Today we draw connections between the recent lithium bounce and the future of the Lynas share price.

Both lithium miners and Lynas are commonly seen as EV plays.

The start of the new year saw some interesting developments in the lithium space — big players like Galaxy Resources Ltd [ASX:GXY], Pilbara Minerals Ltd [ASX:PLS] and Orocobre Ltd [ASX:ORE] snapped their downtrend.

You can see how the late December/early January downtrend snap is followed by a reversal over the last two weeks:

Source: tradingview.com

The big mover though, was Tesla Inc [NASDAQ:TSLA], which devastated shorters with a big squeeze that cost them US$1.5 billion in one day.

Is this lithium/EV push a flash in the pan? Is more pain ahead?

Also, more importantly, why didn’t the Lynas Corporation Ltd [ASX:LYC] share price move more during this period?

Lynas’ raw materials are supposedly critical to the EV push…

We take a look at two reasons why the Lynas share price didn’t get the same jolt that these lithium stocks got.

FREE REPORT: ‘Rare Earth Boom 2.0: An In-Depth Look at the Commodities of the Future’.

Reason #1: Regulatory issues continue to cloud picture for investors

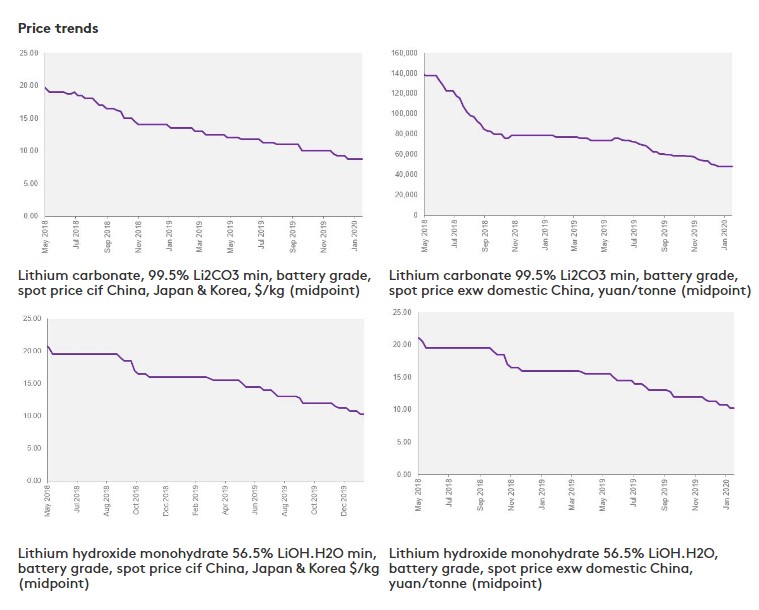

You can see the lithium price for various types of products below:

Source: Metal Bulletin

A trend reversal has yet to materialise and the movement in the lithium players plus Tesla listed before was likely driven by a number of geopolitical factors which investors suddenly woke up to:

- Middle East tensions have highlighted a need for European countries to shift away from oil (Strait of Hormuz closure on the cards)

- Europe wants to keep battery manufacturing ‘in house’ — in particular, auto giant, Germany

- Chinese EV subsidies looking like they will not be cut in July 2020 as previously feared

Meanwhile, Lynas saw a gentle rise as you can see below:

Source: tradingview.com

The more subdued bounce could be traced back to a 17 January announcement that three individuals had launched judicial review proceedings in the High Court of Malaya at Kuala Lumpur.

Respondents named in the proceedings include Lynas as well as the PM of Malaysia and 27 other ministers and Cabinet members.

More likely though is that it could be traced back to the reason below.

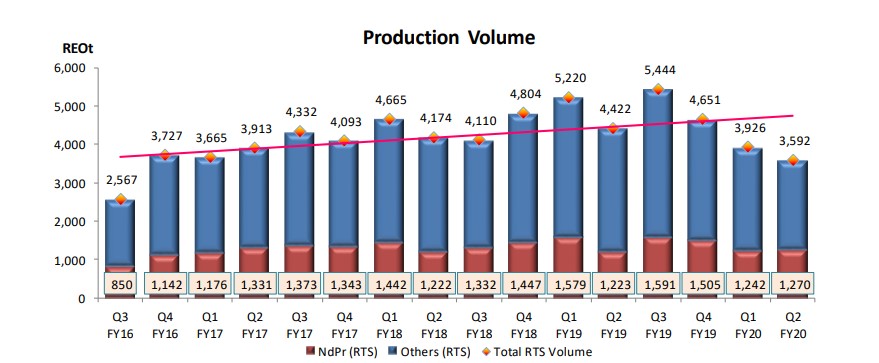

Reason #2: Lynas share price may be a reflection of reduced production volume

As you can see below, Lynas’ production volume is falling — for three quarters in a row in fact.

Source: newswire

The less product you pump out, the harder it gets to maintain revenue.

The Quarterly released on 24 January shows declining sales revenue — down from $99.1 million last quarter to $85.8 million this quarter.

Investors care about revenue growth and the lower production and revenue is likely a factor in the recent downturn in the Lynas share price.

Putting this together with regulatory fear, you have a better grasp of why the January EV bounce didn’t quite impact Lynas as much.

That being said, there are reasons for optimism, which are spelled out here.

If you want a clearer picture of the various factors at play in the rare earths market — be sure to read this free report. It’s a great in depth look at the rare earths industry.

Regards,

Lachlann Tierney,

For Money Morning