We examine Wednesday’s updates from Liontown Resources Ltd [ASX:LTR], Argosy Minerals Ltd [ASX:AGY], and Firefinch Ltd [ASX:FFX].

Liontown’s $450 million placement to fund Kathleen Valley lithium project

Mining is a cost-intensive business.

And despite the favourable conditions for lithium prices, developing a lithium mine and extracting the white metal requires cash…plenty of it.

That’s why we are seeing so many updates from lithium stocks regarding funding arrangements, financing agreements, and offtakes.

Securing the cash to cover development costs greatly derisks the project…and assuages investor concerns.

For its part, Liontown today entered a trading halt before announcing a $450 million underwritten institutional placement.

Existing LTR shareholders can also participate in an upcoming share purchase plan that Liontown expects to contribute a further $40 million.

The capital raise comes with the offer price of $1.65 a share.

As LTR wrote today:

‘Following completion of the Placement, Liontown will have pro-forma cash reserves of ~$474 million (before costs and excluding proceeds raised from the SPP), allowing it to place orders for long-lead items, award key engineering and mining services contracts and build its team to ensure that project development remains on schedule to meet its 2024 production target. This decision comes with the full support of the Board and after careful assessment of available financing options to maximise the value of Kathleen Valley for all shareholders.’

While the capital raise is substantial, it doesn’t cover all of Liontown’s expected costs.

To complete Stage 1 works at Kathleen, LTR will need a further $81–121 million.

Liontown’s board expects to secure the remaining funding prior to making a final investment decision, expected in 2Q22.

How to Limit Your Risks While Trading Volatile Stocks. Learn more.

Argosy shares flat on Rincon operational update

Argosy Minerals today provided an update on its Rincon Lithium project, located in Argentina — part of the coveted ‘lithium triangle’ region.

AGY reported that the project is now 48% complete.

Argosy said it remains on schedule to achieve first commercial production of >99.5% battery-quality lithium carbonate product from mid-2022.

AGY’s share price hardly moved on the news as the update largely amounted to AGY saying it was ‘progressing on schedule and budget.’

Unless investors were worried it wasn’t progressing on schedule, this isn’t news that would move the needle.

While unimpeded by setbacks, AGY’s steady progress at Rincon is likely already reflected in the share price.

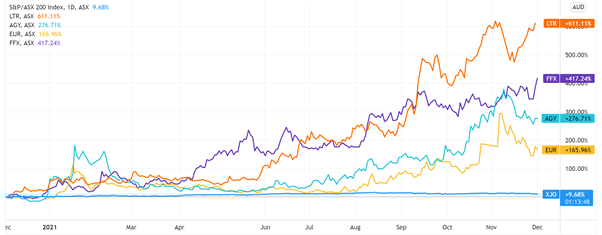

Year to date, AGY shares gained 235%.

Firefinch receives US$39 million from Ganfeng

Lithium developer FFX today updated the market on its joint venture with Ganfeng Lithium to develop the Goulamina lithium project.

The JV — subject to industry standard conditions precedent — will see Ganfeng contribute US$130 million in cash and fork out up to US$64 million in debt.

Today, FFX received a portion of that equity.

Following receipt of Chinese regulatory approvals, Ganfeng deposited the first tranche of equity worth US$39 million.

As Firefinch wrote:

‘As previously announced (on 20th October 2021), the Company is currently completing a Definitive Feasibility Study update (Updated DFS), which will consider a Stage 2 expansion involving a 75% increase in production capacity from 2.3 million to 4 million tonnes per annum. Such an expansion would see spodumene concentrate production increasing from 450,000 tonnes per annum in line with the planned throughput upgrade, placing Goulamina among the largest producers globally.’

FFX’s final investment decision for the Goulamina project is expected for ‘late 2021’.

ASX lithium stocks — further resources

If you want extra information on evaluating and comparing lithium miners, I suggest reading our recent lithium guide.

It’s thorough and takes you through vital factors to think about when considering the lithium sector.

And if you’re inclined to read a report analysing a few ASX lithium stocks, check out Money Morning’s report on three exciting lithium miners.

Regards,

Kiryll Prakapenka,

For Money Morning

PS: Our publication Money Morning is a fantastic place to start on your investment journey. We talk about the big trends driving the most innovative stocks on the ASX. Learn all about it here