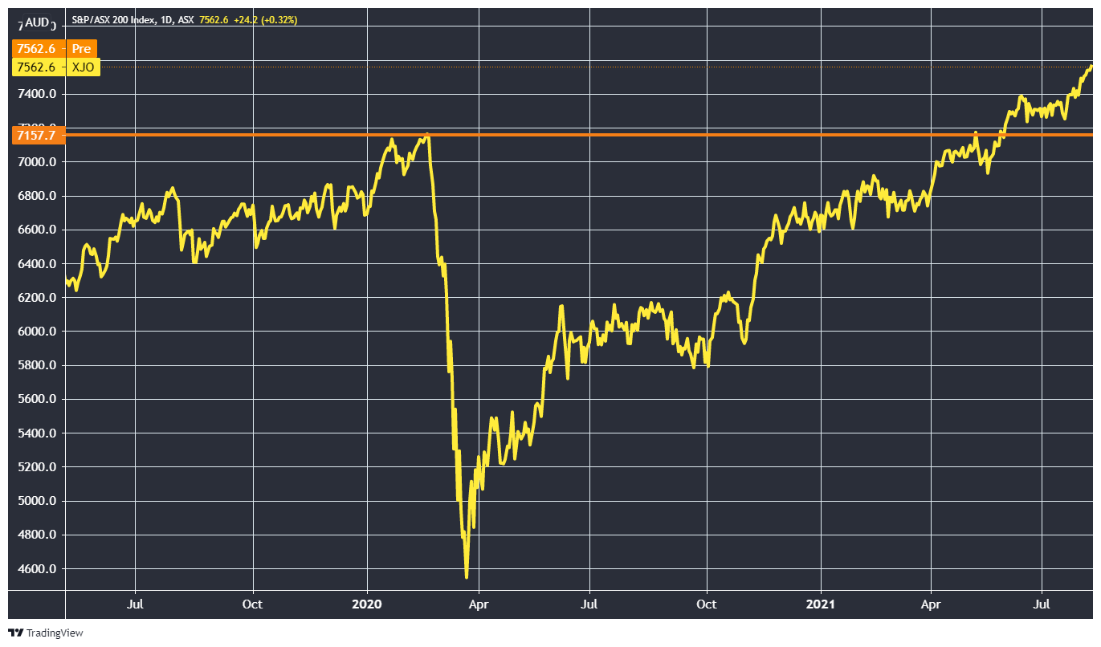

Here in Australia, investors are piling into blue chips pushing the ASX 200 [XJO] ever-higher:

|

|

|

Source: Tradingview.com |

After the index punched through resistance dating back to the pre-plague era at around 7,150, it’s straight-line stuff for now.

Many of the companies in the XJO are immune to the lockdown plague — big funds buying shares in these companies see it as the best place to put their money.

Too big to be locked down.

But hold up, what happens if lockdowns become a thing of the past?

Economy’s double-dip recession be damned.

What about vaccine euphoria 2.0?

Don’t discount it. This might be where we see a renewed speculative frenzy for the smaller end of the market.

How small-cap investors can have the last laugh

If you buy this version of events, we could be due to see lift-off once more for certain well-selected small-caps.

That’s the short term.

As always, small-caps often move quickly up/down on news and are risky, volatile creatures.

But even if this short-term story doesn’t play out, consider reading through this RBA report by Alexandra Heath.

Ignore the whacky RBA policy decisions, some of their research is stellar.

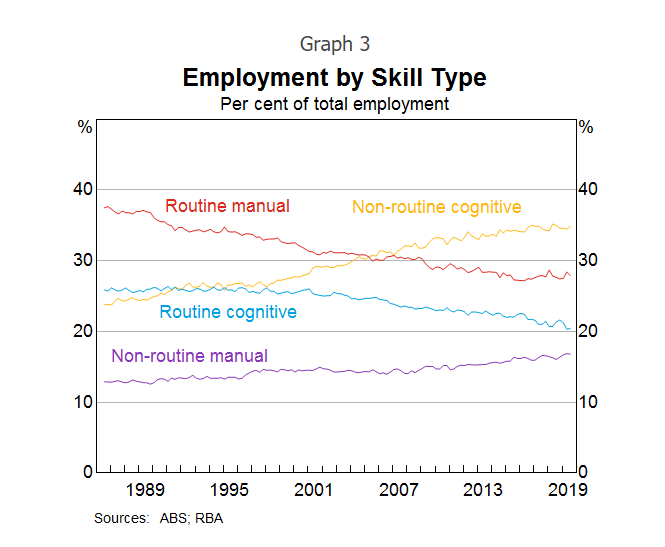

Take a look at this chart:

|

|

|

Source: RBA |

There’s a lot to digest in that report.

And it tells you what you may already know about Australia — we have a lot of highly-educated brainiacs in the country.

(Interestingly, this chart ties in very well with a recent conversation I had with the OpenLearning Ltd [ASX:OLL] CEO Adam Brimo on disruption in the education industry for The Money Morning Podcast.)

The word ‘knowledge economy’ gets thrown around a lot, but I’d say Australia is well-placed to be a tech hotbed in the coming years.

The skills of the labour pool are just too compelling for prospective companies, despite high corporate taxes and the fact that it’s seriously hard to get your physical body in the door of a plane right now.

We’re talking about disruptive companies that want to follow the Afterpay model and achieve unicorn and then ‘to the moon’ status.

These are exactly the types of companies that Murray Dawes and Ryan Clarkson-Ledward hunt for relentlessly in Australian Small-Cap Investigator.

Not all of their picks go gangbusters like their Afterpay Touch Ltd [ASX:APT] tip, and they will inevitably get a portion of picks wrong.

These are high-risk companies.

But they are the companies built for when the Bizarro Economy gives way to a potential Aussie tech boom.

If you’re looking for ultra-disruptive companies that may thrive in the next 2–5 years, look no further.

Check out what Murray and Ryan have to say in the coming days and weeks, you won’t regret it.

Regards,

|

Lachlann Tierney,

For Money Morning

PS: Watch my latest episode with Raiz Invest CEO George Lucas. To start watching click here or the thumbnail below.