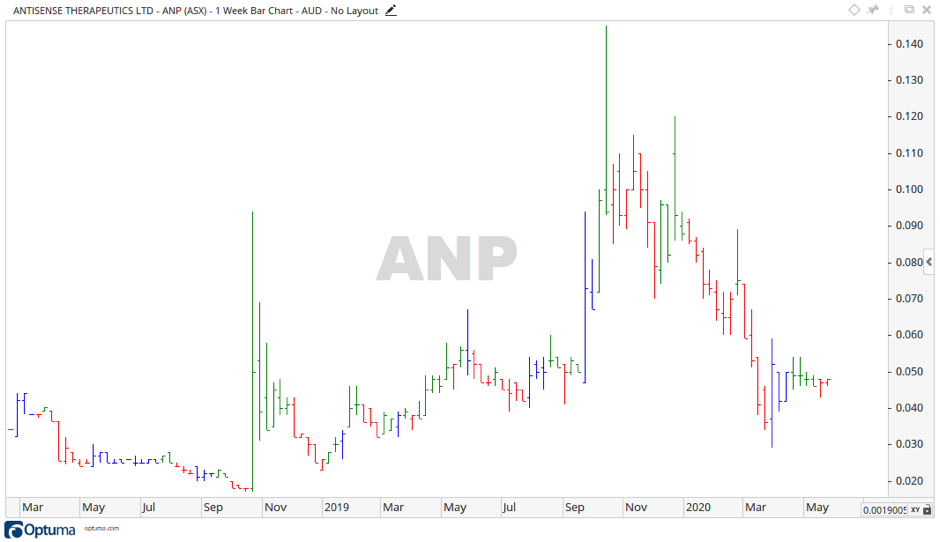

These two Australian biotech companies have both completed successful clinical trials today. In turn, boosting their stock prices well into positive territory over a 12-month period.

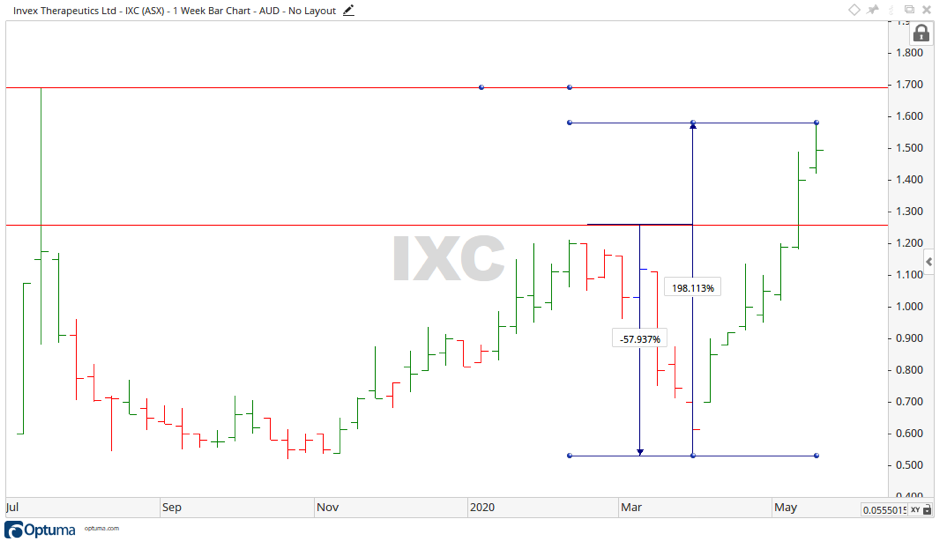

Antisense Therapeutics Ltd [ASX:ANP] specialise in the creation of drugs to treat muscular dystrophy and multiple sclerosis. Invex Therapeutics Ltd [ASX:IXC] focus on research and development of exenatide as an efficacious treatment for neurological conditions derived from or involving raised intracranial pressure.

Source: Optuma

Source :Optuma

What’s taken place for ANP and IXC Shares:

Antisense announced recently that it had completed a phase 2 clinical trial for one of its products, reaching the primary end point and exceeding expectations.

The market greeted the most recent announcement with enthusiasm and their share price is up 45.83% to $0.07, at the time of writing.

Invex also announced good news to the market, completing phase 2 of clinical trials of their drug presendin. According to the company, the results derived from completion of this phase strongly supported the move into phase 3.

Source: Optuma

The Invex share price fell from the peak at the start of March into the low of $0.53 — a 57.93% decline. Since then it has recovered and moved up 198.11%. Should price continue its upward streak the level of the previous all-time high of $1.69 may come into focus, but should the price fall back, the level of the march high of $1.26 may provide support.

Source: Optuma

Here at Money Morning, we aim to give readers unique insights from across the market to help them make more informed investing decisions. Money Morning is a unique publication that you can get direct to your inbox seven days a week. If that sounds like something you’d be interested in, click here to read more.

Regards

Carl Wittkopp

For Money Morning

Comments