A couple of years ago, Australians were punting on footy, horses…and lithium miners.

Or so it seemed.

In 2021 and early 2022, lithium stocks were galloping. Traders, chancers, and newcomers alike were rushing to buy.

It was a frenzy.

Developers years out from production and without project costings were trading at billion dollar valuations.

Companies sitting on nothing but tin sheds in Argentina would proclaim themselves future major players in the lithium triangle.

Paper fortunes were made. Early retirement plans were arranged.

All this culminated in eight of the 10 best performing stocks on the All Ords being lithium stocks in 2021.

Then the exuberance vanished.

Lithium stocks take a beating

Economist Herbert Stein once quipped that if something cannot go on forever, it will stop.

Lithium stock valuations were no exception.

Except, instead of stopping, the valuations went backwards. Worldwide.

The Solactive Global Lithium Index — tracking the world’s largest and most liquid lithium companies — is down 48% since November 2021.

Some once-popular ASX lithium miners have fared even worse.

Now lithium stocks are generating a different kind of interest.

Less frenzied, more ruthless.

Short interest.

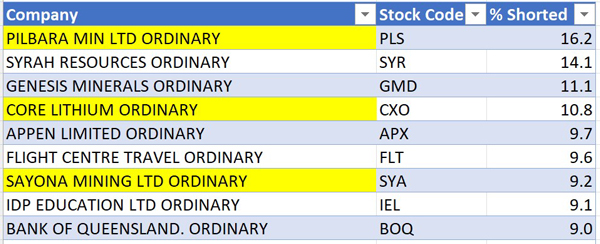

Lithium miners feature heavily in ASIC’s latest release on the most shorted ASX stocks.

The most shorted stock is in fact the lithium producer Pilbara Minerals [ASX:PLS].

Rounding out the top 10 are Core Lithium [ASX:CXO] and Sayona Mining [ASX:SYA].

|

|

| Source: ASIC |

Despite becoming a profitable producer in recent years, Pilbara is down 30% since November 2022.

Stocks not yet producing — or not producing at scale — are down even more.

Sayona Mining, for instance, is down 80% since April 2022.

Another former fan favourite, Lake Resources [ASX:LKE], is down 93% since April 2022.

That is massive!

And unfortunate…for I fear plenty of investors — intoxicated by the hype — bought near the top.

But have the steep falls of Sayona and Lake deterred new investors?

Not really.

Lithium still entices punters

The lithium sector is still a happy hunting ground for punters.

Undaunted, some still see great reward among the risk.

Just look at the best performing All Ords stocks over the last 52-months to now.

Topping the list is lithium junior Wildcat Resources, up 2,100%.

The third-best performer is another lithium junior, AZURE Minerals, up 1,000%.

As long as these types of spikes are on offer, risk junkies will continue to flock to the sector.

That’s why Matthew Haupt, portfolio manager at Wilson Asset Management, called lithium stocks the ‘gambling end of town’, attracting ‘hot money and retail’.

It’s not just in Australia, either.

As Bloomberg reported:

‘In South Korea, there’s a similar frenzy for shares perceived as being tied to the metal. Hydro Lithium rocketed more than 1500 per cent last year after the little-known civil engineering firm changed its name from Korea SE Corp and created plans for EV battery-related businesses. Chemicals firm Kum Yang Co has jumped more than 400 per cent this year on its link with a Mongolian lithium mine.’

But this year’s lithium stars have something in common.

Both Wildcat and AZURE, like another Western Australian lithium hopeful Liontown Resources, are big takeover targets.

AZURE is being eyed up by SQM and Gina Rinehart.

And Wildcat is being considered by Mineral Resources.

These hot stocks are not being bid up by an indiscriminate frenzy of yesteryear, where the hype tide was raising any which lithium stock higher.

No, this suggests the lithium investor is becoming more discerning.

Stocks operating in good jurisdictions with sound outlooks that may prove attractive to major players are catching the bids.

But Herb Stein should be heeded here.

If something cannot go up forever, it will stop.

Albermarle, SQM, and even Gina don’t have unlimited coffers. At a certain price, any project — no matter how good — becomes too expensive.

Not to mention that even without the anchoring effect of potential takeover bids, the mines themselves may prove more problematic than anticipated.

Just look at Core Lithium…and its short interest.

Core Lithium skyrocketed in 2022 as it neared production.

But once it shipped its first ore, the mood soured.

All of a sudden, it became just another producer — and had to deal with being treated like one.

Production delays and output guidance cuts have all weighed the stock down this year.

And consider Pilbara, too.

Despite becoming a very profitable producer, the stock’s heavy short interest implies the market thinks the outlook baked into its current valuation is too rosy.

Falling lithium prices have a lot to do with that.

What’s the go with lithium prices?

Yes, current electric vehicles need lithium to run. Along with graphite, nickel, cobalt, and copper.

The more EVs the world sells, the more lithium we’ll need.

The crux is whether we’ll need more lithium than we can get our hands on.

Just because an input is needed, doesn’t automatically mean it’s in short supply.

Sometimes I like to remind myself of a point made by historian Edward Chancellor, who said that ‘investors spend 90 per cent of their time thinking about demand and only 10 per cent on supply’.

Demand for lithium is clear to see.

You can see the demand on the roads, after all!

But what about the supply side?

In early October, the Department of Industry released its latest quarterly report on key materials like lithium.

Regarding the white metal, the Department was adamant supply was quickly catching up to demand, expecting prices to fall further by 2025:

‘In 2023, prices have fallen significantly as the market swings from deficit to being in balance. The high prices in 2021 and 2022 incentivised more investment in lithium production, resulting in global supply catching up to demand. The high prices of the period also drove companies to destock to reduce the cost of carrying inventory — putting further downward pressure on prices.

‘Prices are forecast to fall further by 2025 as the lithium market enters a period of surplus supply, and is expected to result in rising stockpiles. However, prices are expected to remain well above levels traded in the few years prior to 2021.’

Billionaires like Rinehart are positioning for a different outcome, expecting long-term prices to march higher as EV adoption explodes.

The years ahead will prove who’s right.

In the meantime, it looks like investors will punt on lithium juniors forever.

Regards,

|

Kiryll Prakapenka,

Editor, Fat Tail Daily

|

Comments