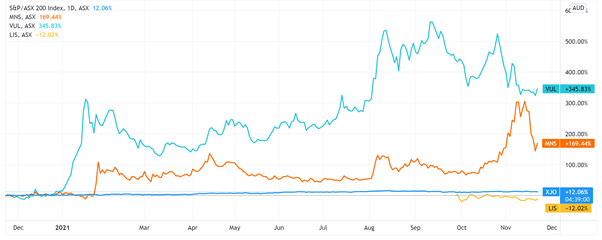

Vulcan Energy Resources Ltd [ASX:VUL], Magnis Energy Technologies Ltd [ASX:MNS], and Li-S Energy Ltd [ASX:LIS] shares are up on Monday morning following a string of updates.

At midday, VUL shares were up 5%, MNS shares were up 15%, and LIS shares were up 4%.

Let’s quickly summarise what’s sending these lithium stocks higher on Monday.

VUL signs binding lithium offtake with Renault

Building on a conditional term sheet agreement signed back in August, Vulcan today revealed it has now signed a binding lithium hydroxide offtake agreement with Renault, the major European automaker.

Following the launch of Renault’s ElectriCity production unit for EV markets, the automaker is set to purchase between 26,000–32,000 metric tonnes of battery grade lithium chemicals over the new deal’s life.

The binding offtake runs for an initial six-year term, with the start of commercial delivery set for 2026.

Managing Director Francis Wedin said:

‘For Vulcan, the agreement is consistent with our strategy to enter into long term, stable supply agreements with companies that share our ethos on sustainability and decarbonisation ambitions. We look forward to a long and productive relationship between Vulcan and Renault Group going forward.’

Now, what is interesting is the difference between today’s announcement and the one in August.

As VUL said today, Renault is set to ‘purchase between 26,000 to 32,000 metric tonnes of battery grade lithium chemicals over the duration of the agreement.’

But in August, the offtake term sheet was for five years with Renault purchasing ‘between 6,000 and 17,000 metric tonnes per year of battery grade lithium chemicals.’

So over the duration of the initial agreement, VUL was set to deliver between 30,000–85,000 metric tonnes to Renault.

Today’s announcement follows an update last Friday, where, tucked away in a dot point on page five, VUL briefed investors on local opposition to its Upper Rhine Valley geothermal lithium project.

As Vulcan noted:

‘Vulcan has previously stated in local media interviews that there have been local municipalities who have opposed Vulcan’s plans to conduct a 3D seismic survey in the Phase 2 region. As Vulcan has stated before, and consistent with virtually any sort of new renewable energy development including wind and solar, there may be opposition to some of Vulcan’s planned projects. The Mining Authority is responsible for granting Vulcan’s 3D seismic permit application and is in the process of reviewing Vulcan’s application, which Vulcan understands there are no impediments to being granted. Vulcan has requested this application review be paused whilst it engages further with local stakeholders to ensure alignment.

‘Meanwhile, Vulcan is progressing and expanding its community outreach activities, to understand and resolve any concerns that local stakeholders have, and to communicate the local benefits of clean, renewable heat and power, as well as sustainable lithium production for the automotive industry in Germany.’

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

LIS to collaborate on electric trucks

Li-S Energy, an ASX newcomer who listed in September, today announced a collaboration with Janus Electric to develop lithium sulphur and/or lithium metal battery cells for use in Janus Electric’s prime mover battery packs.

LIS says Janus intends to purchase battery cells to meet its anticipated future requirements of 495,000 battery cells by the end of 2023.

This all depends on the parties striking further commercial agreements and LIS’s volume supply capability.

Janus has already developed a proprietary battery system that allows batteries to be swapped out of vehicles at designated change and charge stations ‘in a matter of minutes.’

Right now, though, Janus is using conventional lithium-ion cells.

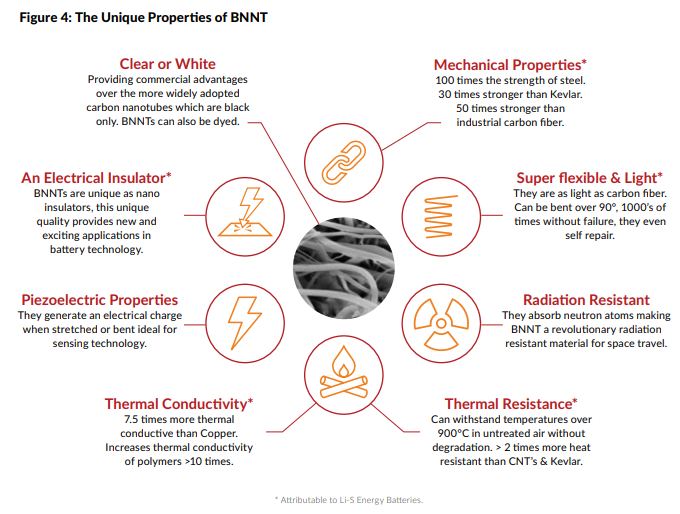

The collaboration with LIS will test whether lithium sulphur battery cells — aided by PPK Group Ltd’s [ASX:PPK] BNNT material — can increase the trucks’ range and reduce the weight of the battery packs.

MNS rebounds on AGM

Magnis Energy, which is down more than 30% since reports the Australian Securities & Investments Commission is investigating MNS executive chairman Frank Poullas, is rebounding today after shareholders were buoyed by a positive AGM.

As The Australian reported last week, the exact matter under ASIC investigation is unclear, but the Australian Federal Police did offer assistance.

As The Australian explained:

‘While the corporate regulator has not outlined why it is making inquiries into Mr Poullas, ASIC has previously moved to deter the pumping up of the Magnis share price. Last month, the regulator entered a Telegram group of 400 traders, warning they could be breaking the law with a “pump-and-dump” campaign.’

But Magnis is standing by its executive chairman.

Mr Poullas was standing for re-election at Monday’s annual general meeting, with the next-gen battery firm recommending he be re-endorsed.

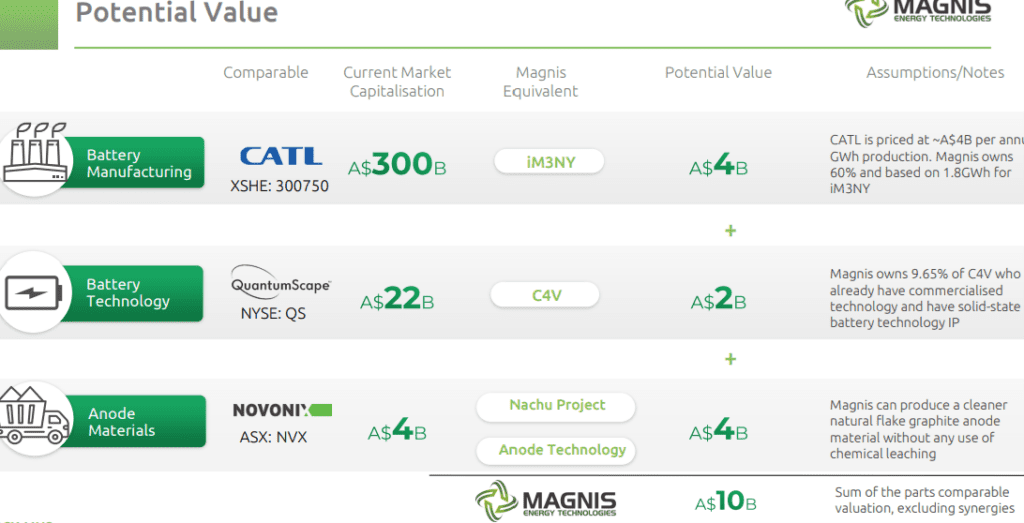

MNS management also used the AGM to talk up the company’s potential, comparing its battery tech and manufacturing favourably to larger peers like CATCL and QuantumScape.

MNS expects to begin fully automated production at its 60%-owned iM3NY battery plant in New York by 2Q22.

Now, if you want extra information on evaluating and comparing lithium miners, I suggest reading our lithium guide released last month.

It’s thorough and takes you through vital factors to consider when pondering the lithium sector.

Additionally, if you’re inclined to read a report analysing a few ASX lithium stocks, check out Money Morning’s report on three exciting lithium miners.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here